Get the free NATIONAL HIGHWAYS AUTHORITY OF INDIA - 54EC CAPITAL GAIN BONDS (Series-XV)

Show details

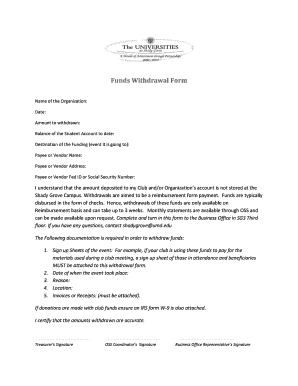

This document provides information on the 54EC Capital Gain Bonds including application requirements, payment details, and contact information for investor grievances.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign national highways authority of

Edit your national highways authority of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your national highways authority of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing national highways authority of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit national highways authority of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out national highways authority of

How to fill out NATIONAL HIGHWAYS AUTHORITY OF INDIA - 54EC CAPITAL GAIN BONDS (Series-XV)

01

Obtain the application form for 54EC Capital Gain Bonds from the official website or authorized banks.

02

Fill in personal details such as name, address, PAN, and contact information in the application form.

03

Specify the investment amount you wish to make in the bonds, keeping in mind the minimum and maximum limits.

04

Provide the details of the capital gains for which you are claiming exemption.

05

Attach the required documents, including proof of capital gains and identity verification as specified.

06

Submit the completed application form along with the supporting documents to the designated authority or bank branch.

07

Make the payment for the investment amount through the accepted modes (cheque, demand draft, online transfer, etc.).

08

Receive the bond certificate and acknowledgment once the application is processed.

Who needs NATIONAL HIGHWAYS AUTHORITY OF INDIA - 54EC CAPITAL GAIN BONDS (Series-XV)?

01

Individuals or entities looking to invest in long-term capital gain bonds to avail tax exemption on capital gains.

02

Taxpayers who have realized capital gains from the sale of a property or any specified assets.

03

Investors seeking a safe and secure investment option backed by the government.

04

Those who wish to diversify their investment portfolio while minimizing tax liability.

Fill

form

: Try Risk Free

People Also Ask about

Can I buy 54EC bonds online?

How can I invest in 54EC Capital Gain Bonds? You can invest in these bonds online through SBI Securities and also offline by filling up application form.

Can NRI invest in 54EC bonds?

Any person/entity can apply in 54EC Bonds i.e. Individuals including NRIs, HUFs, Company, Firms, Association of Persons, Body of Individuals, Artificial Judicial Persons, Local Authority. In case of Individuals, applicants can also nominate second/third holder.

What is the interest rate for rec 54EC bonds for senior citizens?

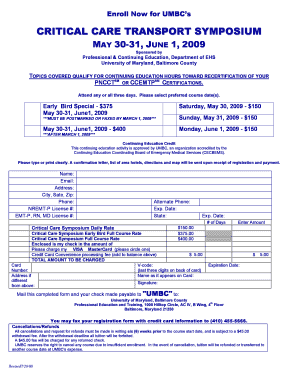

It offers a 5.25% rate of interest payable annually. The amount of 1 bond is 10,000/- and for PFC, IRFC, and REC the minimum number of bonds should be 2 which is 20,000/- for each and the maximum investment in 54EC bonds is 500 bonds amounting to Rs 50 lakhs in a financial year.

How is interest paid on 54EC bonds?

54EC Bonds have an interest rate of 5.25% per annum currently which is payable annually. This income is taxable although no TDS is deducted. 54 EC bonds have a maturity of 5 years from the date of issuance. 54 EC bonds can be held in your existing demat accounts or in physical form based on your preference.

What is the lock-in period for 54EC bonds?

The lock-in period for these bonds is 5 years from the date of purchase. You cannot redeem or sell these bonds before the completion of this period.

Is it worth investing in 54EC bonds?

“Section 54EC bonds can be a useful investment option for individuals looking to save tax on long-term capital gains. While the interest rate may not be exceptionally high, the tax benefits and regular income can make it an attractive option for those with long-term capital gains.

What is the interest rate on NHAI 54EC bonds?

54EC Capital Gain Bonds by NHAI & REC 5.75% is the interest rate on these bonds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NATIONAL HIGHWAYS AUTHORITY OF INDIA - 54EC CAPITAL GAIN BONDS (Series-XV)?

NATIONAL HIGHWAYS AUTHORITY OF INDIA - 54EC CAPITAL GAIN BONDS (Series-XV) are investment instruments issued by the National Highways Authority of India to provide an avenue for tax-efficient investment for individuals who have realized long-term capital gains.

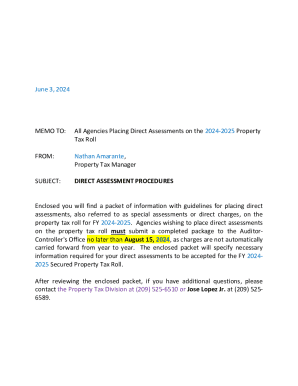

Who is required to file NATIONAL HIGHWAYS AUTHORITY OF INDIA - 54EC CAPITAL GAIN BONDS (Series-XV)?

Individuals or entities that have incurred long-term capital gains and wish to claim exemption from capital gains tax by investing in these bonds are required to file for NATIONAL HIGHWAYS AUTHORITY OF INDIA - 54EC CAPITAL GAIN BONDS (Series-XV).

How to fill out NATIONAL HIGHWAYS AUTHORITY OF INDIA - 54EC CAPITAL GAIN BONDS (Series-XV)?

To fill out the application for NATIONAL HIGHWAYS AUTHORITY OF INDIA - 54EC CAPITAL GAIN BONDS (Series-XV), investors need to provide personal details, details of the capital gains, and the amount to be invested in the bonds, along with necessary identification and financial documentation.

What is the purpose of NATIONAL HIGHWAYS AUTHORITY OF INDIA - 54EC CAPITAL GAIN BONDS (Series-XV)?

The purpose of these bonds is to enable investors to park their long-term capital gains in a secure investment while simultaneously availing tax benefits under Section 54EC of the Income Tax Act.

What information must be reported on NATIONAL HIGHWAYS AUTHORITY OF INDIA - 54EC CAPITAL GAIN BONDS (Series-XV)?

The information that must be reported includes the amount of capital gains, the investment amount in the bonds, the investor's identification details, and any other relevant financial documentation as per the guidelines provided by the National Highways Authority of India.

Fill out your national highways authority of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

National Highways Authority Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.