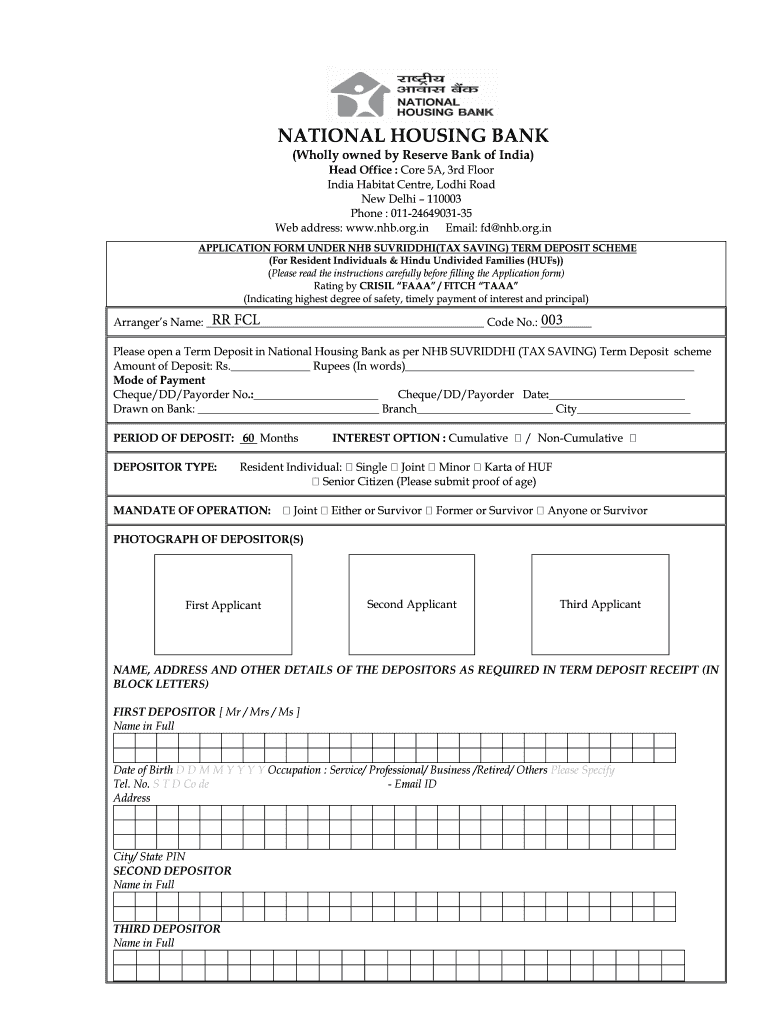

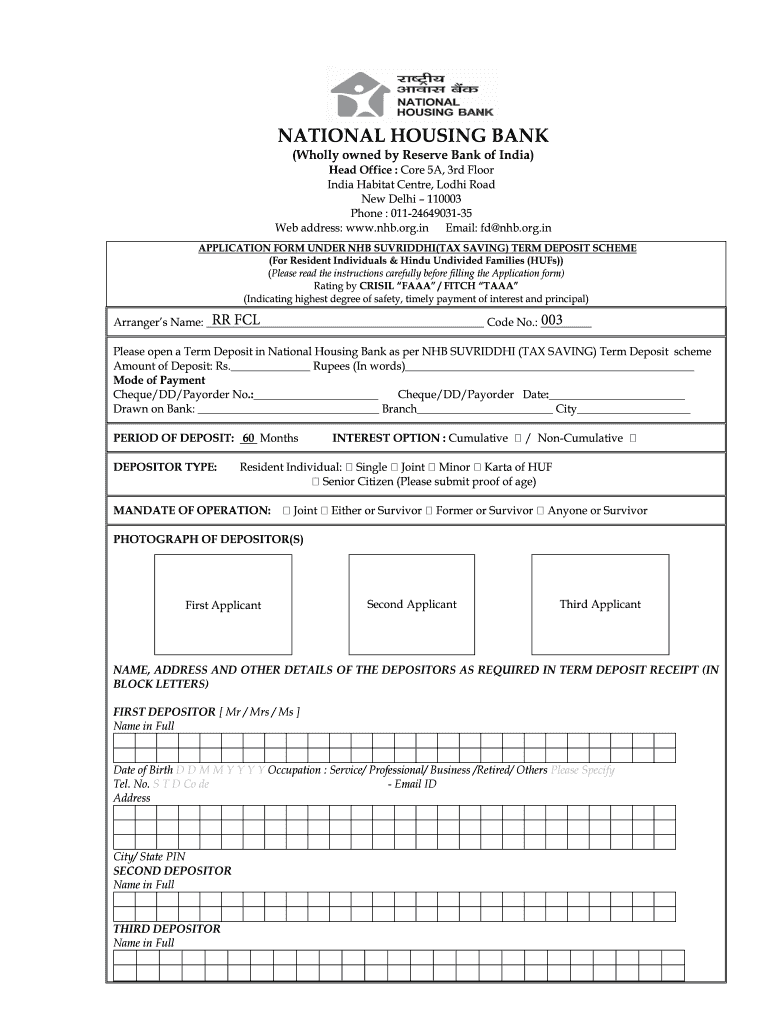

Get the free APPLICATION FORM UNDER NHB SUVRIDDHI(TAX SAVING) TERM DEPOSIT SCHEME

Show details

This document is an application form for opening a Tax Saving Term Deposit account under the NHB SUVRIDDHI scheme for resident individuals and Hindu Undivided Families. It provides instructions for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application form under nhb

Edit your application form under nhb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application form under nhb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application form under nhb online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application form under nhb. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application form under nhb

How to fill out APPLICATION FORM UNDER NHB SUVRIDDHI(TAX SAVING) TERM DEPOSIT SCHEME

01

Obtain the APPLICATION FORM from the bank or financial institution offering the NHB Suvriddhi (Tax Saving) Term Deposit Scheme.

02

Fill in your personal details including your name, address, date of birth, and contact information.

03

Provide details of your PAN (Permanent Account Number) as it is mandatory for tax savings.

04

Indicate the investment amount you wish to deposit under the scheme.

05

Choose the tenure of the deposit, usually ranging from 5 to 10 years.

06

Specify the mode of interest payment (monthly, quarterly, or at maturity) as per your preference.

07

Sign the declaration section confirming that the information provided is accurate.

08

Attach any required documents such as ID proof, address proof, and PAN copy.

09

Submit the completed application form along with the deposit amount to the bank.

Who needs APPLICATION FORM UNDER NHB SUVRIDDHI(TAX SAVING) TERM DEPOSIT SCHEME?

01

Individuals looking for a safe investment option that offers tax benefits under Section 80C of the Income Tax Act.

02

Taxpayers seeking to save on their taxable income while earning fixed returns.

03

Anyone planning for long-term financial goals while benefiting from the security of a term deposit.

Fill

form

: Try Risk Free

People Also Ask about

How to open tax saving fixed deposit?

Minimum deposit of Rs. 100/- or in multiples thereof, subject to maximum deposit of Rs. 1.50 Lakh per financial year only. A declaration from the depositor(s), as per ANNEXURE-B, to be obtained at the time of opening of Account, under the Scheme and annexed with AOF of the depositor only.

How to write an application for renewal of a fixed deposit?

I hereby request you to renew / reinvest the above referred fixed deposit for a further period of months/years. The particulars including Nominee etc, furnished by me in the application form at the time of opening up of original deposit may be treated as valid for this deposit also. Place: Date: Yours faithfully.

How do I renew my fixed deposit account?

How to renew an FD? Visit the concerned bank branch or navigate to the online banking portal to start the FD tenure renewal process. Submit a renewal application. Specify the details, amount and tenure for renewal of your Fixed Deposit. Verify the details and submit your term deposit renewal request.

How to fill a renewal of term deposit form?

How to renew an FD? Visit the concerned bank branch or navigate to the online banking portal to start the FD tenure renewal process. Submit a renewal application. Specify the details, amount and tenure for renewal of your Fixed Deposit. Verify the details and submit your term deposit renewal request.

How to fill in a deposit form?

How to fill out a deposit slip for cash. Make sure you provide your name as it appears on your account. Include the account number. If you are requesting cash back, you may be required to sign the deposit slip in the appropriate space. Include a subtotal for the cash and checks, along with any amount you want back.

Can you renew a Term Deposit?

When you renew or re-invest your Term Deposit, you may not continue to receive the same rate as when you first opened it. You may choose to reinvest in a Term Deposit as part of your superannuation strategy. It's a good idea to chat to a Financial Planner who can answer questions and help with your super strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FORM UNDER NHB SUVRIDDHI(TAX SAVING) TERM DEPOSIT SCHEME?

The APPLICATION FORM UNDER NHB SUVRIDDHI (TAX SAVING) TERM DEPOSIT SCHEME is a formal document required for individuals to apply for a fixed deposit account that offers tax benefits under Section 80C of the Income Tax Act in India.

Who is required to file APPLICATION FORM UNDER NHB SUVRIDDHI(TAX SAVING) TERM DEPOSIT SCHEME?

Individuals who wish to open a term deposit account under the NHB Suvriddhi scheme to avail of tax benefits must fill out the APPLICATION FORM. This includes taxpayers seeking to invest up to the prescribed limits to benefit from tax deductions.

How to fill out APPLICATION FORM UNDER NHB SUVRIDDHI(TAX SAVING) TERM DEPOSIT SCHEME?

To fill out the APPLICATION FORM, applicants need to provide personal details such as name, contact information, PAN number, and details regarding the investment amount and tenure. Additional identification documents may also be required.

What is the purpose of APPLICATION FORM UNDER NHB SUVRIDDHI(TAX SAVING) TERM DEPOSIT SCHEME?

The purpose of the APPLICATION FORM is to formally request the opening of a tax-saving term deposit account under the NHB Suvriddhi scheme, allowing individuals to secure savings while benefiting from tax deductions.

What information must be reported on APPLICATION FORM UNDER NHB SUVRIDDHI(TAX SAVING) TERM DEPOSIT SCHEME?

The information required includes the applicant's full name, PAN, address, contact details, investment amount, tenure of the deposit, and signature. Other details may include nominee information and declarations for tax purposes.

Fill out your application form under nhb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application Form Under Nhb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.