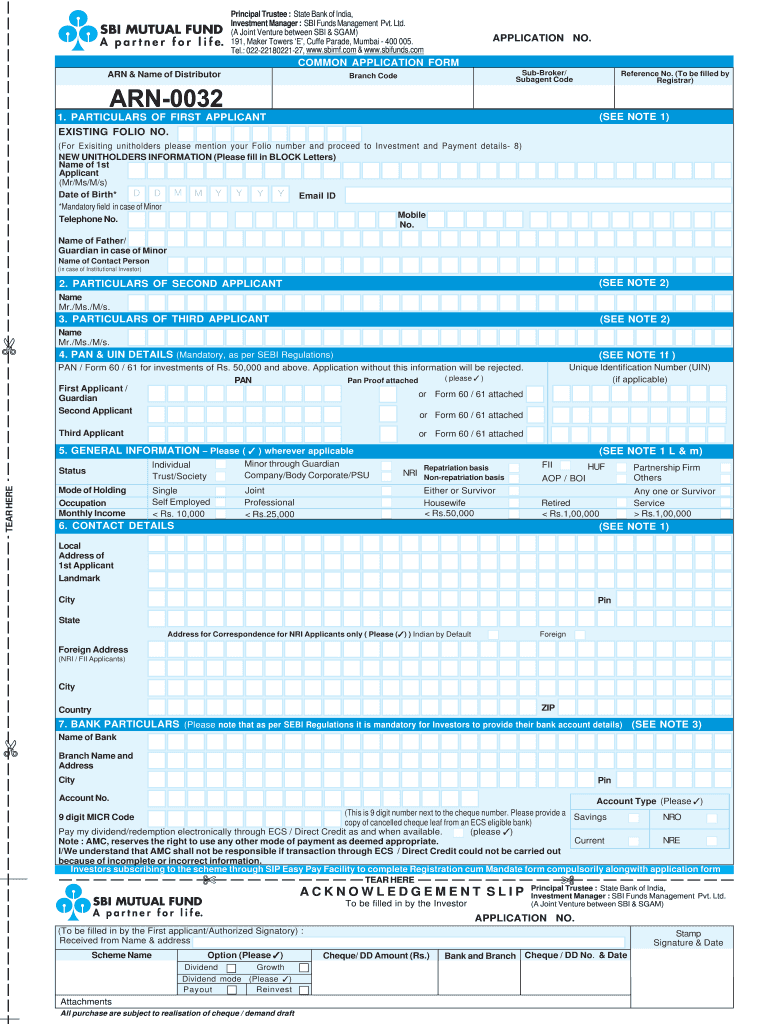

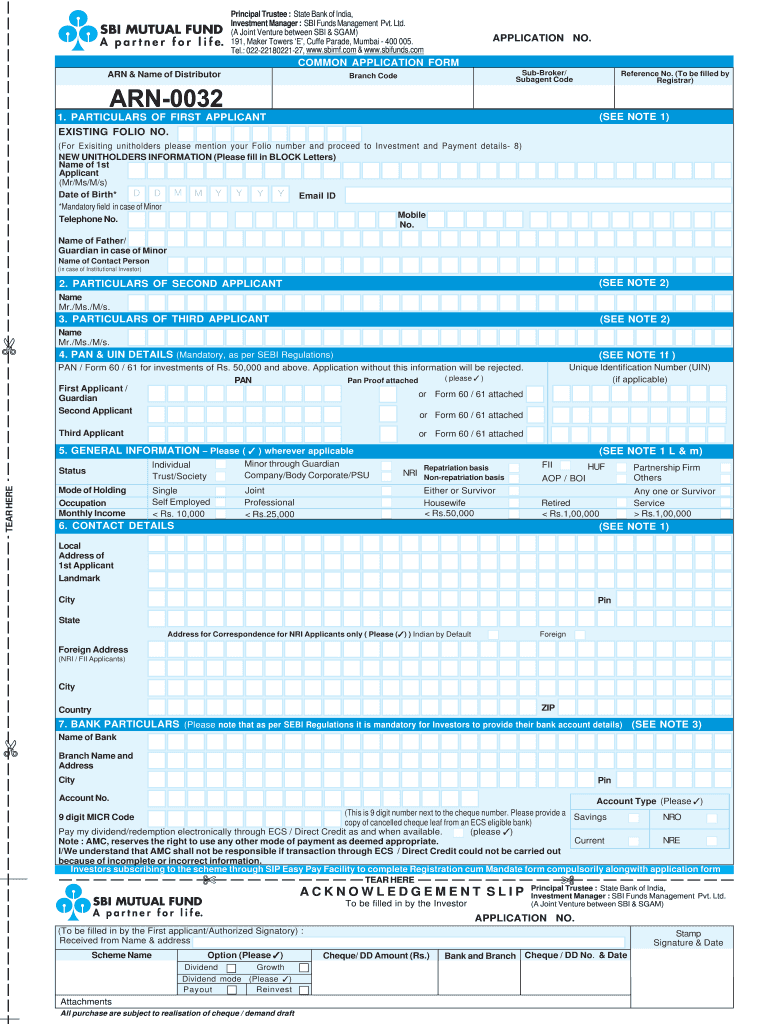

Get the free SBI Mutual Fund Common Application Form

Show details

This document is a common application form for individuals and entities looking to invest in SBI Mutual Fund schemes, detailing personal information, investment details, and compliance declarations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sbi mutual fund common

Edit your sbi mutual fund common form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sbi mutual fund common form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sbi mutual fund common online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sbi mutual fund common. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

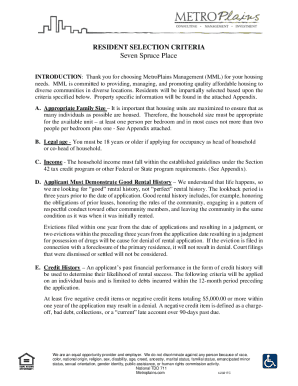

How to fill out sbi mutual fund common

How to fill out SBI Mutual Fund Common Application Form

01

Obtain the SBI Mutual Fund Common Application Form from the official website or a financial advisor.

02

Fill in your personal details such as name, address, and contact information.

03

Provide your bank account details for fund transfer.

04

Select the type of investment option (Growth or Dividend).

05

Choose the mutual fund scheme you want to invest in.

06

Specify the investment amount you wish to invest.

07

Complete the KYC (Know Your Customer) details if required.

08

Sign and date the application form.

09

Submit the application form along with necessary documents to the nearest SBI Mutual Fund branch or online through their portal.

Who needs SBI Mutual Fund Common Application Form?

01

Individuals looking to invest in SBI Mutual Fund products.

02

Existing investors wishing to make additional investments.

03

New investors starting their investment journey in mutual funds.

04

Financial advisors and institutions facilitating investments for clients.

Fill

form

: Try Risk Free

People Also Ask about

What is SWP form of SBI Mutual Fund?

A Systematic Withdrawal Plan(SWP) works in an opposite way to Systematic Investment Plan(SIP).A Systematic Investment Plan(SIP) allows an investor to invest a fixed amount at pre-determined intervals and a Systematic Withdrawal Plan(SWP) is a facility which allows an investor to withdraw a fixed amount at pre-

How much is 1000 for 5 years in SIP SBI?

1,000 monthly investment in an SBI Mutual Fund SIP over a period of 5 years, assuming an expected annual return rate of 12%. Using the SIP formula with compound interest, the estimated maturity amount and total interest earned would be: Maturity Amount: Approximately Rs. 82,486.

How to fill mutual fund form SBI?

How to fill out the SBI Mutual Fund Application Form Guidelines? Start with your personal information, including name and contact details. Fill in the investment details accurately, specifying the scheme and amount. Complete the KYC details as per requirements, ensuring all documents are in order.

Which SBI Mutual Fund gives the highest return?

Best SBI Mutual Fund Schemes to Invest in 2025 Fund nameAUM3Y Returns SBI Gold Fund Direct (G) ₹4409.89 Cr 23.218% SBI Consumption Opportunities Fund Direct (G) ₹3185.83 Cr 18.332% SBI Banking and PSU Fund Direct (G) ₹4107.13 Cr 7.809% SBI Corporate Bond Fund Direct (G) ₹25615.90 Cr 8.022%16 more rows

How to fill KYC form for mutual fund?

To register for online KYC, visit the mutual fund's official website or KYC Registration Agency (KRA) portal. Provide your PAN, Aadhaar, and personal details, upload the required documents, and complete verification using the OTP sent to your registered mobile number.

How to fill sip form sbi?

0:27 1:21 Amount select the start date. And fill in the required. Details once done tap proceed to moveMoreAmount select the start date. And fill in the required. Details once done tap proceed to move forward review your transaction details carefully read and accept the terms and conditions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SBI Mutual Fund Common Application Form?

The SBI Mutual Fund Common Application Form is a standardized document used by investors to apply for mutual fund schemes offered by SBI Mutual Fund. It facilitates a seamless process for investing in various funds.

Who is required to file SBI Mutual Fund Common Application Form?

Individuals, corporations, trusts, and other entities looking to invest in SBI Mutual Fund schemes are required to fill out the SBI Mutual Fund Common Application Form.

How to fill out SBI Mutual Fund Common Application Form?

To fill out the SBI Mutual Fund Common Application Form, investors should provide their personal details, investment amount, scheme choice, KYC information, and payment details, ensuring all fields are accurately completed and signed.

What is the purpose of SBI Mutual Fund Common Application Form?

The purpose of the SBI Mutual Fund Common Application Form is to gather necessary information for processing mutual fund investments and to comply with regulatory requirements, such as Know Your Customer (KYC) norms.

What information must be reported on SBI Mutual Fund Common Application Form?

Information that must be reported on the SBI Mutual Fund Common Application Form includes the investor's name, address, phone number, email ID, PAN (Permanent Account Number), investment amount, chosen schemes, KYC compliance status, and payment method.

Fill out your sbi mutual fund common online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sbi Mutual Fund Common is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.