Get the free ICICI Prudential Fixed Maturity Plan - Series 65

Show details

This document provides key information regarding ICICI Prudential Fixed Maturity Plan - Series 65, including details about the investment objectives, asset allocation, risk factors, options available,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign icici prudential fixed maturity

Edit your icici prudential fixed maturity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your icici prudential fixed maturity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing icici prudential fixed maturity online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit icici prudential fixed maturity. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

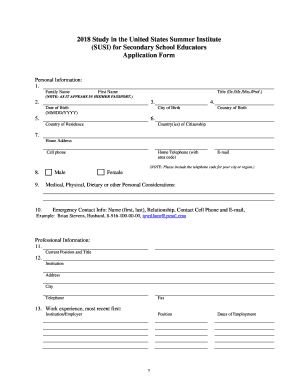

How to fill out icici prudential fixed maturity

How to fill out ICICI Prudential Fixed Maturity Plan - Series 65

01

Visit the official ICICI Prudential website or your nearest branch.

02

Navigate to the Fixed Maturity Plan - Series 65 section.

03

Download or request the application form.

04

Fill out the application form with required personal and financial information.

05

Choose your investment amount and select the appropriate plan option.

06

Provide necessary identification and KYC documents.

07

Review the filled form for accuracy and completeness.

08

Submit the application form along with your investment amount.

09

Receive confirmation and documentation of your investment.

Who needs ICICI Prudential Fixed Maturity Plan - Series 65?

01

Investors looking for relatively safer fixed-income investment options.

02

Individuals seeking a defined return over a fixed tenure.

03

Those who want to invest for tax-saving purposes under 80C.

04

People planning for medium to long-term financial goals.

Fill

form

: Try Risk Free

People Also Ask about

Can I withdraw insurance before maturity?

If a policyholder decides to terminate the policy before its maturity, the insurance company will reimburse the surrender value to the policyholder. Many people believe that surrendering term insurance is not an option.

Which mutual fund has a fixed maturity date?

Fixed Maturity Plans Fund NameMaturity DateLaunched on UTI Fixed Term Income Fund - Series XXXV-II (1223 Days) Apr 15, 2026 Dec 09, 2022 UTI Fixed Term Income Fund - Series XXXV-III (1176 days) Apr 15, 2026 Jan 25, 2023 UTI Fixed Term Income Fund Series XXXVI - I (1574 Days) Jun 21, 2027 Feb 28, 20232 more rows

Which ICICI Prudential Mutual Fund gives the highest return?

List of ICICI Prudential Mutual Fund in India Fund NameCategory1Y Returns ICICI Prudential Bluechip Fund Equity 7.4% ICICI Prudential Equity & Debt Fund Hybrid 6.5% ICICI Prudential Multi Asset Fund Hybrid 10.3% ICICI Prudential Large Cap Fund Equity 3.8%12 more rows

How much money will I get if I surrender my ICICI policy?

Surrender value is the amount of money that you will receive in case you surrender your policy. The surrender value of ICICI Prudential life insurance is calculated as a Single premium multiplied by 75% of the outstanding term to maturity/ total term.

Can I withdraw money from ICICI Prudential Policy before maturity?

To withdraw money from ICICI Prudential Life Insurance before maturity, follow the below steps. Contact ICICI Prudential Life Insurance customer service to inquire about the withdrawal process. They will guide you and provide the necessary forms.

How to withdraw ICICI Prudential policy before maturity?

Process to Surrender an ICICI Prudential Life Insurance Policy Photo Identity Proof (Aadhaar, Voter ID, Passport, Driving License, etc.) Cancelled Cheque (with your name pre-printed) or a recent bank statement/passbook showing your account details. Original Policy Documents. Duly filled Surrender Form.

What is the lock-in period of ICICI Prudential Life Insurance?

ULIPs have a mandatory lock-in period of five years. Partial or complete withdrawals are usually permitted only after this period is over. In addition to completing the ULIP lock-in period, you must have paid all premium payments for the first five policy years to be eligible for partial withdrawals.

Is ICICI Prudential Mutual Fund safe for long term?

Frequent performance in a long time Consistency is important when evaluating the best mutual funds to invest in, and the ICICI Prudential Fund doesn't disappoint. Over the years, it has yielded competitive returns compared to its peers and benchmarks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ICICI Prudential Fixed Maturity Plan - Series 65?

ICICI Prudential Fixed Maturity Plan - Series 65 is a closed-ended debt mutual fund scheme designed to provide investors with stable returns over a fixed investment horizon by investing in debt and money market instruments.

Who is required to file ICICI Prudential Fixed Maturity Plan - Series 65?

Investors who wish to invest in ICICI Prudential Fixed Maturity Plan - Series 65 need to fill out the application form provided by the mutual fund and submit the required documents for KYC compliance.

How to fill out ICICI Prudential Fixed Maturity Plan - Series 65?

To fill out ICICI Prudential Fixed Maturity Plan - Series 65, investors must complete the application form with personal details, investment amount, and choose the mode of payment, ensuring to attach KYC documents.

What is the purpose of ICICI Prudential Fixed Maturity Plan - Series 65?

The purpose of ICICI Prudential Fixed Maturity Plan - Series 65 is to provide investors with a predictable income stream by investing in fixed-income securities that match the plan's maturity period.

What information must be reported on ICICI Prudential Fixed Maturity Plan - Series 65?

The information that must be reported includes the investor's personal details, investment amount, mode of payment, and KYC documentation, as required by the mutual fund regulations.

Fill out your icici prudential fixed maturity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Icici Prudential Fixed Maturity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.