Get the free Life Conversion Coverage - For Auto Parts Repair Pros - aaas

Show details

Life Conversion Coverage Life Goes on with Group Conversion Your group life insurance has been valuable protection for you and your family. Now that it will be terminated, you may wish to convert

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life conversion coverage

Edit your life conversion coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life conversion coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing life conversion coverage online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit life conversion coverage. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

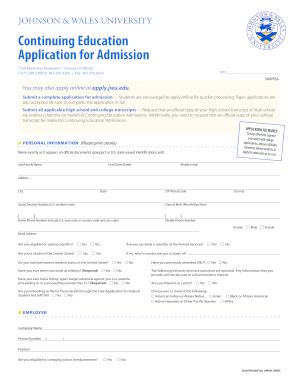

How to fill out life conversion coverage

How to fill out life conversion coverage:

01

Start by gathering all the necessary documents and information. This may include your current life insurance policy, any medical records, and personal identification.

02

Review your current life insurance policy to determine if it offers a conversion option. If it does, familiarize yourself with the terms and conditions for converting the policy.

03

Contact your insurance provider to inquire about the process of converting your policy. They will provide you with the necessary forms and instructions.

04

Fill out the conversion application form accurately and completely. Pay close attention to any required fields or supporting documentation that may be needed.

05

If necessary, provide any additional information or evidence that may be required for the conversion, such as updated medical records or proof of insurability.

06

Submit the completed conversion application and any supporting documents to your insurance provider by the specified deadline. It is advisable to send the documents via certified mail or secure electronic means to ensure they are received.

07

Wait for a response from your insurance provider. They will review your application and determine if you are eligible for the conversion. This process may take some time, so be patient.

08

If approved, carefully review the terms and conditions of the converted policy. Make sure you understand any changes in coverage or premiums.

09

Pay any required premiums for the converted policy to activate the coverage. Set up a payment plan if necessary to ensure timely and consistent payments.

10

Keep a copy of all the documents related to the conversion for your records.

Who needs life conversion coverage:

01

Individuals who currently have a term life insurance policy that is nearing its expiration date may consider life conversion coverage.

02

It can be beneficial for those who want to retain some form of life insurance coverage but do not wish to go through the process of applying for a new policy.

03

People who may have experienced changes in health conditions and are worried about being able to secure new life insurance coverage at reasonable rates.

04

Those who value the convenience and flexibility of converting their existing policy rather than seeking new coverage from scratch.

05

Individuals who want to ensure that their loved ones have financial security in the event of their death, even if it means adjusting or converting their current policy.

Overall, the decision to fill out life conversion coverage should be based on individual circumstances, financial goals, and the coverage needs of the policyholder and their beneficiaries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is life conversion coverage?

Life conversion coverage allows a life insurance policyholder to convert their existing policy into a different type of policy, such as a whole life policy.

Who is required to file life conversion coverage?

Policyholders who wish to convert their existing life insurance policy are required to file for life conversion coverage.

How to fill out life conversion coverage?

To fill out life conversion coverage, policyholders must contact their insurance company or agent to inquire about the process and necessary forms.

What is the purpose of life conversion coverage?

The purpose of life conversion coverage is to provide policyholders with the option to change their life insurance policy to better suit their current needs.

What information must be reported on life conversion coverage?

Policyholders must report their current policy details, desired changes, and personal information on the life conversion coverage form.

How can I send life conversion coverage for eSignature?

When you're ready to share your life conversion coverage, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit life conversion coverage online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your life conversion coverage to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out life conversion coverage using my mobile device?

Use the pdfFiller mobile app to fill out and sign life conversion coverage on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your life conversion coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Conversion Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.