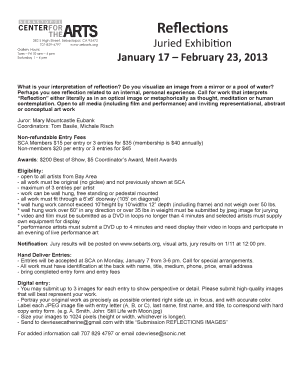

Get the free FIDELITY INDIA CHILDREN'S PLAN

Show details

This document provides information regarding Fidelity India Children's Plan, which is an open-ended hybrid plan comprising three funds: Education Fund, Marriage Fund, and Savings Fund. It includes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity india childrens plan

Edit your fidelity india childrens plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity india childrens plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

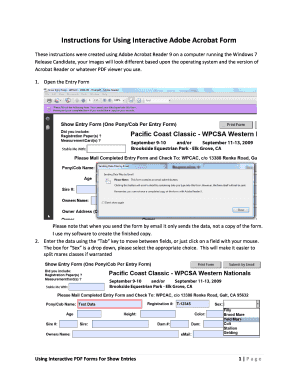

How to edit fidelity india childrens plan online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fidelity india childrens plan. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fidelity india childrens plan

How to fill out FIDELITY INDIA CHILDREN'S PLAN

01

Visit the official Fidelity India website or a local branch.

02

Navigate to the Children's Plan section.

03

Read the eligibility criteria and ensure your child qualifies.

04

Gather necessary documents, such as ID proofs and birth certificates.

05

Fill out the application form with required details.

06

Submit the form along with the required documents.

07

Choose your investment options based on your financial goals.

08

Complete the payment process to initiate the plan.

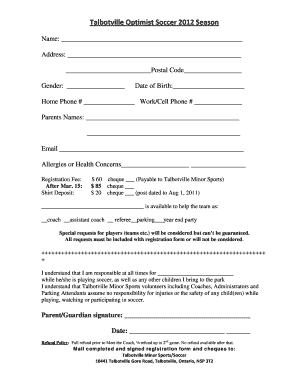

Who needs FIDELITY INDIA CHILDREN'S PLAN?

01

Parents or guardians looking to secure their children’s financial future.

02

Individuals wanting to save for their child’s education or major life events.

03

Those who wish to invest early to maximize returns for their children.

04

Families preparing for future expenses such as marriage or higher studies.

Fill

form

: Try Risk Free

People Also Ask about

What is the best way to invest money for a child in India?

Several options for investment towards children in India are available to choose from, and they are: Unit-Linked Insurance Plans (ULIPs) Life Insurance. Systematic Investment Plans (SIPs) Fixed or Recurring Deposits. Sukanya Samriddhi Yojana. Gold. Public Provident Fund (PPF) Bonds.

Which is the best sip for children in India?

Best SIP for Child Education NameNAVMin Monthly SIP HDFC Flexi Cap Fund Direct - Growth ₹ 2,170.90 Invest ₹ 100 SBI Equity Hybrid Fund Direct - Growth ₹ 336.11 Invest ₹ 500 ICICI Prudential Large Cap Fund Direct - Growth ₹ 120.92 Invest ₹ 100 Nippon India Small Cap Fund Direct - Growth ₹ 194.44 Invest ₹ 10026 more rows

Can kids use Fidelity?

Teens can start investing on their own at age 13 — with some help from a parent or guardian through the Fidelity Youth Account. The parent or guardian must have an account with Fidelity and open the Fidelity Youth Account for the teen.

Can I use Fidelity in India?

Unfortunately, Fidelity does not accept clients from India. But don't worry — we've selected the best alternatives you can choose from.

Can we open a SIP for a child?

Mutual fund investments: A minor SIP account can be opened by a parent or a court-appointed legal guardian. Investing early can secure a child's future. Parents and guardians can start a Systematic Investment Plan (SIP) in a minor's name.

Which SIP gives 40% return in India?

LIC MF Small Cap Fund delivered 40.03% XIRR on SIP investments made on January 1, 2024. The other 258 equity mutual funds active in the mentioned period gave SIP returns ranging between -0.98% and 39.84% in 2024.

Can kids invest in India?

Till the time a child is a minor, any capital gains out of the mutual fund investment will be taxed as per the parent's or guardian's tax slab. Once the minor turns above 18, the capital gain tax will be in the hands of the child.

Which SIP is best for a 3 year old?

Best SIP to Invest for 3 Years NameNAV3 Yr Returns Invesco India Smallcap Fund Direct - Growth ₹ 47.91 Invest 31.02% Invesco India Infrastructure Fund Direct - Growth ₹ 78.92 Invest 30.73% Motilal Oswal ELSS Tax Saver Fund Direct - Growth ₹ 60.90 Invest 30.23% Canara Robeco Infrastructure Fund Direct - Growth ₹ 182.70 Invest 30.16%26 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FIDELITY INDIA CHILDREN'S PLAN?

FIDELITY INDIA CHILDREN'S PLAN is a financial investment scheme designed to save for children's education and future needs, providing various investment options for parents to secure their child's financial future.

Who is required to file FIDELITY INDIA CHILDREN'S PLAN?

Parents or guardians who wish to invest on behalf of their children to ensure that they have sufficient funds for educational and other future expenses are required to file the FIDELITY INDIA CHILDREN'S PLAN.

How to fill out FIDELITY INDIA CHILDREN'S PLAN?

To fill out the FIDELITY INDIA CHILDREN'S PLAN, individuals need to provide necessary personal information, choose the investment options, specify the amount to be invested, and provide details about the beneficiaries (the children) as required in the application form.

What is the purpose of FIDELITY INDIA CHILDREN'S PLAN?

The purpose of FIDELITY INDIA CHILDREN'S PLAN is to help parents systematically save and invest money for their children's future educational needs and other significant life expenses, ensuring financial security.

What information must be reported on FIDELITY INDIA CHILDREN'S PLAN?

The information that must be reported on FIDELITY INDIA CHILDREN'S PLAN includes personal details of the parent or guardian, information about the child, chosen investment strategy, amounts invested, and any relevant financial goals related to the child's education.

Fill out your fidelity india childrens plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity India Childrens Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.