Get the free PETITION FOR DIVISION AND OR CONSOLIDATION FOR TAX YEAR 2010

Show details

This document serves as a petition form for division and/or consolidation regarding tax matters for the year 2010 in Cook County, Illinois.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign petition for division and

Edit your petition for division and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your petition for division and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit petition for division and online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit petition for division and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

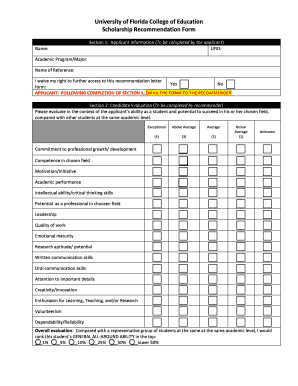

How to fill out petition for division and

How to fill out PETITION FOR DIVISION AND OR CONSOLIDATION FOR TAX YEAR 2010

01

Obtain the correct form for the Petition for Division and/or Consolidation for the tax year 2010.

02

Fill out the title section with the appropriate case name and information.

03

Provide personal identification details including your name, address, and any relevant account numbers.

04

Clearly state the reason for the petition, including specifics about the properties or tax accounts involved.

05

Cite any applicable laws or regulations that support your request for division or consolidation.

06

Attach any relevant documentation that supports your petition, such as prior assessments or tax statements.

07

Review the form for accuracy and completeness.

08

Sign and date the petition.

09

Submit the petition to the appropriate tax authority or agency by the specified deadline.

Who needs PETITION FOR DIVISION AND OR CONSOLIDATION FOR TAX YEAR 2010?

01

Property owners who wish to separate or consolidate their tax accounts for a clearer assessment.

02

Taxpayers dealing with multiple properties or tax accounts that require clarification.

03

Individuals seeking to resolve disputes with tax assessments for the year 2010.

Fill

form

: Try Risk Free

People Also Ask about

What is 448 of CTA 2010?

448“Associate” (ii)has an interest in any shares or obligations of a company which are part of the estate of a deceased person, any other company which has an interest in those shares or obligations.

What is Section 1000 1 of the CTA 2010?

1000Meaning of “distribution” (1)In the Corporation Tax Acts “distribution”, in relation to any company, means anything falling within any of the following paragraphs. A. Any dividend paid by the company, including a capital dividend.

What is the 7za of CTA 2010?

This Part contains provision restricting the amount of certain deductions which a company may make in calculating its taxable total profits for an accounting period.

What is the corporation tax act 2010 cta10?

Corporation Tax Act 2010 (2010 c 4) This Act consolidates provisions relating to corporation tax, aiming to simplify the tax legislation for companies. It brings together various amendments and rules governing corporation tax, ensuring a coherent structure.

What is 439 of CTA 2010?

439“Close company” (b)of participators who are directors. (b)such rights as would, in that event, so entitle them if there were disregarded any rights which any of them or any other person has as a loan creditor (in relation to the relevant company or any other company).

What is the CTA 748 for 2010?

748Application for clearance of transactions (1)A company may provide the Commissioners for Her Majesty's Revenue and Customs with particulars of a transaction or transactions effected or to be effected by it in order to obtain a notification about them under this section.

What is Section 450 of the CTA 2010?

450“Control” (c)is entitled to acquire, direct or indirect control over C's affairs. (d)such rights as would entitle P, in the event of the winding up of C or in any other circumstances, to receive the greater part of the assets of C which would then be available for distribution among the participators.

What is Section 1139 of the CTA 2010?

1139“Tax advantage” (1)This section has effect for the purposes of the provisions of the Corporation Tax Acts which apply this section. (a)a relief from tax or increased relief from tax, (b)a repayment of tax or increased repayment of tax, (c)the avoidance or reduction of a charge to tax or an assessment to tax, F1

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PETITION FOR DIVISION AND OR CONSOLIDATION FOR TAX YEAR 2010?

The PETITION FOR DIVISION AND OR CONSOLIDATION FOR TAX YEAR 2010 is a legal document submitted to request the division or consolidation of tax assessments or liabilities for the tax year 2010, allowing taxpayers to reorganize or combine their tax obligations under specific conditions.

Who is required to file PETITION FOR DIVISION AND OR CONSOLIDATION FOR TAX YEAR 2010?

Taxpayers who have multiple tax assessments or entities for the tax year 2010 that they wish to divide or consolidate are required to file this petition.

How to fill out PETITION FOR DIVISION AND OR CONSOLIDATION FOR TAX YEAR 2010?

To fill out the PETITION FOR DIVISION AND OR CONSOLIDATION FOR TAX YEAR 2010, taxpayers must provide their personal information, specify the tax assessments or liabilities involved, state the reason for the petition, and include any supporting documentation as required by the tax authority.

What is the purpose of PETITION FOR DIVISION AND OR CONSOLIDATION FOR TAX YEAR 2010?

The purpose of the PETITION FOR DIVISION AND OR CONSOLIDATION FOR TAX YEAR 2010 is to streamline the assessment process for taxpayers, allowing for a more efficient management of their tax responsibilities by either dividing them for clarity or consolidating them for simplicity.

What information must be reported on PETITION FOR DIVISION AND OR CONSOLIDATION FOR TAX YEAR 2010?

The information that must be reported includes the taxpayer's identification details, specific tax assessments or liabilities in question, the rationale for the division or consolidation, and any relevant financial documents that support the petition.

Fill out your petition for division and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Petition For Division And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.