Get the free Invesco Solo 401(k)®

Show details

A retirement plan designed for self-employed individuals to save for retirement with tax advantages and high contribution limits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign invesco solo 401k

Edit your invesco solo 401k form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your invesco solo 401k form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing invesco solo 401k online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit invesco solo 401k. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

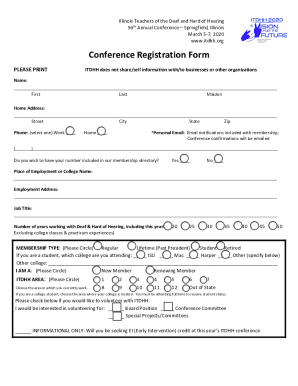

How to fill out invesco solo 401k

How to fill out Invesco Solo 401(k)®

01

Visit the Invesco website and navigate to the Solo 401(k) section.

02

Download the Invesco Solo 401(k) application form.

03

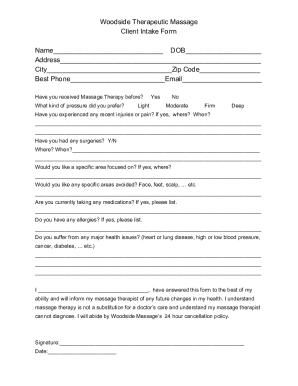

Fill out the personal information section with your name, address, and contact details.

04

Provide information about your business, including its name, type, and tax identification number.

05

Select your contribution types, including employee deferrals and employer profit-sharing contributions.

06

Review the eligibility requirements to ensure you qualify for a Solo 401(k).

07

Sign the application form and include the date.

08

Submit the completed application and any required documentation either online or via mail.

09

Wait for confirmation from Invesco regarding the approval of your Solo 401(k) account.

Who needs Invesco Solo 401(k)®?

01

Self-employed individuals seeking retirement savings options.

02

Small business owners without full-time employees.

03

Freelancers or independent contractors looking to save for retirement.

04

Individuals who want to maximize their retirement contributions and tax benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is the 5 year rule for Solo 401k?

Roth Solo 401k accounts follow an additional rule: the account must be at least five years old before you can take qualified, penalty-free withdrawals. The five-year rule starts when you make your first contribution.

How much income to max out a Solo 401k?

Elective deferrals up to 100% of compensation (“earned income” in the case of a self-employed individual) up to the annual contribution limit: $23,000 in 2024 ($22,500 in 2023; $20,500 in 2022; $19,500 in 2020 and 2021), or $30,000 in 2023 ($27,000 in 2022; $26,000 in 2020 and 2021) if age 50 or over; plus.

How to withdraw from Solo 401k?

In general, distributions from a Solo 401(k) cannot be made until one of the following occurs: The employee reaches retirement age as defined under the plan, which is typically the age of 59 1/2. The employee becomes disabled. The employee dies, at which time the beneficiary is eligible for distributions.

Is a Solo 401k better than a Roth IRA?

Due to the much higher contribution limit, a Roth Solo 401k is the superior investment vehicle if your goal is to save as much as you can for retirement. However, not everyone qualifies since you need self-employment income with no employees.

Is a Solo 401k worth it?

In terms of the tax benefit and the higher contribution limits, a solo 401(k) has the edge over other kinds of individual retirement accounts. Depending on where you open your account, you may even be able to borrow against your balance with a 401(k) loan.

How much does Invesco Solo 401k cost?

Annual account maintenance fee per participant: - $30 for account balances under $50,000. - $0 for account balances $50,000 or greater. 4 • $75 loan set-up fee.

What are the disadvantages of a Solo 401k?

Solo 401(k) Cons No employees. In order to qualify for a Solo 401(k), you cannot have any employees (other than your spouse), so if you have employees or want to have employees in the future, this plan is not for you. 5500 filing. Substantial and recurring.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Invesco Solo 401(k)®?

Invesco Solo 401(k)® is a retirement savings plan specifically designed for self-employed individuals and small business owners, allowing them to save for retirement with various investment options and tax advantages.

Who is required to file Invesco Solo 401(k)®?

Individuals who establish an Invesco Solo 401(k)® plan and have more than $250,000 in assets must file Form 5500 annually with the IRS.

How to fill out Invesco Solo 401(k)®?

To fill out an Invesco Solo 401(k)®, you need to provide personal and business information, contribution details, and select your investment options as guided by the plan documents.

What is the purpose of Invesco Solo 401(k)®?

The purpose of Invesco Solo 401(k)® is to provide self-employed individuals and small business owners a tax-advantaged way to save for retirement while allowing them to maintain control over their investment choices.

What information must be reported on Invesco Solo 401(k)®?

The information that must be reported includes plan assets, contributions, distributions, and any administrative expenses incurred during the plan year.

Fill out your invesco solo 401k online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Invesco Solo 401k is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.