Get the free invesco solo 401k form

Get, Create, Make and Sign invesco solo 401k form

Editing invesco solo 401k form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out invesco solo 401k form

How to fill out Invesco Solo 401k form:

Who needs Invesco Solo 401k form:

Instructions and Help about invesco solo 401k form

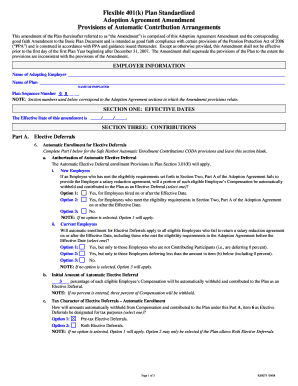

Welcome this is a video tutorial for our new clients that are filing their very first tax form 5500 SF then as your plan just started up in the previous year if your plan started up earlier than that, and you just need a refresher course in filing your 5500 there is a separate video posted on our website just for your returning filers most likely you're watching this video because you just received this email from the online 401k about filing your tax form 5500 this 5500 is an informational tax return that reports the activity of your 401k plan to the feds all 401k plans that have assets by the priest by the previous December 31st have to file a form for that year the feds presumably use this information to gauge how many people are covered by private pension plans and how much money is in these plans we have already input the data into your 5500 for you all you have to do is review it electronically sign it and file it, although we filled the form out for you, we can't sign it and file it for you only you as the plan sponsor can electronically sign it and file it now the first question most new clients have is who can sign the 5500 usually it's the trustee of the plan who will sign the 5500 but anyone who can answer questions about that 5500 can sign it and file it if not the trustee and the plan sponsor or whoever submits the regular payrolls would be a good candidate but mainly if the IRS NBL had a question about the 5500 the person most conversant with the plan would be the logical choice to sign the 5500 now then for first time filers you'll need to go through a two-step process the first step is you're going to let them do is to get an electronic signature from the Department of Labor website this electronic signature looks like this it has a user ID that starts with the letter A, and it says seven digits and a four-digit pin, and I'll walk you through the process of how to get this electronic signature from the Department of Labor website and once you have your electronic signature then you can go to the 5500 website and input this electronic signature on the 5500 itself now then in the email we sent there's a link to the IRS website it's this WWF a DOL that'll take you to the Department of Labor website itself now what do you want to do to get your electronic signature is to click this link here if you are new to be fast to register for any fast to account, and again I'll walk you through this process here you'll read and agree to the agreement check the little box you'll agree to an agreement a couple of dozen times over this process and accept this agreement now then you'll fill this profile information out with your company name and address give you this is a dummy account I set up just for this case so don't use this information, but this is what it might look like now what's important here is checked the box for filing signer you can check these other boxes if you like it won't hurt anything it won't help anything but the most...

People Also Ask about

Can I set up a Solo 401k by myself?

What paperwork is needed for a Solo 401k?

How do I contact Invesco retirement?

How do I contact Invesco Solo 401k?

Does a Solo 401k have a plan document?

Who is the plan administrator for Solo 401k?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify invesco solo 401k form without leaving Google Drive?

How do I edit invesco solo 401k form straight from my smartphone?

How do I complete invesco solo 401k form on an iOS device?

What is invesco solo 401k form?

Who is required to file invesco solo 401k form?

How to fill out invesco solo 401k form?

What is the purpose of invesco solo 401k form?

What information must be reported on invesco solo 401k form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.