Get the free Automated Clearinghouse Authorization Agreement

Show details

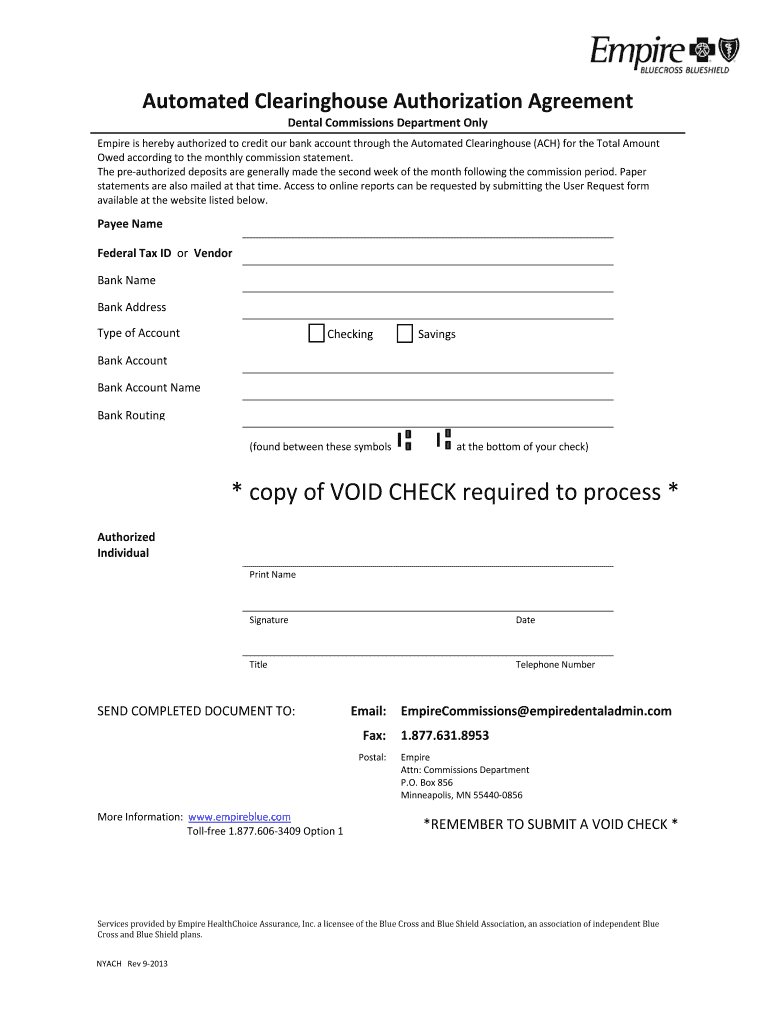

This document authorizes Empire to credit a bank account through ACH for the total amount owed according to the monthly commission statement.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automated clearinghouse authorization agreement

Edit your automated clearinghouse authorization agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automated clearinghouse authorization agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit automated clearinghouse authorization agreement online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit automated clearinghouse authorization agreement. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automated clearinghouse authorization agreement

How to fill out Automated Clearinghouse Authorization Agreement

01

Obtain the Automated Clearinghouse Authorization Agreement form from your bank or financial institution.

02

Fill in your personal information, including your name, address, and phone number.

03

Provide the name of the organization or individual who will be processing the transactions.

04

Indicate the type of transactions you are authorizing (e.g., one-time payments, recurring payments).

05

Specify the amount and frequency of the transactions, if applicable.

06

Sign and date the form to authorize the agreement.

07

Submit the completed form to your bank or the designated entity.

Who needs Automated Clearinghouse Authorization Agreement?

01

Individuals or businesses that wish to set up automatic payments or transfers.

02

Organizations that require authorization to process electronic payments on behalf of individuals or businesses.

03

Banks and financial institutions that facilitate ACH transactions.

Fill

form

: Try Risk Free

People Also Ask about

Is ACH the same as Swift?

ACH and SWIFT are both payment networks but serve different purposes. ACH is used for domestic transactions within the U.S., while SWIFT is an international messaging network for global payments. ACH is more cost-effective and quicker for local payments, but SWIFT supports complex cross-border payments.

What is an ACH and how does it work?

ACH transfers are electronic money transfers sent from one bank to another across an Automated Clearing House (ACH) Network — a digital hub that transfers funds. Banks, credit unions, and other institutions use the network to bundle direct deposits or payments and send them at specific times of the day.

What does ACH authorization mean?

An Automated Clearing House (ACH) authorization is a payment authorization that gives the lender permission to electronically take money from your bank, credit union, or prepaid card account when your payment is due. You can revoke this authorization.

What is the difference between ACH and Nacha?

2 min. ACH (Automated Clearing House) is an electronic network for moving money between US bank accounts, while Nacha (The National Automated Clearing House Association) is the governing body that oversees the ACH network and enforces rules and regulations to protect sensitive information.

Who fills out the ACH form?

Before a business can debit and charge money from its clients' checking accounts using the Automatic Clearing House (ACH) Network, it needs to gain authorization to do so. To receive this authorization, your client has to fill out an ACH authorization form.

Who fills out an ACH form?

Before a business can debit and charge money from its clients' checking accounts using the Automatic Clearing House (ACH) Network, it needs to gain authorization to do so. To receive this authorization, your client has to fill out an ACH authorization form.

How does ACH work in banking?

ACH payments are completely electronic, either as a direct deposit (credit) or a direct payment (debit). The flow of money works like this: The originator (such as your employer) initiates the payment or deposit by giving instructions to their bank. The bank sends digital payment files to the ACH network.

What is an ACH authorization agreement?

An Automated Clearing House (ACH) authorization is a payment authorization that gives the lender permission to electronically take money from your bank, credit union, or prepaid card account when your payment is due. You can revoke this authorization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Automated Clearinghouse Authorization Agreement?

The Automated Clearinghouse Authorization Agreement is a document that allows a bank or financial institution to electronically transfer funds between accounts through the Automated Clearing House (ACH) network. It serves as permission to initiate these transactions.

Who is required to file Automated Clearinghouse Authorization Agreement?

Any individual or business that wishes to set up electronic payments or direct deposits through the ACH must file an Automated Clearinghouse Authorization Agreement with their bank or payment processor.

How to fill out Automated Clearinghouse Authorization Agreement?

To fill out the Automated Clearinghouse Authorization Agreement, one must provide details such as name, account information, the type of transaction (debit or credit), and add signatures. Ensure all fields are completed accurately to prevent transaction issues.

What is the purpose of Automated Clearinghouse Authorization Agreement?

The purpose of the Automated Clearinghouse Authorization Agreement is to authorize financial institutions to initiate electronic transfers of funds. It establishes the terms and conditions for these transactions.

What information must be reported on Automated Clearinghouse Authorization Agreement?

The information reported must include the account holder's name, account number, bank routing number, type of account (checking or savings), the authorization terms, and signatures from all parties involved.

Fill out your automated clearinghouse authorization agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automated Clearinghouse Authorization Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.