Get the free Varifund Dollar Cost Averaging Form

Show details

This document serves as a form for the authorization of automatic dollar-cost averaging for annuity owners, detailing instructions, account information, and transfer preferences.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign varifund dollar cost averaging

Edit your varifund dollar cost averaging form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your varifund dollar cost averaging form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit varifund dollar cost averaging online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit varifund dollar cost averaging. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

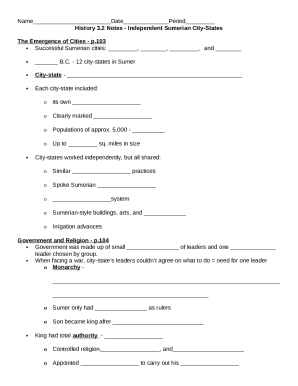

How to fill out varifund dollar cost averaging

How to fill out Varifund Dollar Cost Averaging Form

01

Obtain the Varifund Dollar Cost Averaging Form from the official Varifund website or your financial advisor.

02

Fill in your personal information in the fields provided, including your full name, address, and contact details.

03

Specify the investment amount you wish to contribute on a regular basis.

04

Choose the frequency of your contributions (e.g., weekly, bi-weekly, monthly).

05

Indicate the duration for which you want to set up the dollar cost averaging plan.

06

Review the terms and conditions associated with the form before proceeding.

07

Sign the form to authorize the creation of your dollar cost averaging plan.

08

Submit the completed form via the designated method (online submission, mail, etc.) to Varifund.

Who needs Varifund Dollar Cost Averaging Form?

01

Individuals seeking to invest in a disciplined manner by averaging out their purchase price over time.

02

New investors looking to make regular investments without trying to time the market.

03

Those wanting to minimize the impact of market volatility on their investment portfolio.

04

Investors who prefer a systematic approach to building their investments gradually.

Fill

form

: Try Risk Free

People Also Ask about

How to dollar-cost average for beginners?

Dollar-cost averaging is the practice of putting a fixed amount of money into an investment on a regular basis, such as monthly or even bi-weekly. Over time, the strategy allows you to spread out when you buy — which means you'll do so at market lows and highs — averaging your purchase prices.

How to DCA correctly?

What is an example of dollar-cost averaging? Investing $100 in Bitcoin every month, regardless of price, is an example of DCA. How to DCA properly? Invest a fixed amount at regular intervals, stick to your schedule, and avoid reacting to short-term price swings.

How do I calculate dollar-cost averaging?

How do you calculate average dollar cost? To calculate the average cost of a share under dollar-cost averaging, you don't need to know the value of each share at the time the investor purchased it. The formula to calculate the average cost is: Amount invested / Number of shares purchased = Average cost per share.

What is the alternative to DCA?

However, an alternative to dollar-cost averaging is lump-sum investing, where you put all your money in at once, like investing a tax refund right away rather than spreading it out over time.

How to do dollar-cost averaging?

Dollar-cost averaging is a straightforward investment strategy where you invest a fixed amount of money into a particular investment at regular intervals — regardless of the investment's price. For example, instead of investing a lump sum in a stock or fund, you invest smaller amounts periodically.

What is the best DCA method?

DCA best practice involves investing the same amount at the same time each week or month, regardless of price. This removes the emotional element of trying to time the market and ensures you consistently accumulate Bitcoin over time.

Does dollar-cost averaging actually work?

Dollar cost averaging does not guarantee that an investor will make money, but it does reduce the risk of investing in a volatile market. When done correctly, dollar cost averaging takes the emotions out of investing, which can help an investor stay the course during difficult market conditions.

How to calculate DCA formula?

How do you calculate average dollar cost? To calculate the average cost of a share under dollar-cost averaging, you don't need to know the value of each share at the time the investor purchased it. The formula to calculate the average cost is: Amount invested / Number of shares purchased = Average cost per share.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Varifund Dollar Cost Averaging Form?

The Varifund Dollar Cost Averaging Form is a document used by individuals or entities to report their investments made through dollar cost averaging strategies in the Varifund investment platform.

Who is required to file Varifund Dollar Cost Averaging Form?

Individuals or entities participating in the Varifund investment program who engage in dollar cost averaging must file the Varifund Dollar Cost Averaging Form.

How to fill out Varifund Dollar Cost Averaging Form?

To fill out the Varifund Dollar Cost Averaging Form, you need to provide personal information, details of the investments made, the amount invested at each interval, and the dates of the investments.

What is the purpose of Varifund Dollar Cost Averaging Form?

The purpose of the Varifund Dollar Cost Averaging Form is to track and report investment contributions made using the dollar cost averaging strategy, ensuring proper documentation for tax and record-keeping purposes.

What information must be reported on Varifund Dollar Cost Averaging Form?

The information that must be reported includes the investor's personal details, specific transactions made, amounts invested, frequency of investments, and the overall performance of the investment strategy.

Fill out your varifund dollar cost averaging online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Varifund Dollar Cost Averaging is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.