Get the free Fixed Deposit Form

Show details

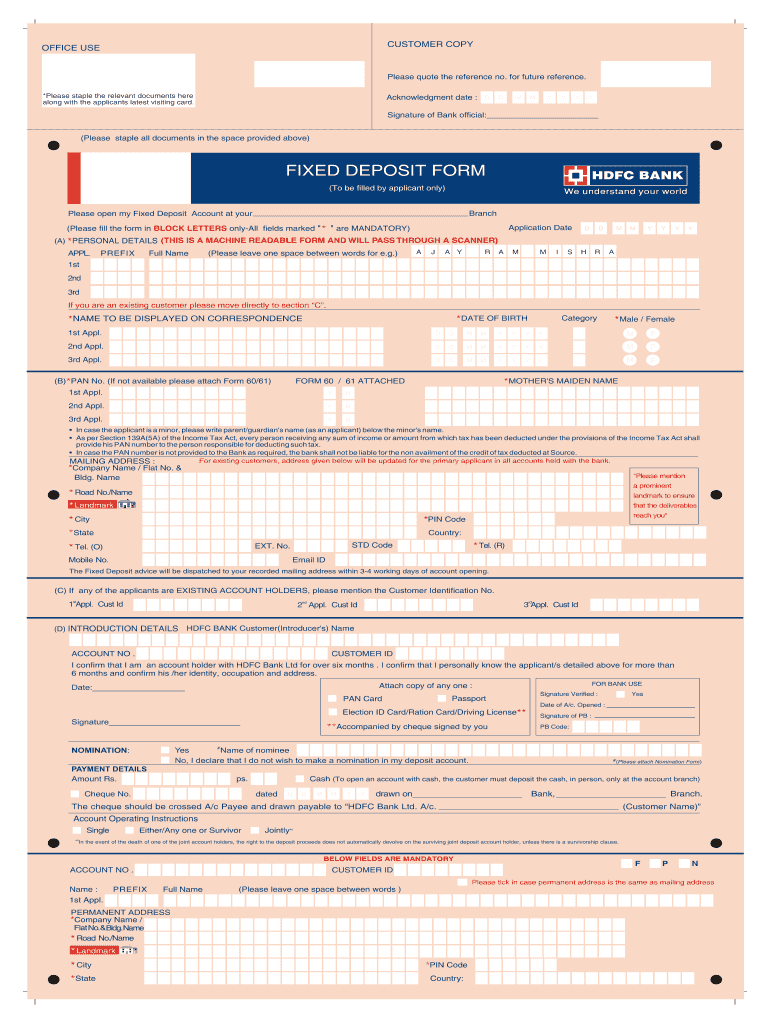

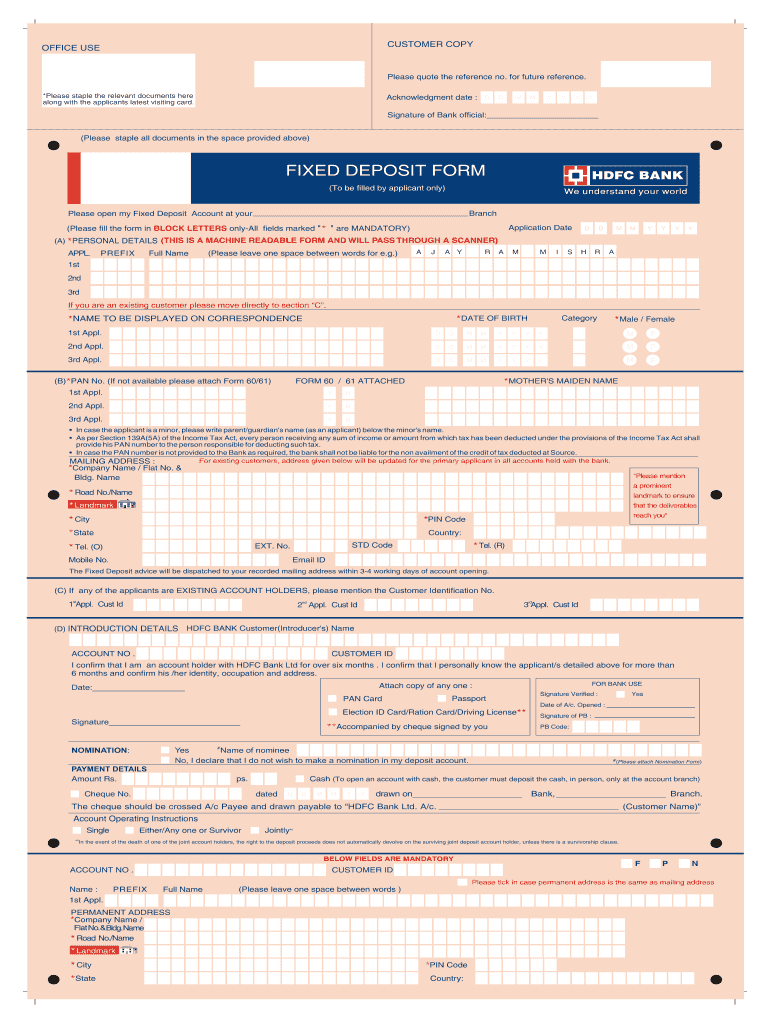

This document is a fixed deposit application form that needs to be filled out by the applicant to open a fixed deposit account at HDFC Bank. It requires personal details, introduction, and payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed deposit form

Edit your fixed deposit form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed deposit form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fixed deposit form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fixed deposit form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed deposit form

How to fill out Fixed Deposit Form

01

Obtain a Fixed Deposit Form from your bank or financial institution.

02

Fill in your personal details like name, address, and contact information.

03

Choose the type of Fixed Deposit account (e.g., regular, monthly income).

04

Specify the amount you wish to deposit.

05

Select the tenure for the fixed deposit (e.g., 6 months, 1 year).

06

Indicate the interest payment method (e.g., monthly, quarterly, at maturity).

07

Provide any additional required information, such as nominee details.

08

Read the terms and conditions carefully.

09

Sign the form to authenticate your application.

10

Submit the completed form at the bank's branch.

Who needs Fixed Deposit Form?

01

Individuals seeking a safe investment option to earn interest.

02

Retirees looking for a reliable source of income.

03

Anyone wanting to save money for future expenses.

04

People needing to park their funds for a specific period without risk.

05

Business owners wishing to invest surplus cash for a fixed term.

Fill

form

: Try Risk Free

People Also Ask about

What is fixed deposit English?

FD full form is Fixed Deposit. FD is a type of investment in which an individual invests a lump sum amount for a specific period of time with a bank. The amount deposited in the FD earns interest at a fixed rate which is set at the time of the account opening.

How to fill 15G form for fixed deposit sample?

How to fill Form 15G? Name of Assesse (Declarant) – Enter your name as per income tax records & PAN number as per your PAN card, Status – Input whether you are an individual or HUF. Previous Year –Input the current financial year for which you are filing up the form.

How to request for a fixed deposit?

Fixed Deposit Application Process Step 1: Access Axis Bank's 'Fixed Deposit' section, click on 'Open Digital FD'. Step 2: On the next page, click on the 'Book FD' option and add all your details to the pop-up section.

How to fill up a fixed deposit form?

How to fill out the Fixed Deposit Account Opening Form? Enter the amount you wish to deposit. Fill in the duration of the deposit in years. Provide your personal details including name and contact information. Nominate a beneficiary if applicable. Sign the form and submit it to the bank.

How to write a letter for a fixed deposit?

LETTER HEAD TO WHOMSOEVER IT MAY CONCERN. This is to certify that Ms. Name resident of (address) holds Fixed Deposit accounts. Account Type Account No Deposit Maturity Amount in Amount in. Date Date INR words. The total balance as on (today's date) in the above mentioned fixed deposit. Seal and Signature.

How do I write a letter to break a fixed deposit before maturity?

I am writing this letter to you for premature withdrawal of fixed deposit/closure of fixed deposit because (mention the reason here). I am requesting you to kindly look into the matter and credit the amount to my savings account.

How to write a letter to bank manager for closing a fixed deposit?

I am writing to request the premature closure of my [Account Type] account with your bank, which has the account number [Account Number]. Due to personal reasons, I need to close this account before the scheduled maturity date.

How do I write a letter for a bank fixed deposit?

Dear Sir, Please open in the name/s shown below a Fixed Deposit Account in ance with the rules of the bank on the following terms & conditions and issue me / us a Deposit Receipt. with you. dated By debit to my / our Savings / Current Account No.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fixed Deposit Form?

A Fixed Deposit Form is a financial document used by individuals to open a fixed deposit account with a bank or financial institution.

Who is required to file Fixed Deposit Form?

Individuals and entities wishing to invest in a fixed deposit account are required to fill out and submit a Fixed Deposit Form.

How to fill out Fixed Deposit Form?

To fill out a Fixed Deposit Form, one must provide personal information such as name, contact details, amount to be deposited, tenure, and selection of interest payout options.

What is the purpose of Fixed Deposit Form?

The purpose of a Fixed Deposit Form is to formally request the opening of a fixed deposit account and to provide the necessary details for processing the investment.

What information must be reported on Fixed Deposit Form?

The Fixed Deposit Form must report the depositor's name, address, contact number, PAN (if applicable), amount of deposit, tenure, interest rate, and any instruction regarding interest payout.

Fill out your fixed deposit form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Deposit Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.