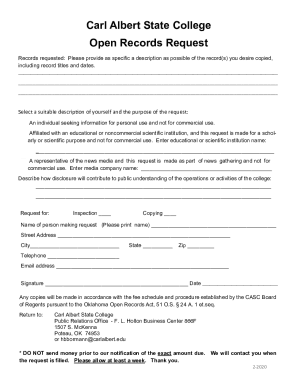

Get the free MUTHOOT FINANCE LIMITED - NON-CONVERTIBLE DEBENTURES

Show details

This document is an application form for subscribing to the Non-Convertible Debentures (NCDs) issued by Muthoot Finance Limited, detailing terms, conditions, and required personal and financial information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign muthoot finance limited

Edit your muthoot finance limited form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your muthoot finance limited form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing muthoot finance limited online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit muthoot finance limited. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out muthoot finance limited

How to fill out MUTHOOT FINANCE LIMITED - NON-CONVERTIBLE DEBENTURES

01

Obtain the application form from Muthoot Finance or download it from their official website.

02

Fill in your personal details such as name, address, and contact information accurately.

03

Choose the amount you wish to invest in the non-convertible debentures.

04

Select the desired tenure and interest payout option (monthly, quarterly, etc.).

05

Provide your bank account details for interest payments.

06

Attach the necessary KYC documents, including a copy of your ID and address proof.

07

Sign the application form at the designated place.

08

Submit the completed application form along with the cheque or demand draft for the investment amount.

09

Keep a copy of the application for your records and follow up on the status after submission.

Who needs MUTHOOT FINANCE LIMITED - NON-CONVERTIBLE DEBENTURES?

01

Investors looking for a stable fixed income option.

02

Individuals seeking to diversify their investment portfolio.

03

Risk-averse investors wanting a relatively safe investment.

04

Those searching for long-term investment opportunities with attractive interest rates.

05

Investors who support corporate finance and wish to invest in reputable companies like Muthoot Finance.

Fill

form

: Try Risk Free

People Also Ask about

What is the rating of Muthoot NCD?

Crisil Ratings has assigned its 'Crisil AA+/Stable' to Rs 13200 crore Non-Convertible Debentures of Muthoot Finance Ltd (Muthoot Finance).

Is it safe to invest in Muthoot NCD?

Muthoot Fincorp Ltd is issuing Non-Convertible Debentures. These NCDs are AA-/Stable by CRISIL. The NCDs are being issued in twelve series: yield ranges from 9.20% to 9.81% p.a. and different tenures of 24 months, 36 months, 60 months, and 72 months. The NCDs are secured and redeemable in nature.

Is Muthoot trustworthy?

1 Most Trusted Financial Services Brand for the 8th consecutive year as per TRA's Brand Trust Report (BTR) 2024.

Is ncd safe to invest?

Non-convertible Debtentures (NCDs) are a type of investment in which you lend money to a company and get paid interest in return. Unlike some other investments, NCDs cannot be changed into company shares. They are safe and give good returns, making them popular for people who want a steady income with low risk.

What is a non-convertible debenture?

Non-convertible debentures (NCD) are those which cannot be converted into shares or equities. NCD interest rates depend on the company issuing the NCD. NCD investment can be held by individuals, banking companies, primary dealers other corporate bodies registered or incorporated in India and unincorporated bodies.

Is muthoot finance ncd safe?

This offer is rated as CRISIL/AA- Stable by CRISIL. The rating of the NCDs indicates that instruments with this rating are considered to have high degree of safety regarding the timely servicing of financial obligations.

What is ncd in muthoot finance?

NCD is the abbriviation for Non-Convertible Debenture. It is a type of debt instrument issued by a company to raise capital from its investors. NCDs offer fixed interest rates and a specific maturity period, during which the issuing company pays regular and fixed interest payments to its debenture holders.

Is it good to invest in non-Convertible Debentures?

NCDs often provide higher interest rates than fixed deposits, making them attractive for investors seeking better returns. However, they carry higher risk since the repayment depends on the issuing company's financial health, unlike fixed deposits which are usually more secure and backed by banks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MUTHOOT FINANCE LIMITED - NON-CONVERTIBLE DEBENTURES?

Muthoot Finance Limited - Non-Convertible Debentures (NCDs) are financial instruments issued by Muthoot Finance that allow investors to lend money to the company in exchange for fixed interest payments over a specified period, without the option to convert the debentures into equity.

Who is required to file MUTHOOT FINANCE LIMITED - NON-CONVERTIBLE DEBENTURES?

Investors who purchase Muthoot Finance Limited - Non-Convertible Debentures typically do not need to file anything related to the NCDs. However, the company itself is required to file necessary disclosures and reports to regulatory authorities concerning the issuance and management of the NCDs.

How to fill out MUTHOOT FINANCE LIMITED - NON-CONVERTIBLE DEBENTURES?

Filling out the application for Muthoot Finance Limited - Non-Convertible Debentures involves providing personal details, such as investor name, address, PAN number, bank details for interest payments, and indicating the number of debentures being applied for, among other required information, depending on the application form.

What is the purpose of MUTHOOT FINANCE LIMITED - NON-CONVERTIBLE DEBENTURES?

The purpose of issuing Muthoot Finance Limited - Non-Convertible Debentures is to raise capital for business expansion, working capital needs, and to support various financial activities of the company while offering investors a fixed return over the investment period.

What information must be reported on MUTHOOT FINANCE LIMITED - NON-CONVERTIBLE DEBENTURES?

The information that must be reported on Muthoot Finance Limited - Non-Convertible Debentures includes the terms and conditions of the debentures, interest rate, maturity date, repayment terms, and any risks associated with the investment, along with periodic financial disclosures by the company.

Fill out your muthoot finance limited online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Muthoot Finance Limited is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.