India HDFC Bank Form 60 free printable template

Show details

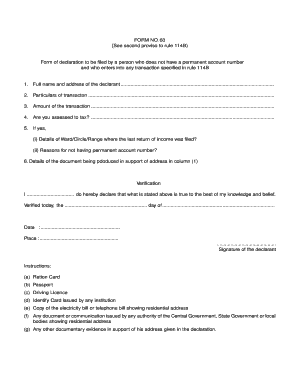

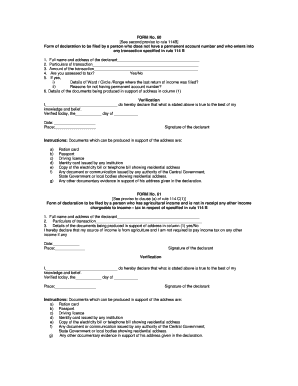

* PAN * FORM 60 Declaration The Manager, HDFC Bank Cards Division, P.O. Box 8654, Thiruvanmiyur P.O., Chennai 600 041. 1. Full name and address ......................................................................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hdfc bank form 60 pdf

Edit your hdfc bank form 60 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hdfc form 60 pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hdfc form 60 download online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bank form 60 online. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hdfc bank form 60 download

How to fill out India HDFC Bank Form 60

01

Obtain the Form 60 from HDFC Bank's website or a branch.

02

Write your name as it appears on your identification documents.

03

Fill in your father's name or guardian's name.

04

Provide your address, including city and PIN code.

05

Indicate your occupation.

06

Fill in the date of birth correctly.

07

Mention your cellphone number and email address for communication.

08

Sign the form at the designated place after reading the declaration carefully.

09

Submit the completed form along with valid ID proof and address proof.

Who needs India HDFC Bank Form 60?

01

Individuals who do not have a Permanent Account Number (PAN) and need to open a bank account, deposit money, or conduct large financial transactions.

Video instructions and help with filling out and completing bank form 60 pdf

Instructions and Help about hdfc form 60

Fill

bank form 60 fill

: Try Risk Free

People Also Ask about bank form 60

What is the validity period of the Form 60?

✅What is the validity period of Form 60? Form 60 is valid for a period of 6 years from the end of the financial year in which the financial transaction was made.

How can I get Form 60 online?

You can also download Form 60 from the income tax portal.

What is Form 60 in HDFC Bank?

Form for declaration to be filed by an individual or a person (not being a company or firm) who does not have a permanent account. number and who enters into any transaction specified in rule 114B.

Is Form 60 required for NRI?

PAN/Form 60 Rules for NRI/PIO/OCI If PAN is not available, Form 60 declaration is mandatory. PAN Application Date and PAN Acknowledgment Number on Form 60 is mandatory if the customer's taxable income in India is Rs 250,000 or more.

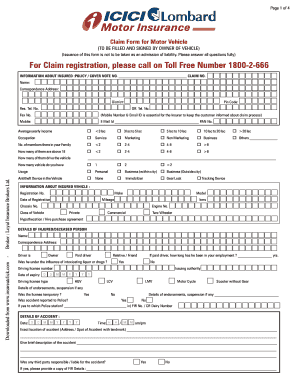

What is Form 60 Icici?

PAN/Form 60 Rules for NRI/PIO/OCI If PAN is not available, Form 60 declaration is mandatory. PAN Application Date and PAN Acknowledgment Number on Form 60 is mandatory if the customer's taxable income in India is Rs 250,000 or more.

Where can I download Form 60?

You can also download Form 60 from the income tax portal.

How to fill out Form No 60?

Structure of FORM 60 First name, middle name and surname. Date of Birth in DDMMYYYY format. Address as per official documents – Flat Number, Name of premises, Block name, Street, Lane, Area, Locality, City, town, District and Pin Code. Telephone Number and Mobile number. Amount of transaction.

Why form 60 is required in bank?

It is an official document that is presented by persons who do not have a PAN card to conduct financial transactions or create bank accounts. Form 60 is also utilized when assets are bought and sold, cash payments above Rs. 50,000 are made, tax returns are filed, businesses are registered, and so on.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify in bank form 60 fill without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your in hdfc bank form 60 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get hdfc declaration 60?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the hdfc bank form 60 format. Open it immediately and start altering it with sophisticated capabilities.

How do I edit form 60 pan card on an iOS device?

Use the pdfFiller mobile app to create, edit, and share bank form 60 make from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is India HDFC Bank Form 60?

India HDFC Bank Form 60 is a declaration form used for individuals who do not have a Permanent Account Number (PAN) and wish to conduct specific financial transactions where providing a PAN is normally required.

Who is required to file India HDFC Bank Form 60?

Individuals who do not possess a PAN but need to execute transactions that require PAN details, such as opening a bank account or making certain financial transactions, are required to file Form 60.

How to fill out India HDFC Bank Form 60?

To fill out Form 60, individuals need to provide personal details such as name, address, the nature of the transaction, and the details of the financial institution involved. The form must be duly signed and can be submitted to the respective bank.

What is the purpose of India HDFC Bank Form 60?

The purpose of Form 60 is to maintain transparency in financial transactions and to prevent tax evasion by individuals who do not have a PAN, thereby helping authorities to keep track of financial activities.

What information must be reported on India HDFC Bank Form 60?

Information that must be reported on Form 60 includes the individual's name, address, details of the transaction, the amount involved, and a declaration stating the absence of a PAN.

Fill out your bank form 60 pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Form 60 Pdf is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.