Get the free Customs Power of Attorney

Show details

This document serves as a legal authorization for a designated agent to act on behalf of a grantor in matters related to customs transactions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign customs power of attorney

Edit your customs power of attorney form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your customs power of attorney form via URL. You can also download, print, or export forms to your preferred cloud storage service.

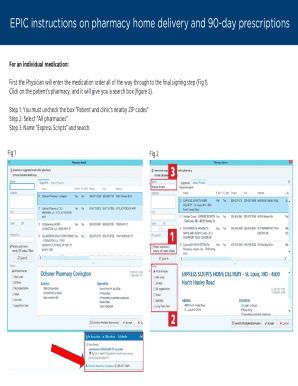

Editing customs power of attorney online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit customs power of attorney. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out customs power of attorney

How to fill out Customs Power of Attorney

01

Obtain a Customs Power of Attorney form from the U.S. Customs and Border Protection (CBP) website or your customs broker.

02

Fill in the name and address of the principal (the person or company granting authority).

03

Provide the name and address of the attorney-in-fact (the person or company receiving authority).

04

Indicate the capacity of the principal if applicable (individual, corporation, partnership, etc.).

05

Specify the types of transactions for which authority is granted (importation, exportation, etc.).

06

Sign and date the form; ensure that the signature is that of the principal or an authorized representative.

07

Submit the completed form to CBP or your customs broker.

Who needs Customs Power of Attorney?

01

Businesses or individuals who import or export goods and need to designate someone to act on their behalf for customs-related transactions.

02

Companies engaged in international trade that require customs clearance services.

03

Importers and exporters looking to simplify the customs process by appointing a customs broker or attorney-in-fact.

Fill

form

: Try Risk Free

People Also Ask about

How long is a customs power of attorney good for?

By granting a Power of Attorney, the grantor authorizes the broker to transact with the CBP in their name. Power of Attorney is valid indefinitely until it has been revoked. An exception to this rule is partnerships - a PoA issued by a partnership is valid for two years only, after which time it must be renewed.

What is a customs power of attorney?

A Customs Power of Attorney is a document that allows an authorised representative, such as a customs broker or freight forwarder, to handle customs formalities on behalf of a business.

Who is responsible for customs paperwork?

When you buy goods from foreign sources, you become the importer. And it is the importer - in this case, YOU - who is responsible for assuring that the goods comply with a variety of both state and federal government import regulations.

What is Power of Attorney for customs?

A power of attorney (POA) is a legal document used in shipping to grant a customs broker the authority to process Customs clearance on your behalf.

How long is a customs Power of Attorney good for?

By granting a Power of Attorney, the grantor authorizes the broker to transact with the CBP in their name. Power of Attorney is valid indefinitely until it has been revoked. An exception to this rule is partnerships - a PoA issued by a partnership is valid for two years only, after which time it must be renewed.

What three decisions cannot be made by a legal Power of Attorney?

When someone makes you the agent in their power of attorney, you cannot: Write a will for them, nor can you edit their current will. Take money directly from their bank accounts. Make decisions after the person you are representing dies. Give away your role as agent in the power of attorney.

What three decisions cannot be made by a legal power of attorney?

When someone makes you the agent in their power of attorney, you cannot: Write a will for them, nor can you edit their current will. Take money directly from their bank accounts. Make decisions after the person you are representing dies. Give away your role as agent in the power of attorney.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Customs Power of Attorney?

Customs Power of Attorney is a legal document that authorizes a designated individual or entity to act on behalf of another party in dealings with customs authorities. This includes the ability to make decisions and complete transactions related to the import and export of goods.

Who is required to file Customs Power of Attorney?

Individuals or businesses that engage in importing or exporting goods and wish to appoint a customs broker or agent to represent them in customs matters are required to file a Customs Power of Attorney.

How to fill out Customs Power of Attorney?

To fill out a Customs Power of Attorney, one must provide information about the principal (the person or business granting authority), the attorney-in-fact (the agent or broker authorized to act), and the specific powers being granted. This typically includes signatures from both parties.

What is the purpose of Customs Power of Attorney?

The purpose of Customs Power of Attorney is to enable a designated individual or entity to efficiently manage customs transactions on behalf of another party, ensuring compliance with customs regulations and streamlining the import and export process.

What information must be reported on Customs Power of Attorney?

The information that must be reported on Customs Power of Attorney includes the names and addresses of the principal and attorney-in-fact, a description of the authority granted, and the signature of the principal. Additional details may include the date and specific powers authorized.

Fill out your customs power of attorney online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Customs Power Of Attorney is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.