Get the free Lost or Missing Receipt Affidavit - BYU Political Science - politicalscience byu

Show details

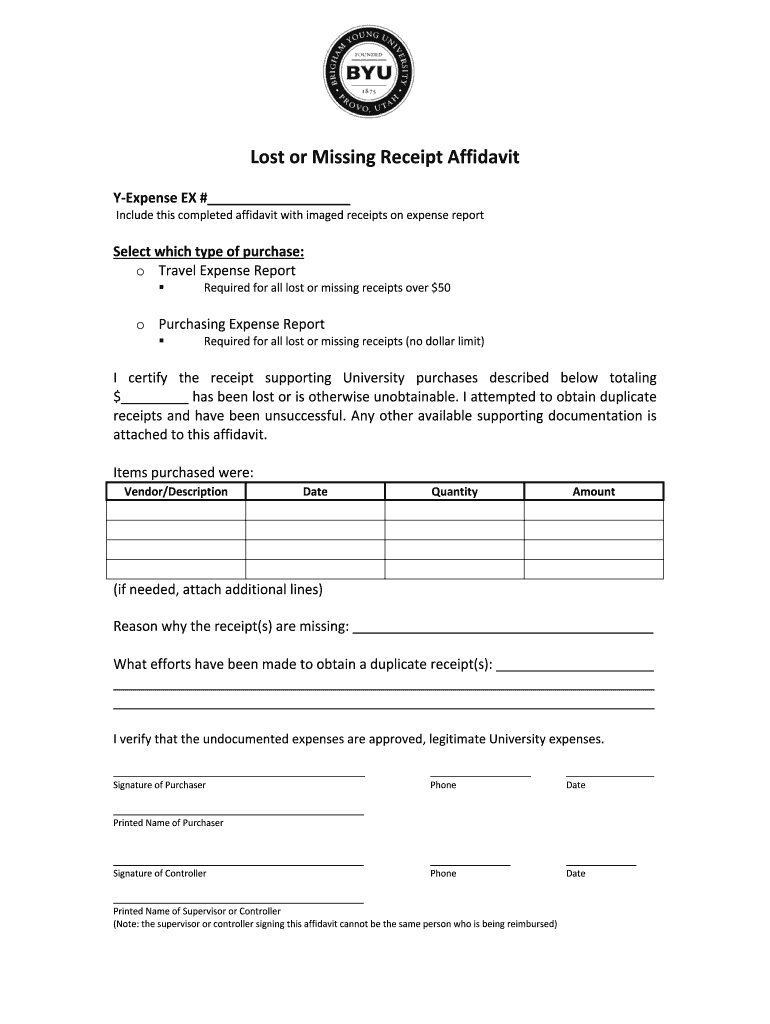

LostorMissingReceiptAffidavit Expense# Includethiscompletedaffidavitwithimagedreceiptsonexpensereport Selectwhichtypeofpurchase: o TravelExpenseReport Requiredforalllostormissingreceiptsover$50 o

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lost or missing receipt

Edit your lost or missing receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lost or missing receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lost or missing receipt online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lost or missing receipt. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lost or missing receipt

How to fill out a lost or missing receipt:

01

Contact the place of purchase: If you have lost or misplaced your receipt, the first step is to reach out to the establishment where the transaction took place. Provide them with the details of the purchase, such as the date, time, and location. They may be able to assist you in retrieving a copy of the receipt or provide alternative documentation.

02

Check your email or online accounts: Many stores and businesses send digital receipts or have customer accounts where purchase history is stored. Take a look at your email inbox or any online platforms associated with the vendor. You might find a digital copy of the receipt that you can use for your records or reimbursement purposes.

03

Utilize credit card or bank statements: Review your credit card or bank statements for the date of the transaction in question. In some instances, the transaction details may be sufficient for certain purposes, such as proof of purchase or tax-related documentation. However, it is always best to have an actual receipt whenever possible.

04

File a report or affidavit: In some cases, if you are unable to obtain a copy of the lost or missing receipt from the place of purchase, you may need to file a report or an affidavit attesting to the circumstances. This statement should outline the details of the transaction, including the amount, items purchased, and any other pertinent information. It is essential to consult with the relevant authorities or seek legal advice to ensure you meet the necessary requirements for this process.

Who needs a lost or missing receipt?

01

Individuals seeking reimbursement: If you need to be reimbursed for a purchase, whether through work expenses or a return, having the original receipt is often required. However, alternative options like bank statements or affidavits may be accepted by some organizations, depending on their policies.

02

Individuals for tax purposes: For tax purposes, retaining receipts can be crucial. Receipts serve as evidence of deductible expenses, credits, or exemptions. If you have lost or misplaced a receipt, you may need to explore other options as mentioned earlier, such as credit card statements or filing an affidavit.

03

Individuals with warranty claims: When making warranty claims, having the original receipt is usually necessary to validate the purchase date and prove that the item is still within the warranty period. If you cannot locate the receipt, contacting the manufacturer or vendor might help you find alternative solutions or provide proof of purchase through other means.

Note: It is important to keep in mind that every situation and organization may have specific requirements regarding lost or missing receipts. Consulting with the relevant parties or seeking professional advice can help you navigate the process effectively.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lost or missing receipt?

Lost or missing receipt is a document that proves a transaction took place but cannot be found or retrieved.

Who is required to file lost or missing receipt?

Individuals or businesses who are unable to provide a receipt for a transaction are required to file a lost or missing receipt.

How to fill out lost or missing receipt?

To fill out a lost or missing receipt, provide as much detail as possible about the transaction, such as the date, amount, and parties involved.

What is the purpose of lost or missing receipt?

The purpose of a lost or missing receipt is to document a transaction that occurred even if the physical receipt is not available.

What information must be reported on lost or missing receipt?

Information such as the date of the transaction, amount, description of the purchase, and parties involved should be reported on a lost or missing receipt.

How do I make edits in lost or missing receipt without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your lost or missing receipt, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the lost or missing receipt electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your lost or missing receipt.

Can I create an eSignature for the lost or missing receipt in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your lost or missing receipt directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your lost or missing receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lost Or Missing Receipt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.