Get the free ING SEPARATE PORTFOLIOS TRUST

Show details

This document serves as a notice for the special meeting of shareholders of ING Separate Portfolios Trust, including the proposed advisory agreements and election of Trustees.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ing separate portfolios trust

Edit your ing separate portfolios trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ing separate portfolios trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ing separate portfolios trust online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ing separate portfolios trust. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

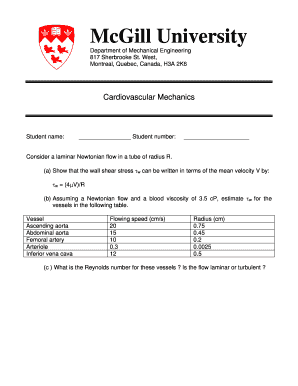

How to fill out ing separate portfolios trust

How to fill out ING SEPARATE PORTFOLIOS TRUST

01

Gather all necessary personal and financial information.

02

Obtain the ING SEPARATE PORTFOLIOS TRUST application form.

03

Fill out the personal details section, including your name, address, and contact information.

04

Specify the type of trust for the portfolio.

05

Include details of the assets you wish to place into the trust.

06

Designate beneficiaries, including their names and relationships to you.

07

Indicate the management structure or appoint a trustee.

08

Review and verify all the information entered.

09

Sign and date the application form.

10

Submit the completed application to ING for processing.

Who needs ING SEPARATE PORTFOLIOS TRUST?

01

Individuals looking for a structured way to manage and separate their investment assets.

02

Those seeking to minimize estate taxes and avoid probate.

03

People wanting to ensure specific allocations of assets for beneficiaries.

04

Investors who desire professional management of their portfolios through a trust.

Fill

form

: Try Risk Free

People Also Ask about

What is portfolio management in banking?

Portfolio management's meaning can be explained as the process of managing individuals' investments so that they maximise their earnings within a given time horizon. Furthermore, such practices ensure that the capital invested by individuals is not exposed to too much market risk.

Do banks do asset management?

There are many types of asset managers. Some work for family offices and wealthy individuals and others are employed by major banks and institutional investors. Polaris Market Research.

Is ING a prestigious bank?

ING has again been awarded the world's best bank in Australia, Germany, Poland and Spain by Forbes. The recognition follows a survey of more than 50,000 people across 34 countries.

Does ING do asset management?

Its primary businesses are retail banking, direct banking, commercial banking, investment banking, wholesale banking, private banking, asset management, and insurance services.

Does ING have an investing app?

In the secure, user-friendly environment of the ING Banking app, you can access all your portfolios. For ING Self Invest and ING Easy Invest, you also easily place buy or sell orders. As cherry on the cake, with ING Self Invest you also gain inspiration by browsing the wide range of offerings.

Which is the best asset management company?

Find most comprehensive mutual fund details of all leading AMCs (Asset Management Companies) in India SBI Mutual Fund. AUM. ₹11,93,297 Cr. ICICI Prudential Mutual Fund. AUM. ₹9,87,232 Cr. HDFC Mutual Fund. AUM. Nippon India Mutual Fund. AUM. Kotak Mahindra Mutual Fund. AUM. AUM. ₹4,11,969 Cr. AUM. ₹3,73,665 Cr. Axis Mutual Fund. AUM.

Who is the No. 1 asset manager?

Largest companies RankFirm/companyAssets Under Management (billion USD) 1 BlackRock 10,473 2 Vanguard Group 9,300 3 Fidelity Investments 5,303 4 State Street Global Advisors 4,34016 more rows

Can I invest through ING?

There are several ways to invest with ING. You can invest independently or leave it to us. If you'd like to invest on your own, try ING self invest (ING Zelf op de Beurs). If you'd like us to invest your money, you have two options.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ING SEPARATE PORTFOLIOS TRUST?

ING SEPARATE PORTFOLIOS TRUST is a financial trust structure that allows investors to access separate investment portfolios, each with distinct investment strategies and objectives, managed independently.

Who is required to file ING SEPARATE PORTFOLIOS TRUST?

Entities or individuals who invest in the ING SEPARATE PORTFOLIOS TRUST or those managing the trust's portfolios may be required to file, depending on jurisdiction and specific tax obligations.

How to fill out ING SEPARATE PORTFOLIOS TRUST?

To fill out the ING SEPARATE PORTFOLIOS TRUST documentation, one must provide necessary identification information, financial details of the portfolios, and any other required disclosures as specified by the managing entity or regulatory bodies.

What is the purpose of ING SEPARATE PORTFOLIOS TRUST?

The purpose of ING SEPARATE PORTFOLIOS TRUST is to facilitate diversified investment opportunities while allowing for streamlined management and reporting for the various portfolios within the trust.

What information must be reported on ING SEPARATE PORTFOLIOS TRUST?

Information that must be reported on the ING SEPARATE PORTFOLIOS TRUST includes portfolio performance data, investment holdings, fees, and other financial disclosures relevant to investors and regulatory requirements.

Fill out your ing separate portfolios trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ing Separate Portfolios Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.