Get the free NON PROFIT ORG US POSTAGE PAID St Francis Hospice - legacy stfrancishawaii

Show details

St. Francis Hospice c/o St. Francis Healthcare System of Hawaii 2226 Lilia Street, Suite 227 Honolulu, Hawaii 96817 NON PROFIT ORG. U.S. POSTAGE PAID HONOLULU, HI PERMIT NO. 1647 St. Francis Hospice

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non profit org us

Edit your non profit org us form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non profit org us form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non profit org us online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit non profit org us. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

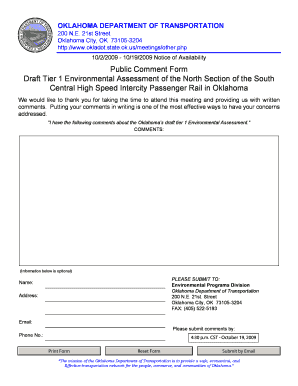

How to fill out non profit org us

How to Fill Out Non Profit Org US:

01

Start by gathering the necessary documents and information: You will need the organization's name, address, and contact information, as well as details about its purpose and goals. Additionally, you will need to gather the names and addresses of the organization's directors and officers.

02

Determine the appropriate federal tax-exempt status: Non profit organizations can be classified as 501(c)(3), 501(c)(4), 501(c)(6), and so on, each with different eligibility requirements and benefits. Identify the one that aligns with your organization's activities and goals.

03

Complete the necessary forms: The most common form for non profit organizations is the IRS Form 1023 or 1023-EZ (streamlined application for smaller organizations). These forms require detailed information about the organization's activities, governance structure, financials, and more. Be sure to fill out all sections accurately and thoroughly.

04

Pay the required fees: Along with the application, certain fees must be paid to the IRS. The specific amount will depend on the tax-exempt status you are applying for and the organization's average annual gross receipts.

05

Review and submit the application: Carefully review the completed forms and all supporting documents to ensure accuracy and thoroughness. Once reviewed, submit the application to the IRS, either electronically or via mail.

06

Maintain compliance: After successfully obtaining tax-exempt status, it is essential to comply with ongoing requirements such as filing annual reports and maintaining good governance practices. Be sure to familiarize yourself with these obligations to keep your non profit org in good standing.

Who Needs Non Profit Org US:

01

Charitable Organizations: Non profit organizations are commonly formed for charitable purposes, aiming to provide assistance to those in need, advance knowledge, or promote various causes such as education, health, or social welfare.

02

Social Welfare Organizations: Some non profit orgs focus on promoting the common welfare of the community, addressing social issues, or advocating for specific policies or legislation.

03

Business and Professional Associations: Certain non profit orgs are created for the benefit and representation of businesses or professionals in a particular industry. These organizations may engage in activities such as networking, lobbying, or providing educational resources.

04

Religious Organizations: Religious institutions, churches, or religiously affiliated groups often obtain non profit status to carry out their missions, provide spiritual guidance, and offer community support.

05

Amateur Sports Clubs: Many non profit orgs are dedicated to providing opportunities for participation in amateur sports, promoting physical fitness, and organizing sports events at various levels.

In summary, anyone interested in carrying out charitable, social welfare, business/professional, religious, or sports-related activities can establish a non profit organization in the US. The process involves filling out the necessary forms, determining the appropriate tax-exempt status, and complying with ongoing requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute non profit org us online?

pdfFiller has made it easy to fill out and sign non profit org us. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make changes in non profit org us?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your non profit org us to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an eSignature for the non profit org us in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your non profit org us right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is non profit org us?

A non-profit organization in the US is an organization that is tax-exempt under section 501(c) of the Internal Revenue Code and operates for a charitable, educational, religious, or other purpose.

Who is required to file non profit org us?

Non-profit organizations in the US are required to file Form 990 with the IRS if they have gross receipts of $200,000 or assets of $500,000 or more.

How to fill out non profit org us?

Non-profit organizations can fill out Form 990 by providing information about their financial activities, programs, governance, and compliance with tax laws.

What is the purpose of non profit org us?

The purpose of non-profit organizations in the US is to serve the public good by providing charitable, educational, religious, or other beneficial services to the community.

What information must be reported on non profit org us?

Non-profit organizations must report their financial activities, programs, governance structure, and compliance with tax laws on Form 990.

Fill out your non profit org us online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non Profit Org Us is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.