Get the free Form 34TE

Show details

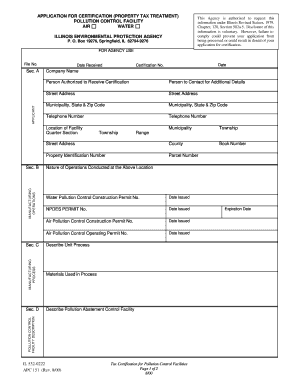

This document is used for reporting itemized deductions related to classroom activities, including mileage, medical visits, and various student activities such as being Student of the Week or earning

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 34te

Edit your form 34te form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 34te form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 34te online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 34te. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 34te

How to fill out Form 34TE

01

Obtain Form 34TE from the relevant authority or website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal details such as name, address, and contact information in the designated fields.

04

Provide any necessary identifying information, such as your tax identification number or social security number.

05

Complete the specific sections of the form as required based on your situation or purpose of filing.

06

Review the form for any errors or missing information before submission.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate office or online portal as per the instructions.

Who needs Form 34TE?

01

Individuals or entities needing to report specific tax information.

02

Taxpayers who are required to document certain transactions or income.

03

Businesses that need to comply with particular tax obligations.

04

Residents or citizens who require official documentation for financial transactions.

Fill

form

: Try Risk Free

People Also Ask about

How to form questions in English in ESL?

1:22 3:07 There are some exceptions to this rule. Firstly if you want to ask a yes or no. Question then youMoreThere are some exceptions to this rule. Firstly if you want to ask a yes or no. Question then you just need to remove.

What is the genitive form in English?

In grammar, the genitive case (abbreviated gen) is the grammatical case that marks a word, usually a noun, as modifying another word, also usually a noun — thus indicating an attributive relationship of one noun to the other noun.

How to form a genitive?

Genitive case and possessive nouns To make a noun genitive case, add an apostrophe + “-s” or just an apostrophe if the noun already ends in “-s” (e.g., “Luca's house” or “the students' essays”).

How to form genitive in English?

To make a noun genitive case, add an apostrophe + “-s” or just an apostrophe if the noun already ends in “-s” (e.g., “Luca's house” or “the students' essays”). Place the possessive noun right before the noun it owns if there are no other modifiers.

How to make genitive sentences?

There are 2 ways to form the genitive in German: add an 's' to names or family member terms that come directly in front of the noun they're modifying. use the structure modified noun + determiner (and/or +adjectives) + modifying noun which requires genitive case declensions on the determiner and/or adjective(s)

What is form in GCSE English?

FORM - is the name of the text type that the writer uses. For example, scripts, sonnets, novels etc. All of these are different text types that a writer can use. The form of a text is important because it indicates the writer's intentions, characters or key themes.

When to put s or es in genitiv?

If the -e is in brackets, then you can use either -s or -es at the end of the word in the genitive. As a general rule, one-syllable words usually add -es and longer words just -s. Der Chef ihres Onkels – Her uncle's boss (the boss of her uncle).

What is the written form of English?

Written English is the way in which the English language is transmitted through a conventional system of graphic signs (or letters). Compare to spoken English. The earliest forms of written English were primarily the translations of Latin works into English in the ninth century.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

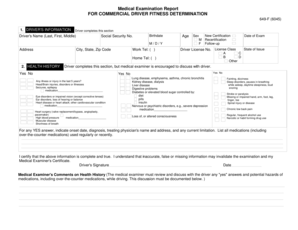

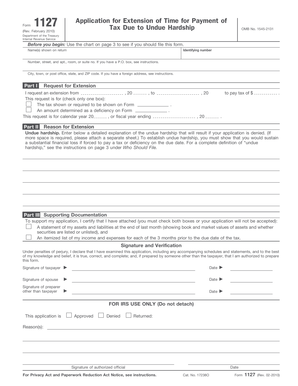

What is Form 34TE?

Form 34TE is a tax form used in the United States for reporting certain transactions and tax liabilities, typically related to excise taxes.

Who is required to file Form 34TE?

Entities or individuals engaged in specific activities that incur excise taxes are required to file Form 34TE, such as manufacturers, importers, and certain service providers.

How to fill out Form 34TE?

To fill out Form 34TE, one must provide personal or business information, detail the transactions subject to excise tax, and calculate the total tax liability as per the guidelines provided by the IRS.

What is the purpose of Form 34TE?

The purpose of Form 34TE is to report and remit excise taxes to the Internal Revenue Service, ensuring compliance with federal tax obligations.

What information must be reported on Form 34TE?

Form 34TE requires reporting information such as the taxpayer's identification number, the nature of the excise tax, transaction details, tax calculations, and any other pertinent financial information.

Fill out your form 34te online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 34te is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.