Get the free Insurance Guide

Show details

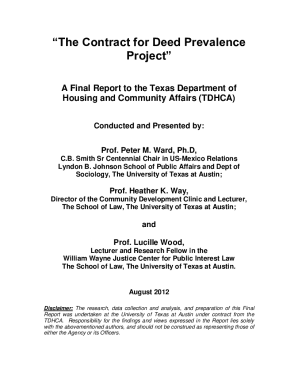

This document serves as a comprehensive guide for the Premier 1 Medical Plan provided by International Health Insurance Danmark, detailing coverage options, benefits, and procedures for reimbursement.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance guide

Edit your insurance guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing insurance guide online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit insurance guide. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance guide

How to fill out Insurance Guide

01

Gather all necessary personal information, including names, addresses, and contact details.

02

Collect data on all insurance policies, including policy numbers, coverage details, and premium amounts.

03

Document any claims made under each policy with dates and descriptions.

04

Fill out the Insurance Guide form systematically, starting from personal information to policy details.

05

Review all entered information for accuracy before submission.

06

Submit the completed Insurance Guide according to the provided instructions, whether online or through mail.

Who needs Insurance Guide?

01

Individuals seeking to organize their insurance policies and claims.

02

Families wanting to ensure they have adequate coverage for various risks.

03

Business owners needing to manage commercial insurance policies.

04

Anyone preparing for financial planning or review with an insurance advisor.

Fill

form

: Try Risk Free

People Also Ask about

What are the principles of insurance in simple words?

It is based on the principle that insurance is a means of restoring the insured to the same financial position they were in before the loss occurred. In simpler terms, indemnity means that the insured is entitled to receive compensation for the actual loss suffered, but not more than the amount of the loss.

What are the 7ps of insurance?

The document discusses the marketing mix or "7 P's" for insurance companies, which are product, price, place, promotion, people, process, and physical evidence. It provides details on each element of the marketing mix for insurance. For product, it discusses the types of insurance policies and services offered.

What are the 7 pillars of insurance?

In insurance, there are 7 basic principles that should be upheld, ie Insurable interest, Utmost good faith, proximate cause, indemnity, subrogation, contribution and loss of minimization. Principle of Utmost Good Faith: This is a primary principle of insurance.

What are the 4 most important types of insurance?

Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have. Employer coverage is often the best option, but if that is unavailable, obtain quotes from several providers as many provide discounts if you purchase more than one type of coverage.

What are the 5 P's of insurance?

This article outlines the “Five P's of Insurance” that I discuss with my clients when designing group benefits plans. The five “P's” include premium, plan, providers, participation, and performance. Consider these five elements of benefits design and rank them by importance.

What are the 7 most important principles of insurance?

The seven core principles underpinning the insurance industry are: Utmost good faith. Insurable interest. Proximate cause. Indemnity. Subrogation. Contribution. Loss minimisation.

What is the guide to term insurance?

A Term Life Insurance plan is the most basic as well as an affordable form of life insurance coverage. It pays out a pre-determined sum of money (called Sum Assured) to surviving family (nominees) of the insured person in case of his/her unfortunate death during the term of the policy .

What are the 7 basic principles of insurance?

The principles of insurance include seven key concepts: insurable interest, utmost good faith, proximate cause, indemnity, subrogation, contribution, and loss minimisation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Insurance Guide?

Insurance Guide is a document or tool designed to provide detailed information and instructions on insurance policies, coverage types, and claims processes to help policyholders understand and effectively manage their insurance needs.

Who is required to file Insurance Guide?

Typically, insurers or insurance companies are required to file the Insurance Guide with regulatory bodies, but policyholders may also need to reference it when filing claims or understanding policy terms.

How to fill out Insurance Guide?

To fill out the Insurance Guide, one should carefully read the instructions provided, gather all necessary information related to the insurance policy and claims, and then provide accurate and complete details in the required sections of the guide.

What is the purpose of Insurance Guide?

The purpose of the Insurance Guide is to inform and educate policyholders about their insurance options, claim procedures, coverage limits, and exclusions, ultimately aiding them in making informed decisions regarding their insurance.

What information must be reported on Insurance Guide?

The information that must be reported on the Insurance Guide typically includes policyholder details, policy number, types of coverage, limits, deductibles, and any pertinent exclusions or endorsements related to the insurance policy.

Fill out your insurance guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.