Get the free Risk Management in Financial Services - theirm

Show details

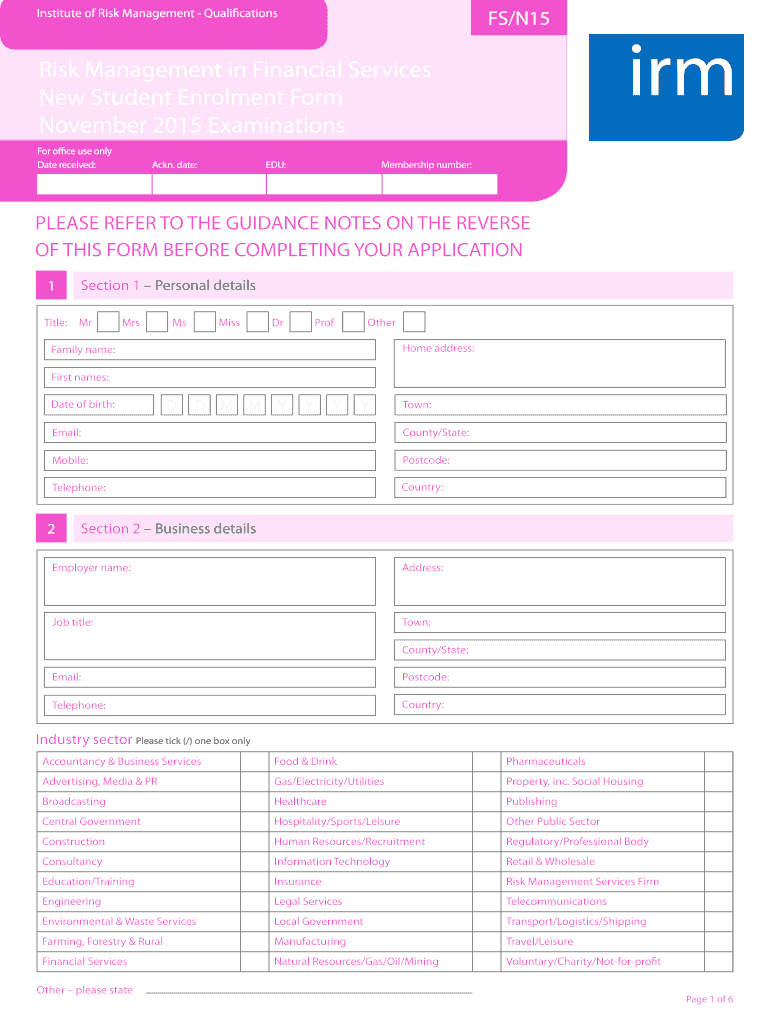

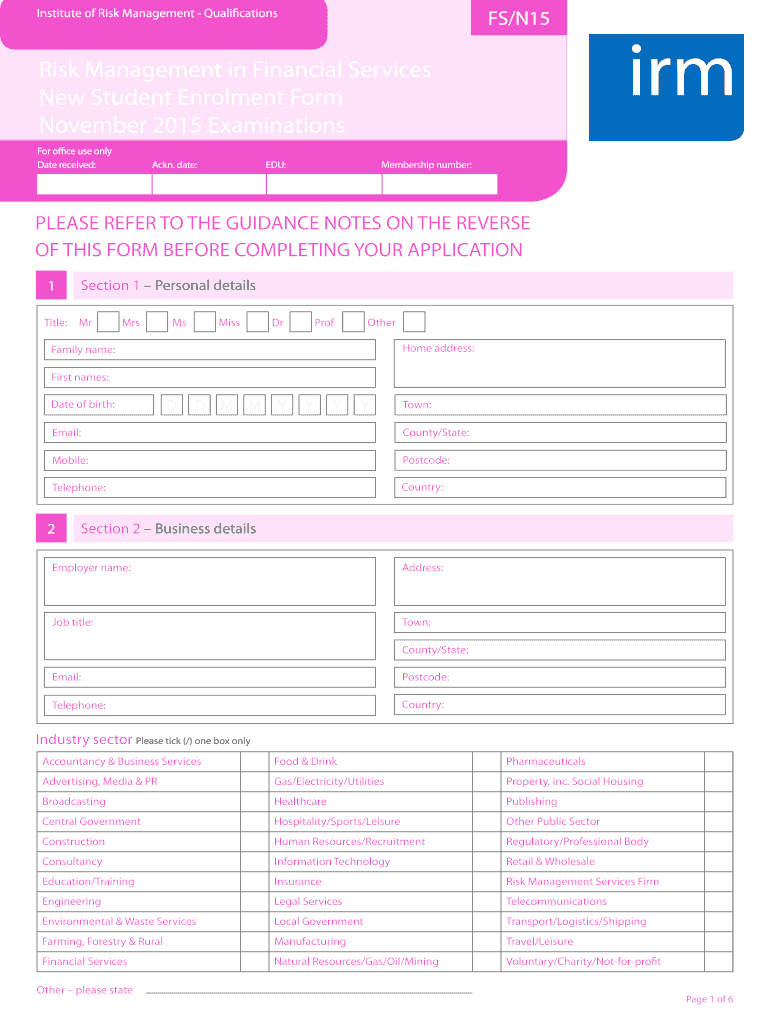

Institute of Risk Management Qualifications FS/N15 Risk Management in Financial Services New Student Enrollment Form November 2015 Examinations For office use only Date received: ACK. Date: EDU: Membership

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk management in financial

Edit your risk management in financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk management in financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit risk management in financial online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit risk management in financial. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk management in financial

How to Fill Out Risk Management in Financial:

01

Start by identifying the potential risks that your financial institution or organization may face. This includes analyzing internal risks such as operational risks and external risks such as market risks.

02

Evaluate the probability of each identified risk occurring and the potential impact it may have on your financial institution. This will help prioritize the risks and focus your risk management efforts.

03

Develop risk management strategies and controls to mitigate or minimize the identified risks. This may involve implementing internal controls, creating contingency plans, or purchasing insurance to transfer the risks.

04

Monitor the effectiveness of the implemented risk management strategies and controls. Regularly review and assess whether they are adequate and identify any new emerging risks that need to be addressed.

05

Continuously communicate and train employees on risk management protocols and procedures. Ensure that all staff members understand their roles and responsibilities in managing risks and that they are aware of the potential consequences of not adhering to the risk management guidelines.

Who Needs Risk Management in Financial:

01

Financial institutions: Banks, investment firms, insurance companies, and other financial institutions have a high level of exposure to various risks. Implementing effective risk management practices is essential for these organizations to safeguard their assets, protect their reputation, and comply with regulatory requirements.

02

Corporations: Large corporations with significant financial operations also require risk management. This includes managing risks associated with foreign exchange, interest rates, market volatility, credit risks, and other financial exposures.

03

Small businesses: Although on a smaller scale, small businesses also need to engage in risk management to protect their financial assets and ensure continuity of their operations. This may include managing risks related to cash flow, inventory management, credit risks, and cybersecurity.

04

Individuals: Even individuals can benefit from applying risk management principles to their personal finances. This may involve making informed investment decisions, purchasing insurance to protect against unforeseen events, and managing debts responsibly.

Overall, risk management in finance is crucial for any entity or individual that deals with financial transactions, assets, or liabilities. It helps identify potential risks, implement appropriate controls, and mitigate the impact of these risks on financial stability and success.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit risk management in financial from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your risk management in financial into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find risk management in financial?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific risk management in financial and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute risk management in financial online?

pdfFiller has made it easy to fill out and sign risk management in financial. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is risk management in financial?

Risk management in financial is the process of identifying, assessing, and prioritizing risks in order to minimize the impact of uncertainties on financial objectives.

Who is required to file risk management in financial?

Financial institutions such as banks, insurance companies, investment firms, and other financial service providers are required to file risk management reports.

How to fill out risk management in financial?

Risk management in financial can be filled out by conducting risk assessments, gathering relevant data, analyzing risks, and developing risk mitigation strategies.

What is the purpose of risk management in financial?

The purpose of risk management in financial is to protect the financial stability of institutions, ensure compliance with regulations, and safeguard stakeholders' interests.

What information must be reported on risk management in financial?

Information such as risk exposure, risk mitigation strategies, stress testing results, and compliance with regulations must be reported on risk management in financial.

Fill out your risk management in financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Management In Financial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.