Get the free LEFTOVER DEED SALE PARCELS

Show details

This document provides detailed information regarding the sale of leftover property parcels in Orange County, including purchasing conditions, responsibilities of the successful bidders, and guidelines

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign leftover deed sale parcels

Edit your leftover deed sale parcels form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your leftover deed sale parcels form via URL. You can also download, print, or export forms to your preferred cloud storage service.

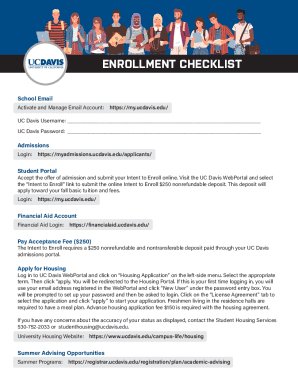

How to edit leftover deed sale parcels online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit leftover deed sale parcels. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out leftover deed sale parcels

How to fill out LEFTOVER DEED SALE PARCELS

01

Obtain the LEFTOVER DEED SALE PARCELS form from the relevant authority or website.

02

Fill in your personal information including name, address, and contact details in the designated sections.

03

Provide specific details about the parcels you are selling or transferring, including size, location, and any identifying numbers.

04

Include any relevant legal descriptions or governmental identifiers for the parcels.

05

Indicate the sale price or terms of the transfer in the appropriate section.

06

Review the form for any required signatures or initials needed from all parties involved.

07

Submit the completed form along with any necessary supporting documents or fees to the appropriate office.

Who needs LEFTOVER DEED SALE PARCELS?

01

Individuals or entities selling leftover parcels from previous land transactions.

02

Developers looking to clear remaining parcels to consolidate property.

03

Landowners wanting to correctly document and transfer ownership of residual land pieces.

Fill

form

: Try Risk Free

People Also Ask about

How do tax deed sales work in Florida?

Each year, real estate taxes are to be paid by a predetermined date to avoid becoming delinquent. Once delinquent, the Tax Collector holds an auction to pay off the taxes. This auction is referred to as a Tax Certificate Sale (FS 197.432).

Does a tax deed sale wipe out a mortgage in Florida?

Tax deed purchasers will be issued a new title to the parcel or unit (rather than a transferred title), and the new title will be free and clear of encumbrances (i.e., mortgages, liens, and judgments), including association assessments and amounts secured by assessment liens.

How does a tax deed sale work in Florida?

Each year, real estate taxes are to be paid by a predetermined date to avoid becoming delinquent. Once delinquent, the Tax Collector holds an auction to pay off the taxes. This auction is referred to as a Tax Certificate Sale (FS 197.432).

Is Missouri a tax deed state?

Missouri is a tax lien state where investors are issued a Collectors Deed after they wait 1 year for the redemption period of their tax lien to expire. Very much like tax deeds or quitclaim deeds in other states, a Collectors Deed does not offer any guarantee to the condition of title.

Who pays the taxes on the deed in Florida?

Exactly who pays the transfer tax in Florida can be negotiated, but usually, the seller is responsible. Clever Real Estate can help you cut costs here — our concierge team will partner you with an experienced agent who can help you negotiate a good deal with your buyer on transfer taxes.

Do you own the property if you pay someone's property taxes in Missouri?

You are only purchasing the tax lien on the property until you obtain a deed. Once you have been issued a Collector's deed, the property is yours. 12.

Can a tax deed be redeemed in Florida?

Property may be redeemed any time prior to the issuance of a tax deed but cannot be redeemed once the Clerk has received full payment for the tax deed. The redemption amount (subject to change) is listed on the "Notice of Application for Tax Deed" mailed prior to the sale.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LEFTOVER DEED SALE PARCELS?

LEFTOVER DEED SALE PARCELS refer to parcels of land that remain unsold or unallocated after a property sale and that can be sold separately or through a public offering.

Who is required to file LEFTOVER DEED SALE PARCELS?

Entities or individuals who hold ownership of the leftover land parcels are required to file LEFTOVER DEED SALE PARCELS.

How to fill out LEFTOVER DEED SALE PARCELS?

To fill out the LEFTOVER DEED SALE PARCELS, one needs to provide accurate information about the property, including its legal description, tax identification number, and any relevant sale conditions.

What is the purpose of LEFTOVER DEED SALE PARCELS?

The purpose of LEFTOVER DEED SALE PARCELS is to facilitate the sale and transfer of land that has not been included in previous sales, ensuring proper ownership and utilization of the property.

What information must be reported on LEFTOVER DEED SALE PARCELS?

The information that must be reported includes the property's legal description, identification of the owner, details of previous sales, and any encumbrances or liens on the property.

Fill out your leftover deed sale parcels online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Leftover Deed Sale Parcels is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.