VA Roster of Sub-Contractor - Caroline County free printable template

Show details

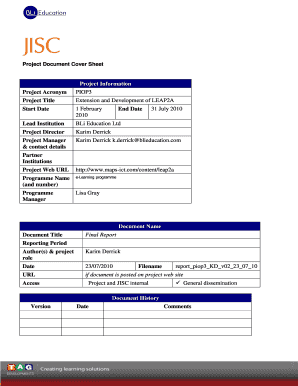

Print Form ROSTER OF SUBCONTRACTOR CAROLINE COUNTY DEPARTMENT OF PLANNING & COMMUNITY DEVELOPMENT P.O. BOX 424 BOWLING GREEN, VIRGINIA 22427 (804) 6339896 Date: Total Contract Amount: $ Permit # Owner:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax filing return form

Edit your taxes file form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax apply form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax return file online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tax file form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out filing taxes file form

How to fill out VA Roster of Sub-Contractor - Caroline County

01

Obtain the VA Roster of Sub-Contractor form from the Caroline County VA website or the local VA office.

02

Gather all necessary information about your subcontractors, including their names, addresses, and contact details.

03

Fill in the subcontractor information accurately in the designated fields on the form.

04

Include details regarding the scope of work each subcontractor will perform.

05

Review the completed form for any errors or missing information.

06

Submit the form to the appropriate VA office for processing, either in person or via the specified submission method.

Who needs VA Roster of Sub-Contractor - Caroline County?

01

Contractors who are hiring subcontractors for projects related to the VA in Caroline County.

02

Subcontractors seeking to be recognized for their work on VA projects.

03

Government agencies requiring a record of subcontractors involved in VA-related services.

Fill

filing tax

: Try Risk Free

People Also Ask about online filed

What are the 5 steps to filing your tax return?

Your Fast and Easy Guide to Filing Taxes Step 1: Gather Your Documents. Step 2: Make Your Decision Between Itemizing and the Standard Deduction. Step 3: State Your Status. Step 4: Officially File. Step 5: Tie Up Loose Tax Ends and Sit Back.

How do I fill out where's my refund?

To use Where's My Refund?, taxpayers must enter their Social Security number or Individual Taxpayer Identification Number, their filing status and the exact whole dollar amount of their refund. The IRS updates the tool once a day, usually overnight, so there's no need to check more often.

How to fill out tax return?

How To Complete Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents. Step 2: Report Your Income. Step 3: Claim Your Deductions. Step 4: Calculate Your Tax. Step 5: Claim Tax Credits.

Can I file taxes online myself?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

How to do taxes yourself step by step?

How to File Your Taxes This Year: 6 Simple Steps Step 1: Determine if You Need to File. First things first. Step 2: Gather Your Tax Documents. Step 3: Pick a Filing Status. Step 4: Choose Between the Standard Deduction or Itemizing. Step 5: Choose How to File. Step 6: File Your Taxes.

How do I fill out a tax form online?

0:19 1:50 How to Fill Out Tax Forms Online (Step-by-Step Guide) - YouTube YouTube Start of suggested clip End of suggested clip Use the online editor to complete the required. Fields. If your form requires signingMoreUse the online editor to complete the required. Fields. If your form requires signing create your personal electronic signature in a few clicks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my online sales tax directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your addition sales dealer and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I sign the sales addition 50 electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your dealer laws vehicle in minutes.

Can I create an eSignature for the file taxes form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your file taxes form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is VA Roster of Sub-Contractor - Caroline County?

The VA Roster of Sub-Contractor - Caroline County is a document that lists all licensed subcontractors working on projects within Caroline County, Virginia, ensuring compliance with local regulations.

Who is required to file VA Roster of Sub-Contractor - Caroline County?

Contractors who are awarded contracts for construction projects in Caroline County are required to file the VA Roster of Sub-Contractor.

How to fill out VA Roster of Sub-Contractor - Caroline County?

To fill out the VA Roster, contractors must provide detailed information about each subcontractor they intend to use, including the subcontractor's name, contact information, licensing details, and the scope of work.

What is the purpose of VA Roster of Sub-Contractor - Caroline County?

The purpose of the VA Roster of Sub-Contractor - Caroline County is to ensure that all subcontractors are properly licensed and compliant with local laws and regulations, promoting fair business practices.

What information must be reported on VA Roster of Sub-Contractor - Caroline County?

The VA Roster must report the subcontractor's name, address, phone number, license number, and the specific work they will be performing for the project.

Fill out your file taxes form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

File Taxes Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.