Get the free DISHONESTY BOND APPLICATION

Show details

This document serves as an application for a dishonesty bond and seeks information from businesses to assess their need for coverage against employee dishonesty losses.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dishonesty bond application

Edit your dishonesty bond application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dishonesty bond application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

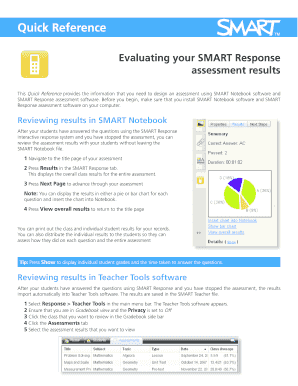

Editing dishonesty bond application online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit dishonesty bond application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dishonesty bond application

How to fill out DISHONESTY BOND APPLICATION

01

Start with the personal information section; fill in your full name, address, and contact details.

02

Provide details about your business, including the name, address, and type of business.

03

State the purpose of the dishonesty bond application clearly, explaining why you need the bond.

04

Fill out the questions related to your financial history, including any past claims or incidents of dishonesty.

05

Include any required documentation as indicated in the application guidelines, such as financial statements or character references.

06

Review the application for any errors or missing information before submission.

07

Sign and date the application form to certify that the information provided is accurate.

Who needs DISHONESTY BOND APPLICATION?

01

Businesses that require protection against employee dishonesty, such as theft or fraud.

02

Employers looking to ensure they are covered for potential losses due to dishonest acts by employees.

03

Contractors and service providers who need to build trust with clients by having a dishonesty bond.

04

Financial institutions that require businesses to have a bond to qualify for certain loans or services.

Fill

form

: Try Risk Free

People Also Ask about

What is an honesty bond?

An honesty bond is also known as a fidelity bond, an employee dishonesty bond, or a business service bond. Such bonds either protect a business from wrongdoing by its employees, a business's clients from theft by that business's employees, or both.

What is a dishonest bond?

Employee Dishonesty Bond is the specific type. This bond covers theft, fraud, forgery, and other dishonest acts committed by employees against the business. Think of it as internal theft coverage. It's one of the most common types of fidelity bonds used by small businesses and nonprofits.

What is the FI bond coverage?

Financial institution bond (FI bond) insurance, also known as a fidelity bond, is designed to help protect financial institutions against a variety of fraudulent risks, including losses from employee dishonesty, such as theft or forgery, as well as certain external perils.

What is staff dishonesty?

Employee Dishonesty means an act or acts of fraud or dishonesty committed by an Employee acting alone or in collusion with others, which results in an actual personal gain for the Employee (other than salary, bonus, commission, fees, bonus, promotion, award, profit sharing, pension or any other employment benefit);

What is a dishonesty bond?

Often referred to as a fidelity bond, an Employee Dishonesty Bond is a type of insurance coverage. It protects a business, a business owner, a not for profit company, and even a government entity from financial loss due to theft by an employee or volunteer.

What is a bond application?

A surety bond application is a form required by the surety carrier. It provides the basic information needed about the bond and the principal for the approval process. It also often serves as the legal contract between the surety carrier and the principal.

What is another name for a fidelity bond?

A fidelity bond is a form of business insurance that offers an employer protection against losses that are caused by its employees' fraudulent or dishonest actions. Also known as an honesty bond, this form of insurance can protect against monetary or physical losses.

What is a fiduciary bond?

A fiduciary bond is court-ordered protection, a form of insurance. It is not protection for the guardian but it is protection for the person who needs a guardian. By issuing a bond the bonding agency agrees to repay the ward any money that might be lost because of the guardian's actions or mistakes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DISHONESTY BOND APPLICATION?

A DISHONESTY BOND APPLICATION is a formal request to obtain a bond that protects against losses caused by dishonest acts of employees or contractors.

Who is required to file DISHONESTY BOND APPLICATION?

Businesses that handle sensitive information or large amounts of money, such as financial institutions, service providers, or any organization employing individuals in positions of trust, are typically required to file a DISHONESTY BOND APPLICATION.

How to fill out DISHONESTY BOND APPLICATION?

To fill out a DISHONESTY BOND APPLICATION, applicants must provide detailed information including the nature of their business, the amount of coverage needed, background information on employees, and any previous claims related to dishonesty.

What is the purpose of DISHONESTY BOND APPLICATION?

The purpose of a DISHONESTY BOND APPLICATION is to secure a bond that offers financial protection against losses due to employee theft, fraud, or other dishonest acts, helping to safeguard the organization's assets.

What information must be reported on DISHONESTY BOND APPLICATION?

Information that must be reported includes the applicant's business details, history of previous dishonesty claims, employee background checks, and the specific nature of the risks for which the bond is being requested.

Fill out your dishonesty bond application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dishonesty Bond Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.