Get the free Cosigner Application

Show details

This document serves as an application to become a cosigner on a surety bond, detailing the obligations of the cosigner, including potential liabilities and the credit relationship with the Surety.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cosigner application

Edit your cosigner application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cosigner application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cosigner application online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cosigner application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

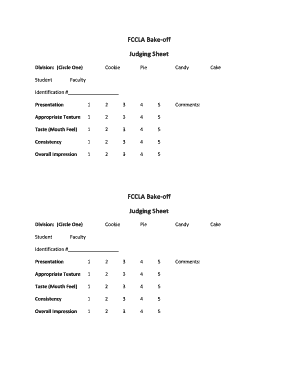

How to fill out cosigner application

How to fill out Cosigner Application

01

Gather necessary documents such as proof of income, credit history, and identification.

02

Fill out the basic personal information section including name, address, and contact details.

03

Provide employment details including employer's name, position, and tenure.

04

Complete the financial information section, listing income sources and monthly expenses.

05

Review the credit history requirement, as some applications might require a credit check.

06

Sign and date the application, confirming the information is accurate and complete.

Who needs Cosigner Application?

01

Individuals who have insufficient credit history or low credit scores.

02

Students applying for student loans without an established credit profile.

03

Renters who may not meet income requirements on their own.

04

First-time home buyers who need additional support in obtaining a mortgage.

Fill

form

: Try Risk Free

People Also Ask about

What is another name for a co-signer?

synonyms: cosignatory. signatory, signer. someone who signs and is bound by a document. noun. a signer in addition to the principal signer (to verify the authenticity of the principal signature or to provide surety)

What is a cosigner?

A cosigner is someone who helps a borrower get approved for a loan. The cosigner agrees to repay the loan if the borrower does not. A lender may require a cosigner if the borrower does not have enough income, or enough credit.

What is a cosigner vs guarantor?

The primary difference between a co-signer and a guarantor is how soon each individual becomes responsible for the borrower's debt. A co-signer is responsible for every payment that a borrower misses. However, a guarantor only assumes responsibility if the borrower falls into total default.

What exactly does a co-signer do?

A co-signer is a person who agrees to be legally responsible to pay a debt if the borrower does not pay back a loan as agreed. A co-signer may be an option if you are trying to make a large purchase, such as a car, and if you are unable to qualify for the loan on your own.

What is a co-applicant in English?

Co-applicant meaning A co-applicant is a person who applies for a Joint Home Loan with another borrower. A co-applicant differs from a co-signer or guarantor in terms of their rights associated with the loan.

What is a co-signer in English?

A co-signer is a person who agrees to be legally responsible for someone else's debt.

How do you get approved for a cosigner?

Although requirements can vary by lender, a cosigner typically needs to have good to excellent credit (670 and up) to cosign a loan or credit line. Lenders look at a cosigner's credit score and report as well as their income and assets to determine whether they qualify for a loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Cosigner Application?

A Cosigner Application is a form used to apply for credit or a loan, where a cosigner agrees to take responsibility for the debt if the primary borrower defaults.

Who is required to file Cosigner Application?

A cosigner application is typically required when the primary borrower has insufficient credit history, poor credit, or low income, making it harder for them to qualify for a loan on their own.

How to fill out Cosigner Application?

To fill out a Cosigner Application, the cosigner must provide personal information, including their name, contact details, Social Security number, employment information, and financial background, alongside the borrower's details.

What is the purpose of Cosigner Application?

The purpose of the Cosigner Application is to allow individuals with limited credit histories to access credit, while ensuring the lender has an additional party to hold accountable for the loan.

What information must be reported on Cosigner Application?

The Cosigner Application must report the cosigner's personal identification information, employment and income details, credit history, and consent to take on financial responsibility for the borrower’s debt.

Fill out your cosigner application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cosigner Application is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.