Get the free DISHONESTY BOND APPLICATION

Show details

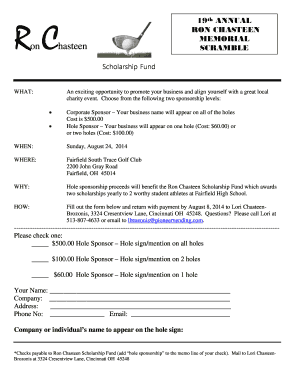

04-21062 CDOI Lic 0B57612 Date Form F6544-10-2000 The effective date of the bond will be the date the bond is issued. WSCo. For Office Use Only SC S DISHONESTY BOND APPLICATION Applicant Phone No* Name of Business Fax No* Address include any branch location addresses Street and Number City State Zip Type of Business Purpose and function Have you sustained any employee dishonesty losses in the last 6 years Amount of coverage requested 1-Year Bond 10 000 25 000 No 50 000 If so please give us...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dishonesty bond application

Edit your dishonesty bond application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dishonesty bond application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit dishonesty bond application online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit dishonesty bond application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dishonesty bond application

How to fill out DISHONESTY BOND APPLICATION

01

Begin by downloading the DISHONESTY BOND APPLICATION from the official website or source.

02

Fill in your personal information, including your full name, address, and contact details.

03

Provide details about your business or employment, including the name and type of business.

04

Include a description of the position you hold or held, along with your responsibilities.

05

Specify the amount of the bond required.

06

Disclose any past administrative actions or claims against you that are relevant to dishonesty.

07

Provide references, if required, including their contact information.

08

Review the completed application for accuracy and completeness.

09

Submit the application along with any required fees to the appropriate bonding company.

Who needs DISHONESTY BOND APPLICATION?

01

Individuals or businesses that require coverage against potential fraudulent acts committed by employees.

02

Employers looking to secure a bond for their business to protect against employee dishonesty.

03

Contractors or service providers who need to prove financial responsibility to clients.

Fill

form

: Try Risk Free

People Also Ask about

What is an honesty bond?

An honesty bond is also known as a fidelity bond, an employee dishonesty bond, or a business service bond. Such bonds either protect a business from wrongdoing by its employees, a business's clients from theft by that business's employees, or both.

What is a dishonest bond?

Employee Dishonesty Bond is the specific type. This bond covers theft, fraud, forgery, and other dishonest acts committed by employees against the business. Think of it as internal theft coverage. It's one of the most common types of fidelity bonds used by small businesses and nonprofits.

What is the FI bond coverage?

Financial institution bond (FI bond) insurance, also known as a fidelity bond, is designed to help protect financial institutions against a variety of fraudulent risks, including losses from employee dishonesty, such as theft or forgery, as well as certain external perils.

What is staff dishonesty?

Employee Dishonesty means an act or acts of fraud or dishonesty committed by an Employee acting alone or in collusion with others, which results in an actual personal gain for the Employee (other than salary, bonus, commission, fees, bonus, promotion, award, profit sharing, pension or any other employment benefit);

What is a dishonesty bond?

Often referred to as a fidelity bond, an Employee Dishonesty Bond is a type of insurance coverage. It protects a business, a business owner, a not for profit company, and even a government entity from financial loss due to theft by an employee or volunteer.

What is a bond application?

A surety bond application is a form required by the surety carrier. It provides the basic information needed about the bond and the principal for the approval process. It also often serves as the legal contract between the surety carrier and the principal.

What is another name for a fidelity bond?

A fidelity bond is a form of business insurance that offers an employer protection against losses that are caused by its employees' fraudulent or dishonest actions. Also known as an honesty bond, this form of insurance can protect against monetary or physical losses.

What is a fiduciary bond?

A fiduciary bond is court-ordered protection, a form of insurance. It is not protection for the guardian but it is protection for the person who needs a guardian. By issuing a bond the bonding agency agrees to repay the ward any money that might be lost because of the guardian's actions or mistakes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DISHONESTY BOND APPLICATION?

A DISHONESTY BOND APPLICATION is a formal request made to obtain a bond that protects an employer or other entity against losses resulting from dishonest acts by an employee or another party.

Who is required to file DISHONESTY BOND APPLICATION?

Employers, businesses, or organizations that want to ensure financial protection against potential losses caused by the dishonest actions of their employees or contractors are typically required to file this application.

How to fill out DISHONESTY BOND APPLICATION?

To fill out a DISHONESTY BOND APPLICATION, one needs to provide specific details including the applicant's personal information, the nature of the business, the types of employees covered, the amount of coverage desired, and any previous claims on dishonesty bonds.

What is the purpose of DISHONESTY BOND APPLICATION?

The purpose of a DISHONESTY BOND APPLICATION is to secure a bond that serves as a financial safety net for businesses against losses due to fraudulent or dishonest activities performed by their employees.

What information must be reported on DISHONESTY BOND APPLICATION?

Information that must be reported on a DISHONESTY BOND APPLICATION typically includes applicant details, business type, job roles of individuals being bonded, amount of bond requested, and any prior incidents of dishonesty or claims.

Fill out your dishonesty bond application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dishonesty Bond Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.