Get the free TAX DEED NO

Show details

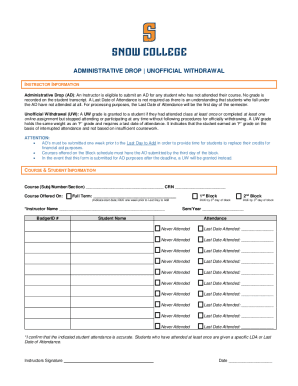

Public notices. Public notices. TAX DEED NO.: 2014TX57 FILED: AUGUST 4, 2014, TAKE NOTICE County of Cousin Date Premises Sold 111411 Certificate Number 100379 Sold for General Taxes of 2010 Sold for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax deed no

Edit your tax deed no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax deed no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax deed no online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax deed no. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax deed no

How to Fill Out Tax Deed No:

01

Determine the purpose: Before filling out a tax deed no (number), it's important to understand why you need it. Tax deed numbers are typically used for tracking property ownership and tax records. So, make sure you have a clear understanding of why you require this information.

02

Gather necessary information: To fill out a tax deed no, you will need specific details such as the property address or legal description. This information can typically be obtained from county or city records, online portals, or by contacting the local tax assessor's office.

03

Complete the application form: Once you have the required information, locate the appropriate application form or request for a tax deed no. In many cases, these forms can be found on the website of the tax assessor's office. Fill out the form accurately, providing all the necessary details and ensuring there are no errors.

04

Submit the application: After completing the form, submit it according to the guidelines provided. This may involve mailing the form, submitting it online, or visiting the tax assessor's office in person. Follow the required procedure and ensure that you include any additional documentation or fees that may be necessary.

05

Track the progress: After submitting the application, it's important to keep track of its progress. This will help you know when to expect the tax deed no. If there are any delays or issues, you may need to follow up with the tax assessor's office for further clarification or assistance.

Who Needs Tax Deed No:

01

Property Owners: Property owners may require a tax deed no to keep track of their property's taxation history and to update their own records.

02

Real Estate Investors: Investors in real estate may require tax deed numbers to conduct due diligence on potential investment properties, assess the property's value, and evaluate any outstanding taxes or liens.

03

Lenders and Title Companies: Lenders and title companies may need tax deed numbers to ensure that the property they are financing or insuring is free from any tax liabilities or encumbrances.

04

Government Agencies: Various government agencies, such as zoning boards or code enforcement offices, may require tax deed numbers to verify property information, assess tax compliance, or enforce local regulations.

05

Legal Professionals: Attorneys or legal professionals involved in property transactions, disputes, or estate planning may need tax deed numbers to investigate ownership or resolve legal matters related to tax obligations.

In conclusion, anyone involved in property ownership, real estate transactions, or legal matters related to taxes may need a tax deed no to ensure accurate record-keeping, compliance, and due diligence.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tax deed no online?

pdfFiller has made filling out and eSigning tax deed no easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in tax deed no without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your tax deed no, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I fill out tax deed no using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign tax deed no and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is tax deed no?

Tax deed no is a legal document that transfers ownership of a property from the delinquent taxpayer to the government or a third party.

Who is required to file tax deed no?

The government or a third party who has purchased a property at a tax sale is required to file a tax deed no.

How to fill out tax deed no?

To fill out a tax deed no, the transferee must include information about the property, the previous owner, and details of the tax sale.

What is the purpose of tax deed no?

The purpose of tax deed no is to legally transfer ownership of a property that was sold at a tax sale due to delinquent taxes.

What information must be reported on tax deed no?

The tax deed must include details of the property, the previous owner, the amount of delinquent taxes, and the date of the tax sale.

Fill out your tax deed no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Deed No is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.