Get the free Massachusetts LLC Foreign Withdrawal

Show details

This document serves as a certificate of withdrawal for a limited liability company (LLC) indicating that it is no longer transacting business in Massachusetts and has fulfilled all obligations regarding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign massachusetts llc foreign withdrawal

Edit your massachusetts llc foreign withdrawal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your massachusetts llc foreign withdrawal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit massachusetts llc foreign withdrawal online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit massachusetts llc foreign withdrawal. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out massachusetts llc foreign withdrawal

How to fill out Massachusetts LLC Foreign Withdrawal

01

Obtain the application form for Foreign Withdrawal from the Massachusetts Secretary of State's website.

02

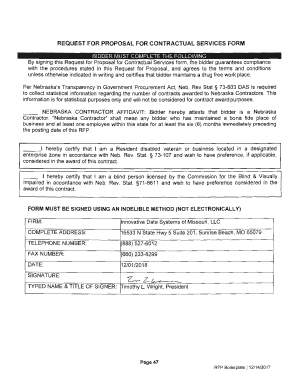

Fill out the required information including the LLC name, state of incorporation, and the reason for withdrawal.

03

Ensure you have the approval of members of the LLC, if required by your operating agreement.

04

Attach any necessary documents, such as a certificate of good standing from the state of incorporation.

05

Submit the completed application along with the filing fee to the Massachusetts Secretary of the Commonwealth.

06

Wait for confirmation of the withdrawal from the Secretary of State.

Who needs Massachusetts LLC Foreign Withdrawal?

01

Foreign LLCs that wish to withdraw their registration to do business in Massachusetts.

02

LLCs that have ceased operations in Massachusetts and need to formally deregister.

03

Businesses looking to eliminate ongoing compliance and tax obligations in Massachusetts.

Fill

form

: Try Risk Free

People Also Ask about

How do I dissolve an LLC in Massachusetts?

Dissolving Your LLC in Massachusetts Step 1: Vote to dissolve the LLC. Step 2: Wind up all business affairs and handle any other business matters. Step 3: Notify creditors and claimants about your LLC's dissolution, settle existing debts, and distribute remaining assets.

How much does it cost to dissolve an LLC in Massachusetts?

Corporations Division Filing Fees Domestic Profit and Professional Corporations Articles of Amendment $100.00 min. per amendment; Share increases $100 for 100,000 shares. Articles of Correction No Fee Articles of Dissolution $100.00 Annual Report $125.00; $150 if not filed timely ($100 if filed electronically)138 more rows

How much does it cost to dissolve an LLC in MA?

Corporations Division Filing Fees Domestic Profit and Professional Corporations Articles of Correction No Fee Articles of Dissolution $100.00 Annual Report $125.00; $150 if not filed timely ($100 if filed electronically) Articles of Consolidation / Merger / Conversion / Share Exchange $250.00 min.138 more rows

Is there an annual fee for an LLC in Massachusetts?

The costs to start an LLC in Massachusetts are significant. LLCs pay a $500 formation fee and $500 annual report fee. Most corporations pay only $275 to get started then $125 per year. Massachusetts registered agent and resident agent are synonymous.

Does an LLC need a business certificate in Massachusetts?

To start an LLC, you'll file a Certificate of Organization with the Secretary of the Commonwealth. The filing fee for the Certificate is $500. An LLC only legally exists after the state approves its certificate of organization, which provides a public record of its name and contact information.

Do I need to renew my LLC every year in Massachusetts?

Each year, all Massachusetts corporations, LLCs, nonprofits, LPs, and LLPs must file an annual report with the Secretary of the Commonwealth, Corporations Division. Let's go over important due dates, filing fees, required information, and answers to any questions you may have along the way!

How do I register as a foreign entity in Massachusetts?

In order to register as a Massachusetts foreign corporation, you'll need to file a Massachusetts Foreign Corporation Certificate of Registration with the Secretary of the Commonwealth of Massachusetts. This costs $400 to file. You'll also need to include the certificate of good standing from your home state.

How do I cancel my LLC in Massachusetts?

Dissolving Your LLC in Massachusetts Step 1: Vote to dissolve the LLC. Step 2: Wind up all business affairs and handle any other business matters. Step 3: Notify creditors and claimants about your LLC's dissolution, settle existing debts, and distribute remaining assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Massachusetts LLC Foreign Withdrawal?

Massachusetts LLC Foreign Withdrawal is the process by which a foreign limited liability company (LLC) formally withdraws its registration to conduct business in the state of Massachusetts.

Who is required to file Massachusetts LLC Foreign Withdrawal?

Any foreign LLC that has been authorized to do business in Massachusetts and wishes to cease its business operations in the state must file for Massachusetts LLC Foreign Withdrawal.

How to fill out Massachusetts LLC Foreign Withdrawal?

To fill out the Massachusetts LLC Foreign Withdrawal form, the foreign LLC must provide details such as its name, the state in which it was originally organized, and any required identification numbers, along with the reason for withdrawal.

What is the purpose of Massachusetts LLC Foreign Withdrawal?

The purpose of Massachusetts LLC Foreign Withdrawal is to legally document the cessation of business activities in Massachusetts, thereby ensuring compliance with state laws and regulations.

What information must be reported on Massachusetts LLC Foreign Withdrawal?

Information that must be reported on the Massachusetts LLC Foreign Withdrawal includes the LLC's name, the state of formation, the date of withdrawal, and any other pertinent details required by the state.

Fill out your massachusetts llc foreign withdrawal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Massachusetts Llc Foreign Withdrawal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.