Get the free Rhode Island Incorporation Checklist

Show details

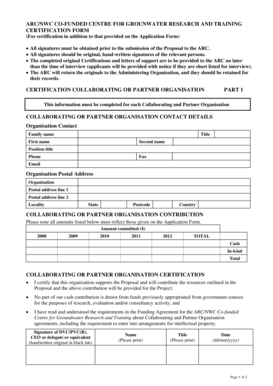

Este checklist resume la información requerida para una incorporación en Rhode Island, conforme al Título 7-1.1 et seq. Compilar esta información con antelación facilitará el proceso de incorporación

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rhode island incorporation checklist

Edit your rhode island incorporation checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rhode island incorporation checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

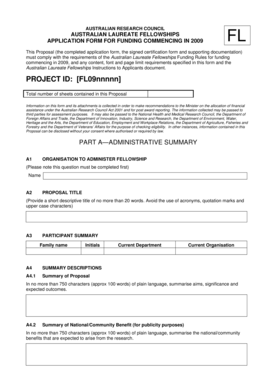

How to edit rhode island incorporation checklist online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit rhode island incorporation checklist. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rhode island incorporation checklist

How to fill out Rhode Island Incorporation Checklist

01

Obtain the Rhode Island Corporation Registration Form.

02

Choose a unique name for your corporation that complies with Rhode Island naming requirements.

03

Prepare and designate a registered agent with a physical address in Rhode Island.

04

Specify the purpose of the corporation in the form.

05

List the names and addresses of the corporation's initial directors.

06

Determine the number of shares the corporation is authorized to issue.

07

Complete the Articles of Incorporation section of the form.

08

Review and check the checklist to ensure all required information is included.

09

Submit the completed form along with the required filing fee to the Rhode Island Secretary of State.

10

Keep a copy of the filed documents for your records.

Who needs Rhode Island Incorporation Checklist?

01

Individuals or groups looking to start a business in Rhode Island.

02

Entrepreneurs who want to establish a corporation.

03

Attorneys or consultants assisting clients with corporate formation.

04

Business owners seeking to understand the incorporation process in Rhode Island.

Fill

form

: Try Risk Free

People Also Ask about

What do I need to start an LLC in Rhode Island?

How to form a Rhode Island LLC in 6 steps Choose your business name. The first step involves selecting a name for your Rhode Island LLC. Appoint a registered agent. File articles of organization. Create an operating agreement. Obtain an EIN and open a business bank account. Register for state taxes and business licenses.

How much does it cost to set up an LLC in Rhode Island?

Rhode Island LLC Formation Filing Fee: $150 The primary cost when starting a Rhode Island LLC is the $150 fee ($152.50 online) to register your business with the Rhode Island Department of State' Business Division.

How much does it cost to start an LLC in Rhode Island?

Rhode Island LLC Formation Filing Fee: $150 The primary cost when starting a Rhode Island LLC is the $150 fee ($152.50 online) to register your business with the Rhode Island Department of State' Business Division.

How do I register my business in Rhode Island?

To register a business in Rhode Island, you must submit either the “Articles of Incorporation For-Profit Corporation” or the “Articles of Incorporation Nonprofit Corporation” to the Rhode Island Secretary of State, depending on your type of business.

What is required to get an LLC in RI?

File an Application for Registration for a Limited Liability Company (Form 450) with the Rhode Island Department of State by postal mail. The filing fee is $150. The application must include either a Certificate of Good Standing or Letter of Status from the LLC's home state that is no more than 60 days old.

How long does it take to get an LLC in Rhode Island?

File Rhode Island Certificate of Formation Agency:Rhode Island Secretary of State Filing Method: Mail, in-person, or online. Agency Fee: $150 + $6 enhanced service Turnaround: ~7 business days by mail or online. Same day for in-person filings. Law: Rhode Island Limited Liability Company Act2 more rows

What is the minimum LLC tax in RI?

Rhode Island LLCs must also pay an Annual Charge of $400 to the RI Division of Taxation. You must pay this fee every year regardless of whether or not your LLC engaged in business activities or earned profits. The Annual Charge is filed with the Rhode Island Department of Revenue: Division of Taxation.

Does a single member LLC need to file a 1065 in Rhode Island?

LLCs, LLPs, LPs, Partnerships and SMLLCs: Limited liability companies not treated as a corporation on the federal level, limited liability partnerships, general partnerships, and single member limited liability companies are required to file an annual tax return using Form RI-1065.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Rhode Island Incorporation Checklist?

The Rhode Island Incorporation Checklist is a guide that outlines the steps and requirements necessary to incorporate a business in the state of Rhode Island.

Who is required to file Rhode Island Incorporation Checklist?

Individuals or groups intending to form a corporation in Rhode Island are required to file the Rhode Island Incorporation Checklist.

How to fill out Rhode Island Incorporation Checklist?

To fill out the Rhode Island Incorporation Checklist, you must provide information about the corporation's name, purpose, registered agent, and the number of shares authorized, along with any other required details as specified in the checklist.

What is the purpose of Rhode Island Incorporation Checklist?

The purpose of the Rhode Island Incorporation Checklist is to ensure that all legal requirements are met for incorporating a business and to streamline the incorporation process.

What information must be reported on Rhode Island Incorporation Checklist?

The information that must be reported on the Rhode Island Incorporation Checklist includes the corporation's name, principal office address, registered agent's name and address, the purpose of incorporation, and details regarding stock, such as the number of shares and classes.

Fill out your rhode island incorporation checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rhode Island Incorporation Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.