Get the free Incoming Direct Rollover 401k Plan - Filice

Show details

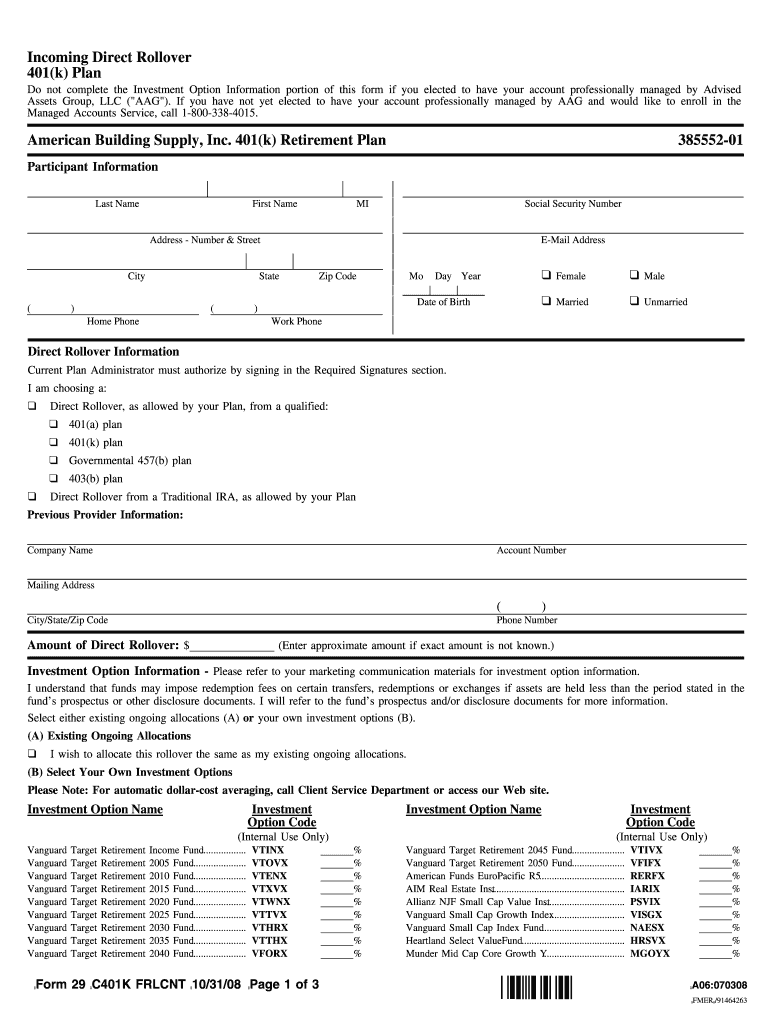

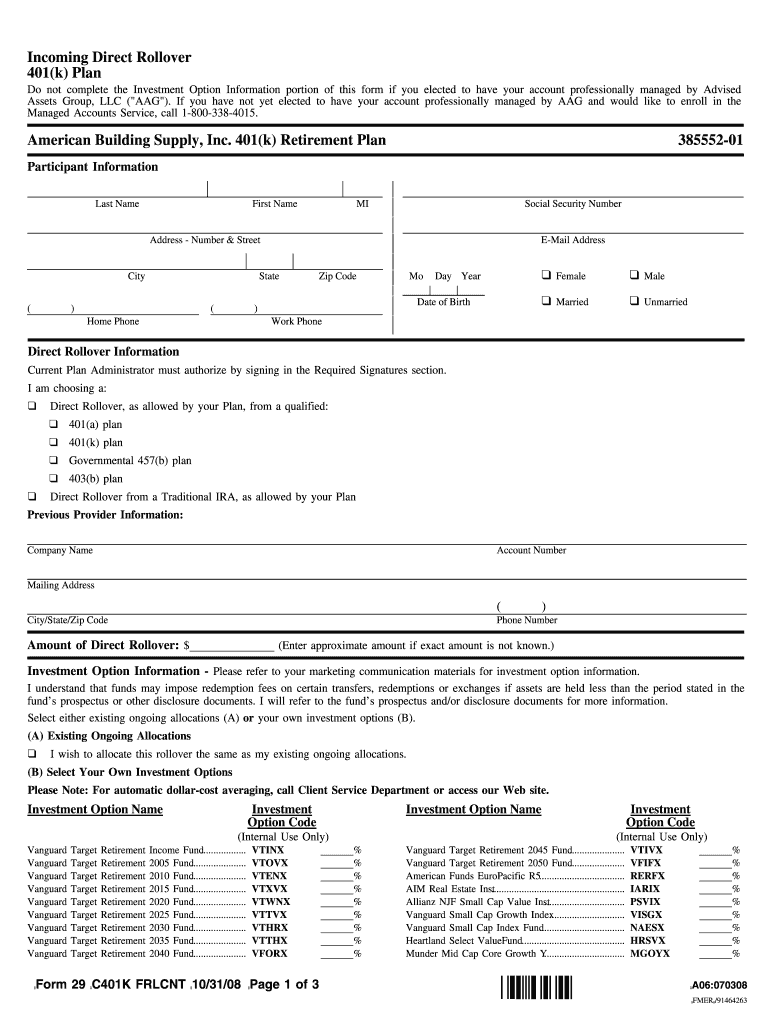

Incoming Direct Rollover 401(k) Plan American Building Supply, Inc. 401(k) Retirement Plan Participant Information 38555201 Do not complete the Investment Option Information portion of this form if

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign incoming direct rollover 401k

Edit your incoming direct rollover 401k form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your incoming direct rollover 401k form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit incoming direct rollover 401k online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit incoming direct rollover 401k. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out incoming direct rollover 401k

How to fill out incoming direct rollover 401k:

01

Contact the administrator of your current 401k plan and inform them about your intention to perform an incoming direct rollover. They will provide you with the necessary paperwork and instructions.

02

Carefully review the paperwork provided by your current 401k plan administrator. It will typically include a direct rollover form or a distribution request form specifically for rollovers.

03

Fill out the required sections of the form, providing accurate personal information such as your full name, social security number, and contact details. Ensure that you include the specific instructions for a direct rollover, such as the name and address of the new custodian or financial institution.

04

If applicable, choose the investment options or asset allocation for your rollover funds. Some plans may offer a range of investment options, while others may automatically transfer the funds into a default option. Consider consulting a financial advisor for guidance in making investment decisions if needed.

05

Review the completed form for any errors or missing information. Ensure that you have signed and dated the document as required.

Who needs an incoming direct rollover 401k:

01

Individuals who are changing jobs and have a 401k plan with their previous employer may opt for an incoming direct rollover. This allows them to transfer the funds from their old 401k plan to a new one without incurring taxes or penalties.

02

Those who have left their previous job and are no longer eligible for their old employer's 401k plan may choose an incoming direct rollover to maintain the tax-advantaged status of their retirement savings.

03

Individuals who have retired but still have assets in a previous employer's 401k plan may also benefit from an incoming direct rollover. This enables them to consolidate their retirement savings into a new or existing retirement account and have more control over their investments.

Overall, an incoming direct rollover 401k is suitable for individuals who want to efficiently manage their retirement savings, maintain tax advantages, and have more control over their investment choices.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit incoming direct rollover 401k from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your incoming direct rollover 401k into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute incoming direct rollover 401k online?

pdfFiller makes it easy to finish and sign incoming direct rollover 401k online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the incoming direct rollover 401k in Gmail?

Create your eSignature using pdfFiller and then eSign your incoming direct rollover 401k immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is incoming direct rollover 401k?

Incoming direct rollover 401k is a financial transaction in which funds from a retirement account are transferred directly to a new retirement account without passing through the individual's hands.

Who is required to file incoming direct rollover 401k?

The individual initiating the rollover is required to file incoming direct rollover 401k.

How to fill out incoming direct rollover 401k?

To fill out incoming direct rollover 401k, the individual must provide information about the transferring and receiving retirement accounts, as well as details about the rollover transaction.

What is the purpose of incoming direct rollover 401k?

The purpose of incoming direct rollover 401k is to allow individuals to move retirement funds from one account to another without incurring taxes and penalties.

What information must be reported on incoming direct rollover 401k?

The information reported on incoming direct rollover 401k includes details about the transferring and receiving retirement accounts, the amount of the rollover, and the date of the transaction.

Fill out your incoming direct rollover 401k online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Incoming Direct Rollover 401k is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.