Get the free Guidelines for Obtaining Receipts

Show details

Guidelines for Obtaining Receipts

Please obtain receipts when making payments on behalf of our clients. Please

use the following guidelines to help you determine what represents a receipt and

how

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guidelines for obtaining receipts

Edit your guidelines for obtaining receipts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guidelines for obtaining receipts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit guidelines for obtaining receipts online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit guidelines for obtaining receipts. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guidelines for obtaining receipts

To fill out guidelines for obtaining receipts, follow these steps:

01

Start by clearly stating the purpose of the guidelines. Specify the context in which these guidelines will be used and why they are necessary. This will help ensure that the guidelines are tailored to the specific needs of the intended audience.

02

Identify the key stakeholders who will benefit from these guidelines. Consider who in your organization or team needs to know how to obtain receipts properly. It could be employees, managers, or any individuals involved in expense reporting or financial processes.

03

Outline the steps involved in obtaining receipts. Break it down into a step-by-step process, providing clear instructions for each stage. Include details such as where receipts should be obtained from, what information they should include, and any specific documentation or forms that may be required.

04

Highlight any guidelines or regulations that need to be followed. Depending on the industry or organization, there may be specific rules or compliance requirements related to obtaining and handling receipts. Make sure to include these in the guidelines to ensure legal and ethical practices are followed.

05

Provide examples and templates if applicable. Sometimes it can be helpful to include sample receipts or templates that can be used as a reference to ensure consistency and accuracy. These examples can also help clarify any specific formatting or information that should be included in a receipt.

06

Include any additional tips or best practices. If there are any commonly encountered challenges or recommendations for improving the receipt procurement process, include them in the guidelines. This can help users navigate potential hurdles and optimize their receipt acquisition efforts.

Who needs guidelines for obtaining receipts?

Any individual or organization involved in expense reporting, financial processes, or compliance requirements can benefit from having guidelines for obtaining receipts. This can include employees who need to submit expense reports, managers responsible for reviewing and approving expenses, finance teams responsible for auditing, compliance officers ensuring legal and regulatory compliance, and anyone else involved in financial record-keeping. By having clear guidelines in place, organizations can ensure that receipts are obtained correctly and consistently, reducing errors, improving accuracy, and facilitating smoother financial processes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit guidelines for obtaining receipts from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including guidelines for obtaining receipts, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send guidelines for obtaining receipts to be eSigned by others?

When your guidelines for obtaining receipts is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I edit guidelines for obtaining receipts on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing guidelines for obtaining receipts, you can start right away.

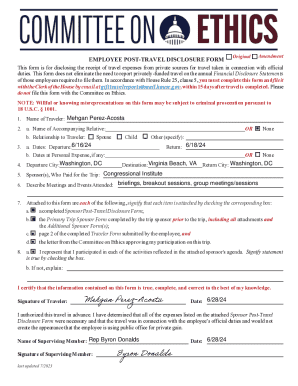

What is guidelines for obtaining receipts?

Guidelines for obtaining receipts provide instructions on how to properly record and report business expenses.

Who is required to file guidelines for obtaining receipts?

All employees who incur business expenses and seek reimbursement are required to file guidelines for obtaining receipts.

How to fill out guidelines for obtaining receipts?

To fill out guidelines for obtaining receipts, you need to provide details of the expense, including the date, amount, purpose, and supporting receipts.

What is the purpose of guidelines for obtaining receipts?

The purpose of guidelines for obtaining receipts is to ensure that all business expenses are accurately recorded and reported.

What information must be reported on guidelines for obtaining receipts?

Information such as date of expense, amount spent, purpose of expense, and supporting receipts must be reported on guidelines for obtaining receipts.

Fill out your guidelines for obtaining receipts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guidelines For Obtaining Receipts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.