Get the free Investment Options HSA Eligibility - Health Savings

Show details

For more information or to enroll online: www.HealthSavings.com (888) 3540697 Monday Friday, 8:30 a.m. 5 p.m. ET Simply put, an HSA is a tax favored health savings account for people with a qualified

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign investment options hsa eligibility

Edit your investment options hsa eligibility form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your investment options hsa eligibility form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit investment options hsa eligibility online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit investment options hsa eligibility. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out investment options hsa eligibility

How to Fill Out Investment Options HSA Eligibility:

01

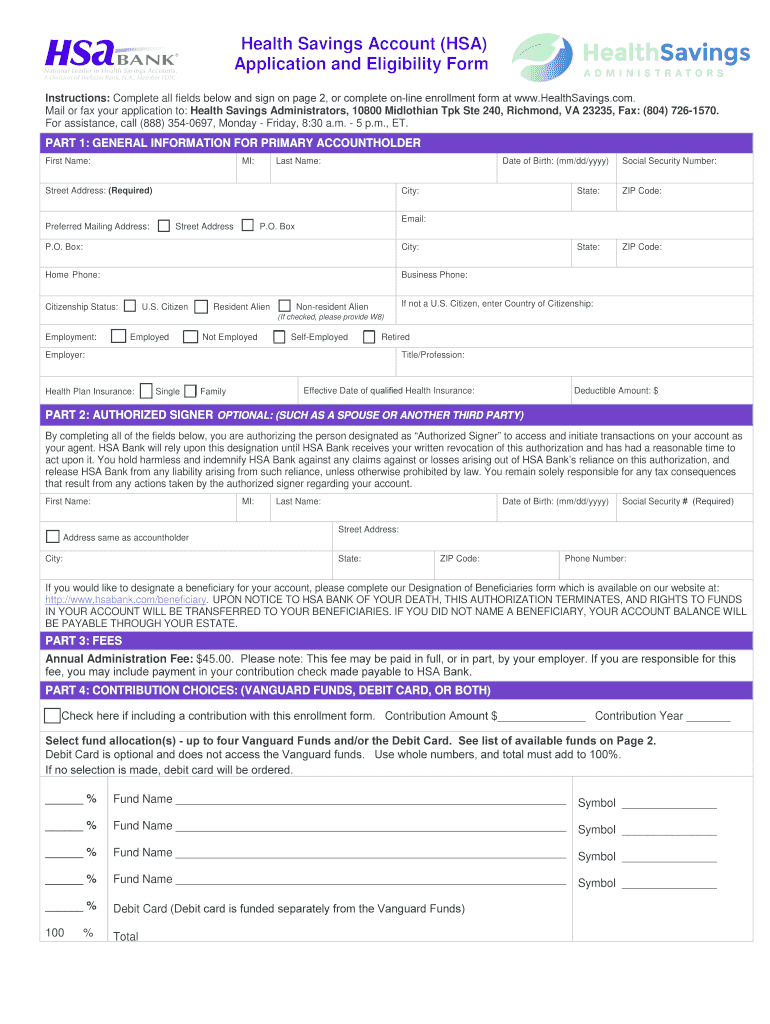

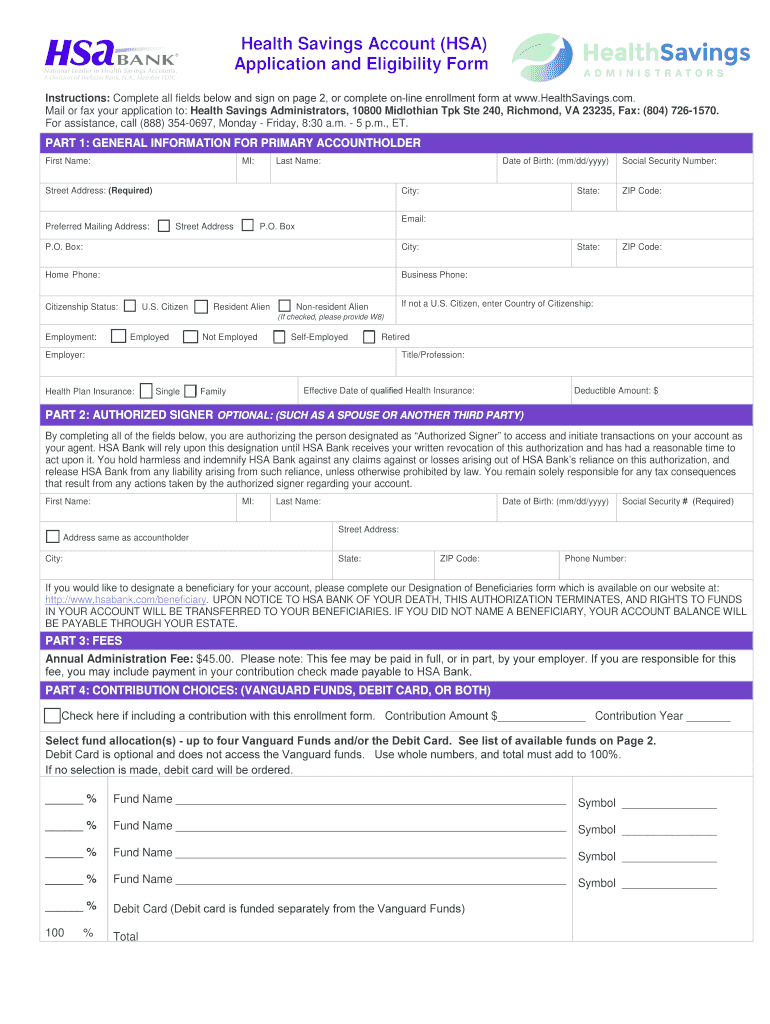

Determine if you are eligible: Before filling out the investment options HSA eligibility form, first confirm if you meet the criteria. Generally, individuals who are covered by a high deductible health plan (HDHP) and do not have any other disqualifying coverage can qualify for an HSA.

02

Verify contribution limits: Familiarize yourself with the contribution limits set by the IRS for HSA accounts. For the current year, these limits usually adjust annually, so ensure you are aware of the maximum amount you can contribute to your HSA.

03

Research investment options: Understand the different investment options available for your HSA account. These options can include stocks, bonds, mutual funds, or even a combination thereof. Research different investment strategies and select options that align with your financial goals and risk tolerance.

04

Contact your HSA provider: Reach out to your HSA provider to inquire about investment options and eligibility requirements. They will have specific instructions on how to proceed with the investment process, including any required forms that need to be filled out.

05

Complete the investment options HSA eligibility form: Once you have gathered all the necessary information and forms, carefully fill out the investment options HSA eligibility form provided by your HSA provider. It is essential to ensure accurate and complete information to avoid any delays or complications.

06

Submit the form to your HSA provider: After completing the form, submit it to your HSA provider as per their instructions. Some providers may allow online submission, while others may require physical copies to be sent via mail or fax. Double-check the submission process to ensure your form reaches the correct department.

Who Needs Investment Options HSA Eligibility:

01

Individuals with a High Deductible Health Plan (HDHP): Those who have opted for a HDHP as their healthcare coverage and meet the IRS criteria are eligible to open an HSA account. By having investment options HSA eligibility, they can make their HSA funds work for them through investments.

02

Individuals seeking additional financial growth: HSA investment options are suitable for individuals who want their HSA funds to grow over time. By investing the funds, they can potentially earn returns and maximize the value of their HSA account.

03

Individuals comfortable with investment risks: Investment options come with inherent risks, and HSA investments are no exception. People seeking HSA investment options should be willing to tolerate potential losses along with potential gains and have a long-term investment mindset.

04

Individuals with long-term healthcare savings goals: Those planning to use their HSA funds for future healthcare expenses can leverage investment options to grow their funds over time. With a long-term savings mindset, they can potentially accumulate a substantial HSA balance to cover future medical costs.

Note: It is recommended to consult with a financial advisor or HSA specialist before making any investment decisions to ensure alignment with your financial goals and risk tolerance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find investment options hsa eligibility?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific investment options hsa eligibility and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute investment options hsa eligibility online?

pdfFiller has made it easy to fill out and sign investment options hsa eligibility. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit investment options hsa eligibility on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing investment options hsa eligibility.

What is investment options hsa eligibility?

Investment options HSA eligibility refers to the criteria that determine which Health Savings Accounts (HSAs) are eligible to invest in different types of assets such as stocks, mutual funds, and bonds.

Who is required to file investment options hsa eligibility?

Individuals who have a Health Savings Account (HSA) and wish to invest their funds in different options are required to meet the eligibility criteria set by the HSA provider.

How to fill out investment options hsa eligibility?

To fill out investment options HSA eligibility, individuals need to review the options offered by their HSA provider, ensure they meet the eligibility criteria, and follow the instructions provided for selecting and investing in the desired assets.

What is the purpose of investment options hsa eligibility?

The purpose of investment options HSA eligibility is to provide HSA account holders with the opportunity to grow their savings by investing in different assets and potentially earning a higher return on investment.

What information must be reported on investment options hsa eligibility?

The information required to be reported on investment options HSA eligibility may include the individual's account details, risk tolerance, investment preferences, and any other relevant information requested by the HSA provider.

Fill out your investment options hsa eligibility online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Investment Options Hsa Eligibility is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.