Get the free HDFC Gold Exchange Traded Fund Scheme Information Document

Show details

This document provides an overview of the HDFC Gold Exchange Traded Fund, detailing important information about the fund's operation, investment objectives, risk factors, and how investors can purchase

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hdfc gold exchange traded

Edit your hdfc gold exchange traded form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hdfc gold exchange traded form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hdfc gold exchange traded online

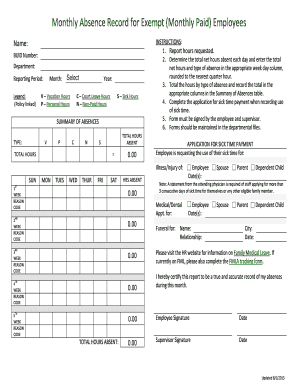

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hdfc gold exchange traded. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hdfc gold exchange traded

How to fill out HDFC Gold Exchange Traded Fund Scheme Information Document

01

Obtain the HDFC Gold Exchange Traded Fund Scheme Information Document (SID) from the HDFC website or authorized distributors.

02

Read the document carefully to understand the investment objectives, features, and risks associated with the scheme.

03

Review the key information section that highlights the fund's past performance and investment strategy.

04

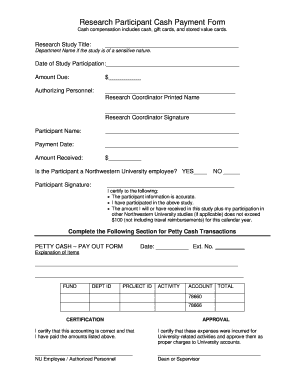

Fill out the application form provided in the SID, ensuring that all details are accurate and complete.

05

Provide necessary KYC (Know Your Customer) documents as mentioned in the SID.

06

Decide on the investment amount and select the mode of investment (lump sum or SIP).

07

Submit the completed application form along with the payment (cheque or online transfer) to HDFC or authorized agents.

08

Wait for confirmation of your investment and receipt of units in your account.

Who needs HDFC Gold Exchange Traded Fund Scheme Information Document?

01

Investors looking to diversify their portfolio with gold-related investments.

02

Individuals seeking a systematic way to invest in gold without the hassles of physical storage.

03

Financial advisors assisting clients in making informed decisions about gold investments.

04

Anyone interested in understanding the structure and operations of the HDFC Gold Exchange Traded Fund.

Fill

form

: Try Risk Free

People Also Ask about

Can I hold gold ETF for long term?

The Zerodha Gold ETF (Symbol: GOLDCASE) is suitable for investors with a long term investment horizon.

Which is better, goldbees or gold ETF?

Physical gold will attract making charges and it is difficult to sell physical gold when you need money, whereas gold bees/ETFs are better because they don't attract any making charges and are easy to sell on stock exchange.

What is the disadvantage of gold ETFs?

No physical ownership: Unlike physical gold, ETFs do not provide the option of direct ownership for jewellery or personal use. Tax implications: Gold ETFs attract capital gains tax based on holding period, affecting net earnings.

How does gold ETF affect gold price?

While the assets in ETFs are backed by gold, the intent here is not to own physical gold. It enables the investors to track the price movements and analyze the performance of gold. When the price of gold appreciates, the value of gold etfs increases and when the price declines the fund loses its value.

Which is better, gold bond or gold ETF?

While both SGBs and Gold ETFs offer safer and smarter alternatives to physical gold, they serve different investor needs. If you're looking for long-term returns with tax benefits and fixed interest, SGBs are the better choice. But if you want liquidity and flexibility, it's better to opt for Gold ETFs.

What is the minimum investment in HDFC Gold ETF?

Minimum Investment: Minimum investment required is Rs 5000 and minimum additional investment is Rs 0.

How to withdraw gold ETF?

How to sell / redeem Gold ETF? Gold ETFs can be sold at the stock exchange through the broker using a demat account and trading account. Since one is investing in an ETF that is backed by physical gold, ETFs are best used as a tool to benefit from the price of gold rather than to get access to physical gold.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HDFC Gold Exchange Traded Fund Scheme Information Document?

The HDFC Gold Exchange Traded Fund Scheme Information Document is a detailed document that provides important information about the HDFC Gold ETF, including its objectives, investment strategy, risk factors, and costs associated with the investment.

Who is required to file HDFC Gold Exchange Traded Fund Scheme Information Document?

The HDFC Gold Exchange Traded Fund scheme is filed by the fund manager or the managing entity responsible for managing the ETF with the regulatory body, ensuring compliance with financial and investment regulations.

How to fill out HDFC Gold Exchange Traded Fund Scheme Information Document?

To fill out the HDFC Gold Exchange Traded Fund Scheme Information Document, the managing entity must provide accurate details regarding the structure of the scheme, investment objectives, benchmarks, fee structure, and risk factors associated with the fund.

What is the purpose of HDFC Gold Exchange Traded Fund Scheme Information Document?

The purpose of the HDFC Gold Exchange Traded Fund Scheme Information Document is to inform potential investors about the ETF, allowing them to make educated investment decisions by understanding the fund's characteristics and the associated risks.

What information must be reported on HDFC Gold Exchange Traded Fund Scheme Information Document?

The HDFC Gold Exchange Traded Fund Scheme Information Document must report information such as the investment objectives, portfolio composition, risk factors, fees and expenses, performance metrics, and regulatory disclosures.

Fill out your hdfc gold exchange traded online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hdfc Gold Exchange Traded is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.