Get the free Secured Lending - Entity Documentation

Show details

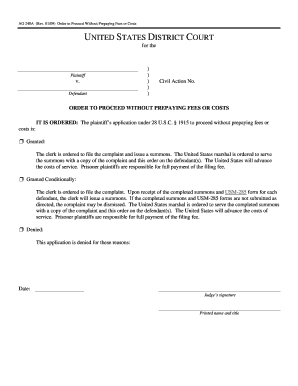

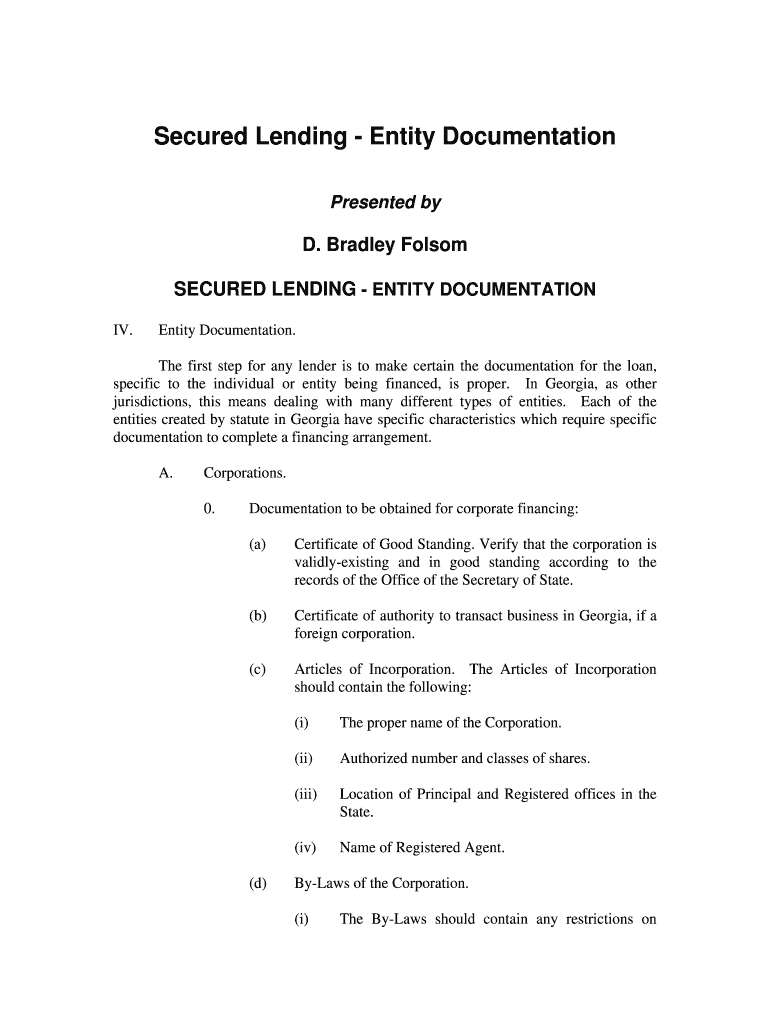

Secured Lending Entity Documentation Presented BYD. Bradley Folsom SECURED LENDING ENTITY DOCUMENTATION IV. Entity Documentation. The first step for any lender is to make certain the documentation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign secured lending - entity

Edit your secured lending - entity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your secured lending - entity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing secured lending - entity online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit secured lending - entity. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out secured lending - entity

To fill out secured lending - entity, follow these steps:

01

Gather the necessary information and documents related to the entity you are representing. This may include financial statements, business plans, and legal documents.

02

Identify the lender or financial institution that will be providing the secured loan. Ensure that they have a lending program for entities and are willing to work with your type of business.

03

Review the terms and conditions of the secured loan carefully. Understand the interest rates, repayment terms, collateral requirements, and any other relevant provisions.

04

Complete the application form provided by the lender. Be accurate and thorough in providing the required information, ensuring that it corresponds to the entity's details.

05

Include any necessary supporting documentation along with the application. This may include business licenses, tax returns, bank statements, and proof of collateral.

06

If required, consult with legal and financial advisors to ensure you are making informed decisions during the application process.

07

Submit the completed application and supporting documents to the lender as per their instructions. Follow up with them to ensure receipt and address any additional requirements promptly.

08

Await the decision from the lender regarding your secured lending application. This may involve a review of the entity's creditworthiness and evaluation of the provided collateral.

09

If the application is approved, carefully review the loan agreement provided by the lender. Seek clarification on any terms or conditions that you may not fully understand.

10

Once satisfied with the loan agreement, sign the document on behalf of the entity and return it to the lender within the specified timeframe.

Secured lending - entity is typically needed by businesses or organizations that require financial assistance and can provide suitable collateral to secure the loan. This may include established companies seeking capital for expansion, startups needing funding for initial operations, or entities looking to refinance existing debt. The specific need for secured lending - entity will depend on the individual circumstances and financial goals of the entity in question.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my secured lending - entity directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your secured lending - entity and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I sign the secured lending - entity electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit secured lending - entity on an Android device?

You can edit, sign, and distribute secured lending - entity on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is secured lending - entity?

Secured lending - entity is a type of loan where the borrower provides collateral, such as real estate or equipment, to secure the loan.

Who is required to file secured lending - entity?

Financial institutions and businesses that engage in secured lending transactions are required to file secured lending - entity.

How to fill out secured lending - entity?

Secured lending - entity can be filled out by providing details of the borrower, collateral, loan amount, interest rate, and repayment terms.

What is the purpose of secured lending - entity?

The purpose of secured lending - entity is to provide financing to borrowers while minimizing the risk to the lender by securing the loan with collateral.

What information must be reported on secured lending - entity?

Information such as the borrower's details, collateral description, loan amount, interest rate, and repayment terms must be reported on secured lending - entity.

Fill out your secured lending - entity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Secured Lending - Entity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.