Get the free application for an Investment Club Account

Show details

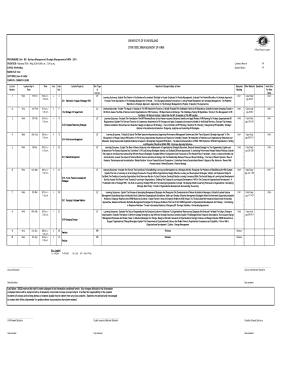

This document is for the application process for setting up an Investment Club Account, including details required from club representatives and members, compliance with identification regulations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for an investment

Edit your application for an investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for an investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for an investment online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for an investment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for an investment

How to fill out application for an Investment Club Account

01

Gather necessary personal and financial information for all members of the investment club.

02

Obtain an application form from the investment club or their website.

03

Fill out the application form with accurate details, including names, addresses, Social Security numbers, and financial backgrounds.

04

Indicate the type of investment account desired (e.g., brokerage account, retirement account).

05

Review the investment club's rules and regulations, ensuring all members understand them.

06

Collect signatures from all members if required.

07

Submit the completed application form along with any necessary documentation and initial capital contributions.

08

Wait for the investment club to process the application and notify you of acceptance.

Who needs application for an Investment Club Account?

01

Individuals looking to collaboratively invest with others.

02

Groups of friends, family, or colleagues wanting to pool resources for investment purposes.

03

New investors seeking guidance and education from more experienced members.

04

People interested in gaining experience with investment strategies and financial markets.

Fill

form

: Try Risk Free

People Also Ask about

What is an investment club account?

An investment club refers to a group of people who pool their money to make investments. Usually, investment clubs are organized as partnerships — after the members study different investments, the group decides to buy or sell based on a majority vote of the members.

What is the best legal structure for an investment club?

LLCs are generally the most flexible and most popular corporate form for smaller investment vehicles. This holds true whether domestic or foreign. Contributors to the LLC can own membership interests according to the relative value of their investment.

What is the 10/5/3 rule of investment?

The 10,5,3 rule will assist you in determining your investment's average rate of return. Though mutual funds offer no guarantees, according to this law, long-term equity investments should yield 10% returns, whereas debt instruments should yield 5%. And the average rate of return on savings bank accounts is around 3%.

How do you form an investment club?

Form Your Investment Club Find Potential Members. Hold Club Organization Meeting. Put a Legal Structure in Place. Establish Club Operating Procedures. Open a Brokerage Account. Create a Club Accounting Structure. Structure the Monthly Club Meeting.

How many members should an investment club have?

How many members can an investment club have? The number of members varies, but a Effective club generally consists of between 5 and 20 people. A small number facilitates decision-making while benefiting from good diversification.

What is another name for an investment club?

Business investment clubs These clubs are often called incubators and are formed to purchase businesses that generate cash flow and equity.

What is the structure of an investment club?

You can think of an investment club as a small-scale mutual fund where decisions are made by a committee of non-professional club members. Clubs can be informal or established as a legal entity such as a partnership. Either way, the club may be subject to regulatory oversight and must account for taxes properly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is application for an Investment Club Account?

An application for an Investment Club Account is a formal request made to financial institutions to open an account specifically for a group of individuals who come together to pool their money for investment purposes.

Who is required to file application for an Investment Club Account?

Typically, at least one member of the investment club, often in the role of a club officer or designated representative, is required to file the application on behalf of all the club members.

How to fill out application for an Investment Club Account?

To fill out the application for an Investment Club Account, you need to provide information such as the name of the investment club, the purpose of the account, member details, and signatures of club officers. Follow instructions provided by the financial institution.

What is the purpose of application for an Investment Club Account?

The purpose of the application is to establish an official investment account that allows members of the club to collectively manage and invest their pooled funds in various financial instruments.

What information must be reported on application for an Investment Club Account?

The application must typically report the club's name, members' personal information, tax identification number, the type of investments planned, and the governance structure of the club.

Fill out your application for an investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For An Investment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.