Get the free Schedule 13d - SEC Compliance

Show details

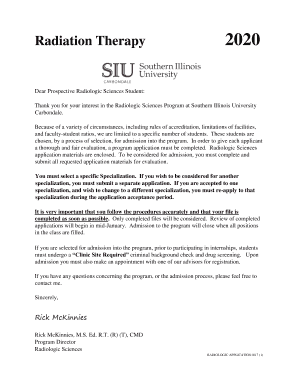

SCHEDULE13D Page1of26 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 13D UndertheSecuritiesExchangeActof1934 POLARIS POWER CELLS, INC. (NameofIssuer) Common Stock,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule 13d - sec

Edit your schedule 13d - sec form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule 13d - sec form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule 13d - sec online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit schedule 13d - sec. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule 13d - sec

How to fill out Schedule 13D - SEC:

01

Obtain the necessary forms: Before starting, make sure to obtain a copy of Schedule 13D and the accompanying instructions from the Securities and Exchange Commission (SEC) website. Review the instructions carefully to understand the requirements and ensure accurate completion.

02

Identify the reporting party: Schedule 13D is generally filed by any person or group who acquires beneficial ownership of more than 5% of a class of equity securities of a public company. If you fall under this criteria, proceed with filling out the form.

03

Provide general information: Begin by entering the name of the reporting party and any applicable co-reporting parties on the top of Schedule 13D. Include their full legal names, addresses, and telephone numbers. Indicate if the reporting party is an individual or an entity.

04

Explain the background: Indicate whether the acquisition was a purchase, exchange, or other transaction. Provide details about the source and amount of funds used to acquire the securities, as well as any related agreements or arrangements.

05

Disclose the purpose of acquisition: Specify the purpose or purposes for which the reporting party acquired the securities. This may include investment, speculation, a desire to influence the company's management or policies, or other objectives. Offer a detailed explanation of the intentions behind the acquisition.

06

Describe the past acquisitions: If there were any other acquisitions of the company's securities within the past 60 days, provide a comprehensive list. Include the dates, number of securities acquired, and the total approximate purchase price. If there were no such acquisitions, state it accordingly.

07

Reveal all contracts, arrangements, or understandings: Detail any contracts, arrangements, or understandings that the reporting party has with any other person regarding the securities of the company. If there are none, explicitly state it.

08

Indicate voting power and the beneficial ownership: Provide information on the number of securities that the reporting party owns or has the right to acquire and the associated voting power. Include details of any securities that are jointly owned, and specify the percentage of class ownership.

09

Sign and date the form: At the end of the Schedule 13D, the reporting party or an authorized representative should sign and date the document to certify its accuracy. Ensure that the signature matches the typed or printed name below.

Who needs Schedule 13D - SEC?

01

Investors acquiring significant stakes: Any individual or group that acquires more than 5% of a public company's equity securities is required to submit Schedule 13D to the SEC. This level of ownership signifies a significant stake and potential influence over the company.

02

Activist shareholder groups: Schedule 13D is often utilized by activist investor groups who aim to influence the company's management, policies, or direction. These groups may seek to effect changes by engaging in shareholder activism.

03

Institutional investors: Institutional investors, such as mutual funds, pension funds, and hedge funds, who exceed the 5% ownership threshold must file Schedule 13D with the SEC to disclose their holdings. This promotes transparency and protects the interests of other shareholders.

It is crucial to consult an attorney or securities professional for specific guidance and clarification when completing Schedule 13D, as the form's requirements may vary depending on the circumstances and individual situations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is schedule 13d - sec?

Schedule 13D is a form that must be filed with the SEC within 10 days of acquiring more than 5% of a company's stock.

Who is required to file schedule 13d - sec?

Investors who acquire 5% or more of a company's stock are required to file Schedule 13D with the SEC.

How to fill out schedule 13d - sec?

Schedule 13D must be filled out accurately and completely, disclosing the background information of the filer and the purpose of the acquisition.

What is the purpose of schedule 13d - sec?

The purpose of Schedule 13D is to provide transparency to the market regarding significant ownership stakes in public companies.

What information must be reported on schedule 13d - sec?

Information such as the filer's background, sources of funds, purpose of the acquisition, and future intentions regarding the company must be reported on Schedule 13D.

How can I send schedule 13d - sec to be eSigned by others?

When you're ready to share your schedule 13d - sec, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete schedule 13d - sec online?

pdfFiller has made it simple to fill out and eSign schedule 13d - sec. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the schedule 13d - sec in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your schedule 13d - sec and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Fill out your schedule 13d - sec online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule 13d - Sec is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.