Get the free C-159A Certificate of Dissolution Form to Dissolve a Profit Corporation pursuant to ...

Show details

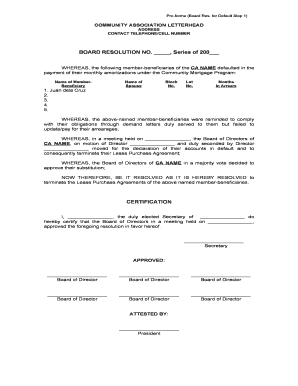

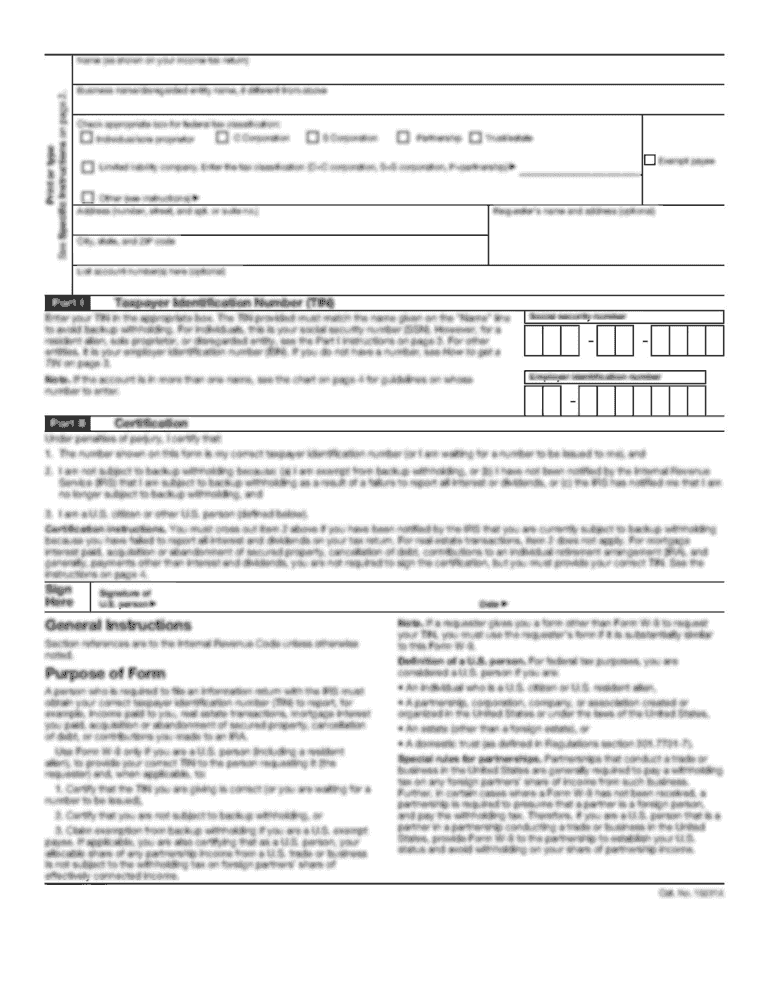

C159S 07/07 New Jersey Division of Revenue Certificate Of Dissolution, Pursuant to Action of Board and Shareholders For Use by Domestic Profit Corporations (NASA 14A:124) 1. Name of Corporation: 2.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign c-159a certificate of dissolution

Edit your c-159a certificate of dissolution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your c-159a certificate of dissolution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit c-159a certificate of dissolution online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit c-159a certificate of dissolution. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out c-159a certificate of dissolution

How to fill out c-159a certificate of dissolution:

01

Begin by obtaining the necessary form. The c-159a certificate of dissolution can typically be found on the official website of the relevant government agency or department.

02

Fill out the header section of the form, providing your business name and address as well as the date.

03

Indicate the jurisdiction under which your business is registered. This refers to the government authority that oversees your business's operations and legal compliance.

04

Provide the reason for dissolution. This could be a voluntary decision by the business owners, bankruptcy, or other legal reasons. Make sure to accurately and clearly state the reason.

05

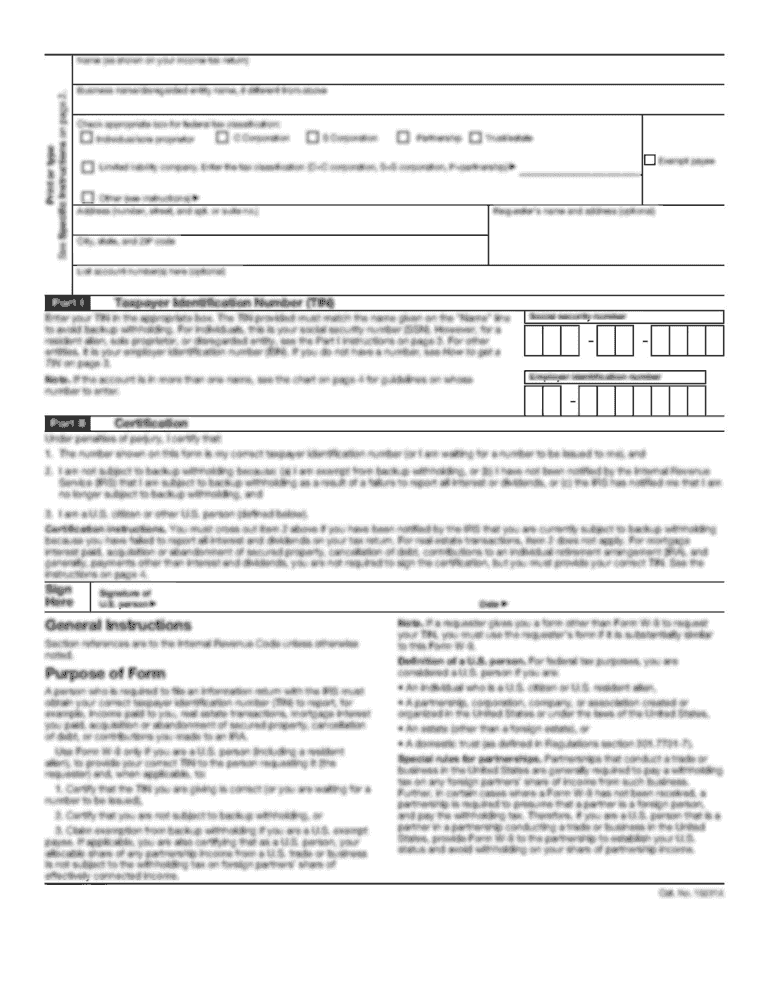

Include information about the shareholders or members of the business and their respective ownership percentages or interests.

06

Indicate whether any outstanding debts or liabilities exist. If so, provide details about the creditors and the amounts owed.

07

Sign and date the form. It is important to have the form signed by authorized individuals, such as the owners or directors of the business.

08

Submit the completed form to the appropriate government agency or department, along with any required fees or supporting documents.

09

Keep copies of the completed form, as well as any receipts or acknowledgments of submission.

Who needs c-159a certificate of dissolution:

01

Businesses owners who have decided to dissolve their company voluntarily.

02

Businesses that have gone bankrupt or are facing insurmountable financial difficulties.

03

Companies undergoing a merger or acquisition where the dissolution of a subsidiary or division is necessary.

04

Organizations that are required by law or regulation to dissolve or terminate their operations.

05

Non-profit organizations or charitable institutions that have completed their mission or are no longer able to sustain their activities.

It is important to consult with legal professionals or relevant government agencies to ensure compliance with local laws and regulations when filing for a certificate of dissolution.

Fill

form

: Try Risk Free

People Also Ask about

Is termination the same as dissolution?

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

What is the difference between dissolution and dissolution and termination?

Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence. What it does is change the purpose of its existence. Instead of conducting whatever business it conducted before, a dissolved LLC exists solely for the purpose of winding up and liquidating.

How do I dissolve a nonprofit corporation with the IRS?

For federal tax purposes, you'll need to file IRS Form 990 or IRS Form 990-EZ. You must include a completed Schedule N (Liquidation, Termination, Dissolution, or Significant Disposition of Assets), as well as copies of your certificate of dissolution and resolution to wind up and dissolve.

What is the difference between certificate of dissolution and dissolution and termination in NJ?

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

How do I dissolve a not for profit corporation in California?

To finalize dissolution with the Secretary of State, a nonprofit corporation is required to obtain from the Attorney General either a written waiver of objections to the dissolution concerning the distribution of the corporation's assets or a written confirmation that the corporation has no assets.

How do I close a nonprofit with the IRS?

For federal tax purposes, you'll need to file IRS Form 990 or IRS Form 990-EZ. You must include a completed Schedule N (Liquidation, Termination, Dissolution, or Significant Disposition of Assets), as well as copies of your certificate of dissolution and resolution to wind up and dissolve.

How do I file a dissolution of a corporation in California?

Steps to dissolve, surrender, or cancel a California business entity File all delinquent tax returns and pay all tax balances, including any penalties, fees, and interest. File the final/current year tax return. Cease doing or transacting business in California after the final taxable year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify c-159a certificate of dissolution without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your c-159a certificate of dissolution into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make edits in c-159a certificate of dissolution without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing c-159a certificate of dissolution and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How can I edit c-159a certificate of dissolution on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing c-159a certificate of dissolution right away.

Fill out your c-159a certificate of dissolution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

C-159a Certificate Of Dissolution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.