Get the free Record Retention Schedule for

Show details

Record Retention Schedule for Wisconsin's Public Libraries and Public Library Systems Adopted by the Wisconsin Public Records Board February 27, 2006We present a schedule of retention guidelines for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign record retention schedule for

Edit your record retention schedule for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your record retention schedule for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit record retention schedule for online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Sign into your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit record retention schedule for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out record retention schedule for

How to Fill Out Record Retention Schedule for:

01

Familiarize yourself with the applicable laws and regulations: Before filling out a record retention schedule, it is crucial to understand the legal requirements specific to your industry. Research and review relevant laws, regulations, and guidelines to ensure compliance.

02

Identify the types of records your organization generates: Make a comprehensive list of all the types of records that your organization creates during its operations. This can include financial records, employee files, contracts, client information, and more. Categorize these records based on their content and purpose.

03

Determine the retention periods for each type of record: Consult legal experts, industry associations, and government agencies to determine the recommended retention periods for each type of record. These periods can vary depending on factors such as legal requirements, potential litigation risk, and business needs.

04

Create a record retention schedule template: Design a record retention schedule template that suits your organization's specific needs. The template should include fields such as the type of record, retention period, disposal method, and any additional notes or requirements.

05

Assign responsibility for record retention: Define individuals or departments responsible for managing and enforcing the record retention schedule. Ensure they understand their roles and responsibilities, including record storage, disposal, and monitoring compliance.

06

Implement a record management system: Utilize a record management system or software that allows you to efficiently track and manage your organization's records. This will facilitate easy identification, retrieval, and disposal of records according to the retention schedule.

Who needs a record retention schedule for:

01

Businesses and organizations of all sizes: Whether you run a small startup or a large corporation, having a record retention schedule is essential. It helps ensure compliance with legal requirements, protects your organization's interests, and enables efficient record management.

02

Industries with strict regulatory compliance requirements: Certain industries, such as healthcare, finance, legal services, and government sectors, have stringent regulatory compliance requirements. These industries deal with sensitive information and are often subject to specific record retention regulations.

03

Organizations facing potential litigation risks: Maintaining a record retention schedule becomes even more critical for organizations that may face litigation risks. Properly managing and retaining records can help provide evidence, support legal claims, and demonstrate compliance in case of legal challenges.

In conclusion, filling out a record retention schedule requires understanding applicable laws, identifying types of records, determining retention periods, creating a template, implementing a management system, and assigning responsibility. This practice is relevant for businesses, industries with regulatory compliance requirements, and organizations facing potential litigation risks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the record retention schedule for in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your record retention schedule for and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How can I fill out record retention schedule for on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your record retention schedule for, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out record retention schedule for on an Android device?

On an Android device, use the pdfFiller mobile app to finish your record retention schedule for. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is record retention schedule for?

The record retention schedule is for determining how long certain types of records should be kept before they are disposed of.

Who is required to file record retention schedule for?

The entities required to file record retention schedules include businesses, organizations, and government agencies.

How to fill out record retention schedule for?

To fill out a record retention schedule, one must categorize the types of records they maintain and determine the appropriate retention period for each category.

What is the purpose of record retention schedule for?

The purpose of a record retention schedule is to ensure that important records are retained for the required period for legal, regulatory, or business purposes.

What information must be reported on record retention schedule for?

The record retention schedule must include details such as the types of records, retention periods, and disposal methods.

Fill out your record retention schedule for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Record Retention Schedule For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

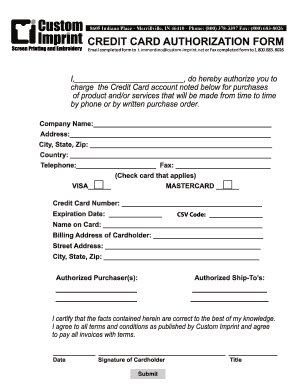

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.