Get the free Nailing Down an NOL - C Forrest Davis Tax Services

Show details

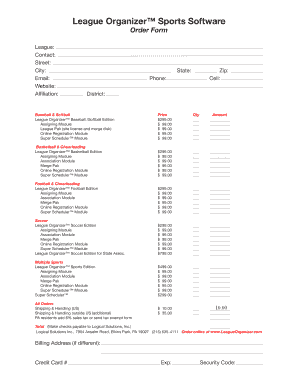

Davis Tax Services, LLP www.davistax.com 4402 E. Brett St. Tucson, AZ 857121102 (520) 3938813 tel & fax davistax.com Nailing Down an NOT Forrest Davis, EA http://davistax.com/download/NOL resources.pdf

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nailing down an nol

Edit your nailing down an nol form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nailing down an nol form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nailing down an nol online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nailing down an nol. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nailing down an nol

How to Fill out Nailing Down an NOL:

01

Begin by gathering all the necessary documentation related to your business losses. This may include financial statements, tax returns, and any other relevant records.

02

Calculate your net operating loss (NOL) for the current tax year. To do this, subtract your business expenses from your business income. If the result is negative, you have an NOL.

03

Determine if you want to carry back your NOL or carry it forward. Carrying back allows you to apply the NOL to previous years' tax returns and potentially receive a refund. Carrying forward allows you to apply the NOL to future tax years to offset future taxable income.

04

If you decide to carry back the NOL, review the rules and regulations of the IRS regarding the carryback period. Generally, you can carry back the NOL for up to two years, but there may be exceptions depending on your business type and circumstances.

05

Complete Form 1045, Application for Tentative Refund, or Form 1040X, Amended U.S. Individual Income Tax Return, if you are carrying back the NOL for an individual tax return. For corporate tax returns, complete Form 1139, Corporation Application for Tentative Refund.

06

Include all necessary information and calculations on the respective forms. Provide accurate details about your NOL, including the amount, the tax year(s) to which you are carrying it back, and any other required information.

07

Double-check all the information before submitting your forms to the IRS. Ensure that you have provided accurate calculations and supporting documentation to avoid any potential errors or delays in processing.

Who Needs Nailing Down an NOL:

01

Businesses that have experienced significant financial losses during a tax year may be eligible to claim an NOL. This could include startups, small businesses, or established companies facing economic downturns or unexpected expenses.

02

Individuals who have income from self-employment, rental properties, or investments may also need to consider nailing down an NOL if they have incurred substantial losses in those areas.

03

Any taxpayer who wants to reduce their taxable income by applying an NOL to previous or future tax years should understand the process of filling out the necessary forms to claim the NOL properly. It is crucial to follow the IRS guidelines and consult with a tax professional if required to ensure compliance and maximize potential benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is nailing down an nol?

Nailing down an NOL stands for Net Operating Loss and it is a tax form used to calculate the amount of tax credit a company can receive based on its losses in previous years.

Who is required to file nailing down an nol?

Companies that have incurred losses in previous years and want to claim a tax credit based on those losses are required to file a Net Operating Loss form.

How to fill out nailing down an nol?

To fill out a Net Operating Loss form, you need to gather information on the company's losses from previous years and follow the instructions on the form provided by the tax authority.

What is the purpose of nailing down an nol?

The purpose of filing a Net Operating Loss form is to allow companies to offset current year's profits with losses incurred in previous years, thus reducing the amount of tax owed.

What information must be reported on nailing down an nol?

The information to be reported on a Net Operating Loss form includes the amount of losses incurred in previous years, the calculation of the tax credit based on those losses, and any other relevant financial information.

How do I edit nailing down an nol straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing nailing down an nol.

How do I fill out the nailing down an nol form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign nailing down an nol and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit nailing down an nol on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign nailing down an nol on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your nailing down an nol online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nailing Down An Nol is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.