Get the free uniform payroll deduction form

Show details

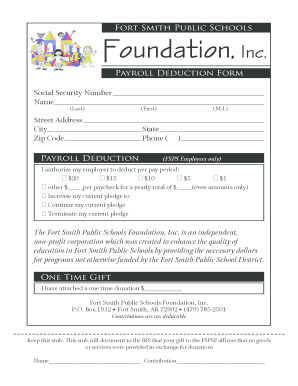

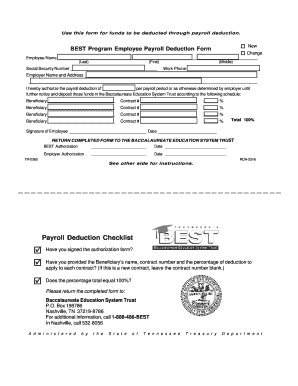

UNIFORM PAYROLL DEDUCTION FORM Please use this form to initiate new payroll deduction instructions or to make changes to an existing account. 1 EMPLOYEE INFORMATION First Name M.I. -- -- Social Security

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign uniform deduction form

Edit your uniform deduction form template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Airserv Uniform Payroll Deduction Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Airserv Uniform Payroll Deduction Form online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit Airserv Uniform Payroll Deduction Form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Airserv Uniform Payroll Deduction Form

How to fill out Airserv Uniform Payroll Deduction Form

01

Obtain the Airserv Uniform Payroll Deduction Form from your HR department or company website.

02

Fill in your personal information at the top of the form, including your full name, employee ID, and department.

03

Identify the uniform items you wish to purchase by checking the appropriate boxes or listing them in the designated section.

04

Specify the cost of each item and calculate the total amount to be deducted from your payroll.

05

Read and acknowledge the terms and conditions regarding the payroll deduction by signing the form.

06

Submit the completed form to your HR department for processing.

Who needs Airserv Uniform Payroll Deduction Form?

01

Employees who are required to wear uniforms as part of their job responsibilities.

02

New hires who need to acquire uniforms.

03

Existing employees wishing to purchase additional or replacement uniform items.

Fill

form

: Try Risk Free

People Also Ask about

Is uniform allow on paycheck?

California employers must reimburse employees for required uniforms. Under Federal law, employers are encouraged to reimburse employees for uniforms or required clothes. But the law does not say that they must reimburse their employees for such costs.

What are the 5 mandatory deductions from your paycheck?

Mandatory Payroll Tax Deductions Federal income tax withholding. Social Security & Medicare taxes – also known as FICA taxes. State income tax withholding. Local tax withholdings such as city or county taxes, state disability or unemployment insurance. Court ordered child support payments.

What is a payroll deduction form?

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

What is the payroll tax in CT?

Connecticut State Payroll Taxes for 2023 The State of Connecticut is on the high end of marginal income tax rates compared to the rest of the country. It's a progressive income tax that ranges from 3% to 6.99%. Connecticut does not have any local city taxes, so all of your employees will pay only the state income tax.

What is the CT payroll deduction form?

Form CT-W4, Employee's Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify Airserv Uniform Payroll Deduction Form without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including Airserv Uniform Payroll Deduction Form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I sign the Airserv Uniform Payroll Deduction Form electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I edit Airserv Uniform Payroll Deduction Form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign Airserv Uniform Payroll Deduction Form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is Airserv Uniform Payroll Deduction Form?

The Airserv Uniform Payroll Deduction Form is a document used by Airserv employees to authorize payroll deductions for uniform expenses.

Who is required to file Airserv Uniform Payroll Deduction Form?

Employees who are required to wear uniforms and wish to have the cost of these uniforms deducted from their paychecks must file the Airserv Uniform Payroll Deduction Form.

How to fill out Airserv Uniform Payroll Deduction Form?

To fill out the form, employees should provide their personal information, indicate the amount to be deducted from each paycheck, and sign the form to authorize the deductions.

What is the purpose of Airserv Uniform Payroll Deduction Form?

The purpose of the form is to facilitate the deduction of uniform costs from employees' salaries, allowing them to more easily manage these expenses.

What information must be reported on Airserv Uniform Payroll Deduction Form?

The form must include the employee's name, employee ID, the specific uniform costs to be deducted, and the authorization for the payroll deduction.

Fill out your Airserv Uniform Payroll Deduction Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Airserv Uniform Payroll Deduction Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.