Get the free Best Practices for Income Documentation

Show details

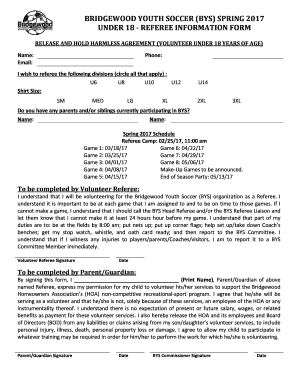

Best Practices for Income Documentation Acceptable Sources of Income Wage Earner Income: All nonselfemployed borrowers who receive a W2 at year-end must provide the W2 as evidence of total earnings

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign best practices for income

Edit your best practices for income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your best practices for income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing best practices for income online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit best practices for income. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out best practices for income

How to fill out best practices for income:

01

Start by gathering and organizing all relevant financial documents, such as pay stubs, investment statements, and tax returns. This will provide a comprehensive overview of your income sources.

02

Review your income sources and categorize them accordingly. This could include regular employment wages, freelance income, investment dividends, rental property income, or any other sources of money coming in.

03

Calculate your monthly and annual income for each category by adding up the amounts received from each source. Use accurate figures to ensure the best understanding of your financial situation.

04

Consider any fluctuations or irregularities in your income. For example, if you have self-employment income that varies each month, it is important to average it or account for the highest and lowest months separately to get a more accurate representation.

05

Fill out the best practices for income form or document by clearly stating each income source and the corresponding monthly or annual amount. Make sure to include any additional details or explanations if necessary.

06

Double-check your calculations and ensure that all information provided is accurate and up to date. If you are unsure about any aspect, consult a financial advisor or experienced professional for guidance.

Who needs best practices for income?

01

Individuals or households who want to gain better control and understanding of their financial situation can benefit from following best practices for income. This could include creating a budget, planning for retirement, or applying for loans or mortgages.

02

Entrepreneurs or self-employed individuals who have variable income streams may find it especially helpful to establish best practices for income. This can aid in budgeting, tax planning, and financial forecasting.

03

Financial professionals, such as accountants or financial advisors, can also benefit from best practices for income. They can use these practices to help their clients analyze their financial health, identify areas of improvement, and provide accurate advice and recommendations for financial planning.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is best practices for income?

Best practices for income refer to the recommended processes and strategies that individuals or businesses can follow to effectively manage and maximize their income.

Who is required to file best practices for income?

Anyone who receives income, whether it be from employment, investments, or other sources, is encouraged to follow best practices for income.

How to fill out best practices for income?

To fill out best practices for income, individuals or businesses should assess their current financial situation, set financial goals, create a budget, track spending, save for the future, and regularly review and adjust their financial plan.

What is the purpose of best practices for income?

The purpose of best practices for income is to help individuals and businesses effectively manage their income, save for the future, and achieve financial stability and success.

What information must be reported on best practices for income?

Information that must be reported on best practices for income may include income sources, expenses, savings, investments, debts, and financial goals.

How can I edit best practices for income from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including best practices for income, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make edits in best practices for income without leaving Chrome?

best practices for income can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the best practices for income in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your best practices for income and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your best practices for income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Best Practices For Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.