Get the free BROKER COMMISSION AGREEMENT - diversitranscom

Show details

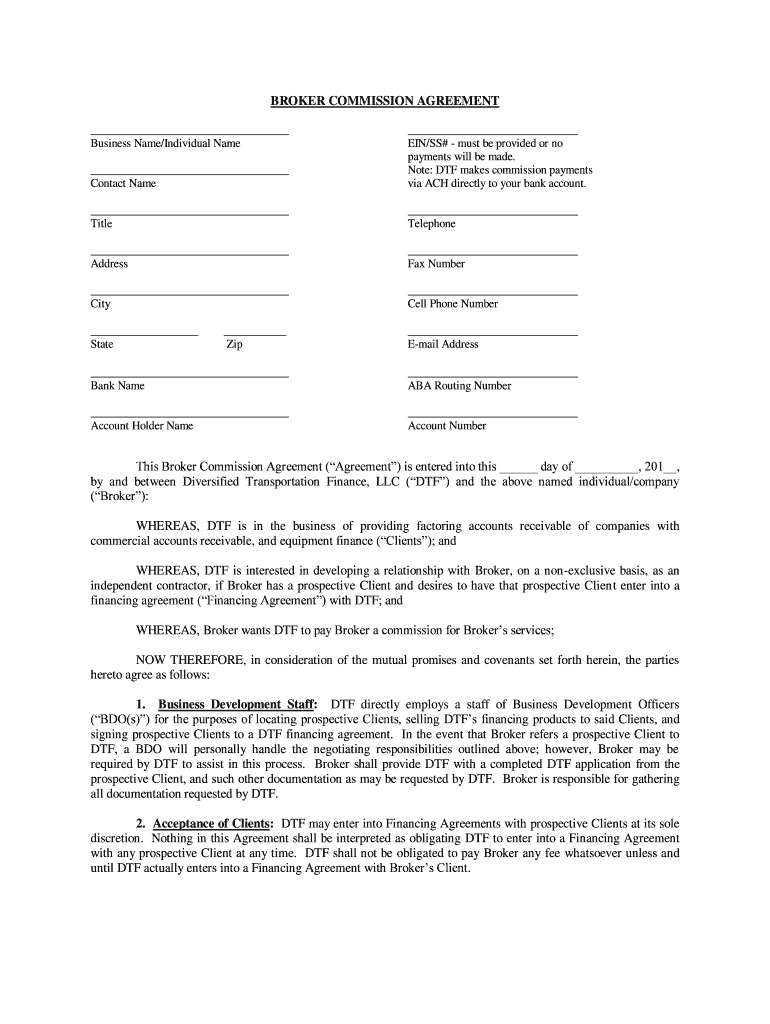

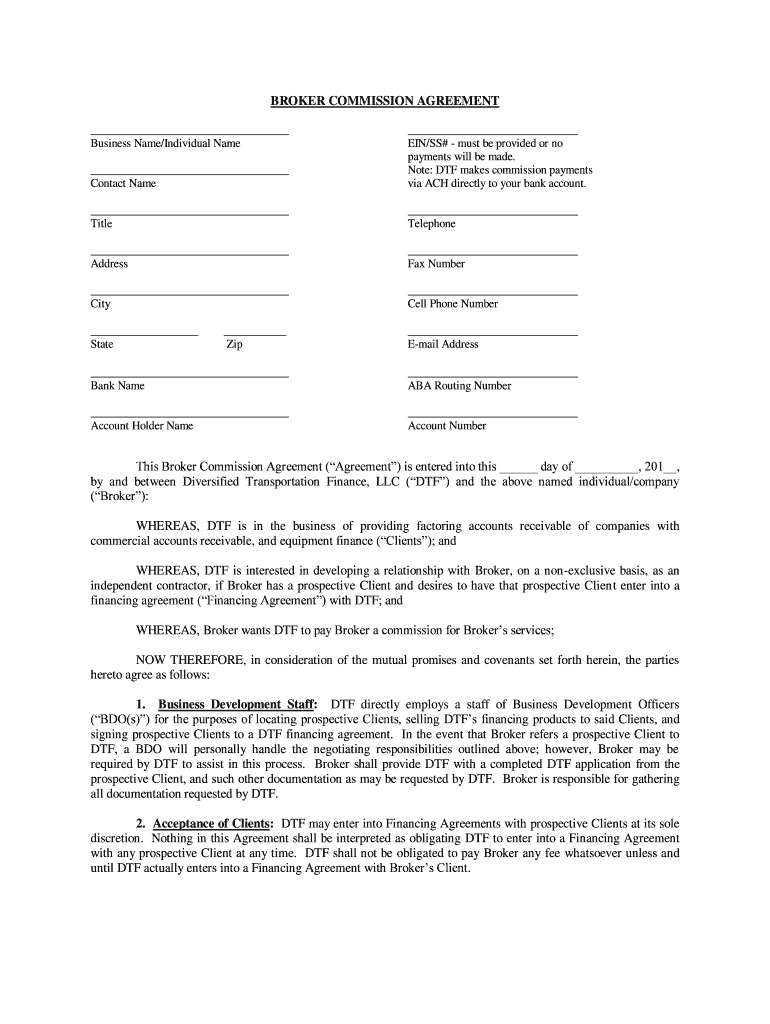

BROKER COMMISSION AGREEMENT Business Name/Individual Name Contact Name EIN/SS# must be provided or no payments will be made. Note: DT makes commission payments via ACH directly to your bank account.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign broker commission agreement

Edit your broker commission agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your broker commission agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit broker commission agreement online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit broker commission agreement. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out broker commission agreement

How to fill out a broker commission agreement:

01

Start by reviewing the agreement carefully to understand its terms and conditions. Familiarize yourself with the specific commission structure, payment terms, and any other relevant provisions.

02

Fill in your personal information as the broker, including your name, contact details, and any licensing or certification numbers required.

03

Include the client's information, such as their name, contact details, and any relevant identification or account numbers.

04

Specify the scope of the agreement by clearly describing the services that will be provided by the broker. This can include tasks such as marketing, negotiating contracts, and facilitating transactions.

05

State the commission rate or fee agreed upon. This should be clearly defined, whether it is a percentage of the sale price, a flat fee, or a combination of both.

06

Outline the conditions under which the broker is entitled to receive the commission. This can include successful completion of the transaction, full payment from the client, or any other specific criteria.

07

Include any additional terms or conditions that are relevant to the agreement, such as confidentiality clauses, termination provisions, or dispute resolution mechanisms.

08

Both the broker and the client should review and sign the agreement to indicate their acceptance and agreement to its terms.

Who needs a broker commission agreement:

01

Real Estate Agents: Real estate agents who represent buyers or sellers in property transactions often use broker commission agreements to establish their commission rates and ensure they are compensated for their services.

02

Mortgage Brokers: Mortgage brokers who assist clients in securing loans or financing may use commission agreements to outline their compensation terms with lenders or borrowers.

03

Insurance Brokers: Insurance brokers who help clients find and purchase insurance policies may utilize commission agreements to establish their compensation from insurance companies.

04

Stockbrokers: Stockbrokers who facilitate the buying and selling of securities for their clients may have commission agreements in place to define their fees and commission rates.

05

Commercial Brokers: Commercial brokers who assist in corporate transactions, such as mergers and acquisitions or business sales, may use commission agreements to establish their compensation terms with their clients.

In conclusion, filling out a broker commission agreement requires a careful review of the agreement's terms, providing relevant personal and client information, specifying the scope of services, outlining the commission rate, and including any additional terms or conditions. Various professionals, such as real estate agents, mortgage brokers, insurance brokers, stockbrokers, and commercial brokers, may need broker commission agreements to establish their compensation arrangements with clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is broker commission agreement?

Broker commission agreement is a contract between a broker and a client that outlines the terms of the commission payment for the broker's services in facilitating a transaction.

Who is required to file broker commission agreement?

Both the broker and the client involved in the transaction are required to file the broker commission agreement.

How to fill out broker commission agreement?

The broker commission agreement can be filled out by including details such as the names of the parties involved, the property or service being provided, the commission amount or percentage, and the terms of payment.

What is the purpose of broker commission agreement?

The purpose of the broker commission agreement is to establish a clear understanding of the commission payment terms and protect the rights of both the broker and the client.

What information must be reported on broker commission agreement?

The broker commission agreement must include details such as the names of the parties involved, the property or service being provided, the commission amount or percentage, and the terms of payment.

How can I manage my broker commission agreement directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your broker commission agreement and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I get broker commission agreement?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific broker commission agreement and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out broker commission agreement on an Android device?

On an Android device, use the pdfFiller mobile app to finish your broker commission agreement. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your broker commission agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Broker Commission Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.