Get the free EXEMPT EFFECTIVE JULY 1 2006 - City of Athens TN

Show details

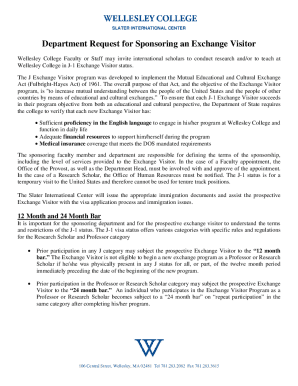

EXEMPT EFFECTIVE: JULY 1, 2006, DIRECTOR OF FINANCE City of Athens Finance Department GENERAL DESCRIPTION: The position oversees all functions of finance, including purchasing. The position is responsible

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign exempt effective july 1

Edit your exempt effective july 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your exempt effective july 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit exempt effective july 1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit exempt effective july 1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out exempt effective july 1

How to fill out exempt effective July 1:

01

Obtain the necessary forms: Start by obtaining the appropriate forms for exempt status. These forms can usually be found on the website of the government agency responsible for overseeing exemptions, such as the Internal Revenue Service (IRS) for tax exemptions.

02

Review eligibility criteria: Before filling out the forms, it is important to familiarize yourself with the eligibility criteria for exempt status. Different exemptions have different requirements, so make sure you qualify before proceeding with the application.

03

Gather required documentation: In order to support your exemption claim, you may need to provide certain documentation. This can include financial records, proof of non-profit status, or other relevant paperwork. Take the time to gather all the necessary documents before starting the application process.

04

Complete the forms accurately: Once you have the forms and the required documentation, carefully fill out each section of the forms. Make sure to provide accurate and up-to-date information. Double-check your work to avoid any errors or omissions.

05

Seek assistance if needed: If you're unsure about any part of the application or if you have complex circumstances, consider seeking assistance from a tax professional or someone knowledgeable in the area of exemptions. They can provide guidance and help ensure that your application is properly filled out.

06

Submit your application: Once you have completed all the necessary forms and attached the required documentation, submit your application according to the instructions provided. This may involve mailing the forms to a specific address, submitting them electronically, or hand-delivering them to the appropriate office.

07

Follow up and keep records: After submitting your application, it is important to follow up to ensure that it is being processed. Keep copies of all forms and documentation for your records. If you receive any correspondence or requests for additional information, respond promptly to avoid any delays in the processing of your exemption request.

Who needs exempt effective July 1:

01

Individuals with specific income criteria: Some exemptions apply to individuals who meet certain income thresholds. These exemptions are typically aimed at lower-income individuals and may provide relief from certain taxes or fees.

02

Non-profit organizations: Many exemptions are targeted towards non-profit organizations, such as charities, educational institutions, or religious entities. These exemptions often relate to tax benefits, allowing non-profit organizations to operate with reduced financial burden.

03

Special circumstances: Some exemptions are available for individuals or businesses that meet certain criteria or fall under specific circumstances. For example, exemptions for military personnel, veterans, or individuals with disabilities may be available.

It is important to consult the specific regulations and requirements of the relevant government agency or tax authority to determine who exactly needs to apply for exempt status effective July 1.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is exempt effective july 1?

Exempt effective July 1 refers to certain individuals or entities that are not required to pay or file taxes starting on that date.

Who is required to file exempt effective july 1?

Individuals or entities who meet specific criteria set by the tax authorities may be required to file for exempt status effective July 1.

How to fill out exempt effective july 1?

To fill out exempt status effective July 1, individuals or entities must provide relevant information to the tax authorities through the designated forms or online portal.

What is the purpose of exempt effective july 1?

The purpose of exempt effective July 1 is to provide relief from certain tax obligations for eligible individuals or entities.

What information must be reported on exempt effective july 1?

The information required to be reported on exempt effective July 1 may include details about income, assets, expenses, and any other relevant financial information.

How can I edit exempt effective july 1 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your exempt effective july 1 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I make changes in exempt effective july 1?

With pdfFiller, the editing process is straightforward. Open your exempt effective july 1 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my exempt effective july 1 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your exempt effective july 1 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your exempt effective july 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Exempt Effective July 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.