Get the free S/O Invoice - Gross margin/Short Form/RGA/SR Invoice

Show details

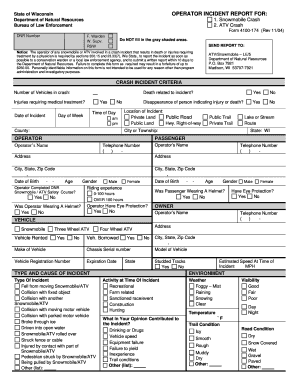

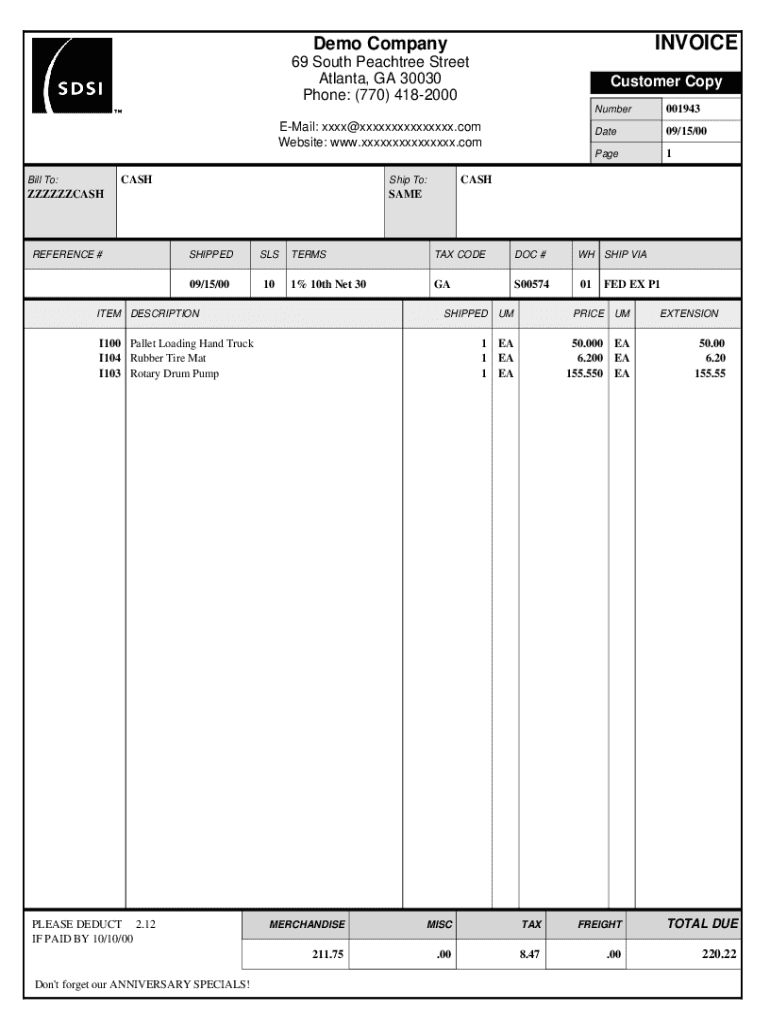

INVOICED emo Company

69 South Peachtree Street

Atlanta, GA 30030

Phone: (770) 4182000Customer Voicemail: xxxx@xxxxxxxxxxxxxxx.com

Website: www.xxxxxxxxxxxxxxx.com

CASH Bill To:REFERENCE #001943Date09/15/00Page1CASHShip

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign so invoice - gross

Edit your so invoice - gross form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your so invoice - gross form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing so invoice - gross online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit so invoice - gross. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out so invoice - gross

How to fill out an invoice - gross?

01

Start by writing your contact information at the top of the invoice, including your name, address, phone number, and email address.

02

Next, add the recipient's contact information, including their name, address, phone number, and email address.

03

Include a unique invoice number and date. This helps with tracking and organizing your invoices.

04

List the goods or services provided on the invoice, including a description, quantity, and price for each item. Make sure to include any applicable taxes or fees.

05

Calculate the total amount due by adding up the prices of all items and including any additional charges. This will be the gross amount.

06

If applicable, include payment terms and methods. Specify when the payment is due and provide details on how it can be made (e.g., bank transfer, credit card, etc.).

Who needs an invoice - gross?

01

Businesses: Any company or organization that sells products or services to their customers needs to provide an invoice. This includes small businesses, freelancers, and large corporations.

02

Freelancers: Independent contractors and freelancers often use invoices to bill their clients. This ensures they receive payment for their work and provides a record of the transaction.

03

Service Providers: Service-based industries, such as plumbers, electricians, or consultants, commonly use invoices to request payment for their services rendered.

In conclusion, anyone involved in a business transaction, whether it's selling products or providing services, can benefit from using invoices. It helps in maintaining records, establishing payment terms, and facilitating smooth financial transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out so invoice - gross on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your so invoice - gross from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit so invoice - gross on an Android device?

You can make any changes to PDF files, such as so invoice - gross, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I fill out so invoice - gross on an Android device?

Use the pdfFiller mobile app to complete your so invoice - gross on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is so invoice - gross?

A gross invoice is an invoice that includes both the net amount and any taxes or other fees.

Who is required to file so invoice - gross?

Businesses who provide goods or services and collect taxes or fees are required to file gross invoices.

How to fill out so invoice - gross?

To fill out a gross invoice, include the net amount of the goods or services provided, as well as any applicable taxes or fees.

What is the purpose of so invoice - gross?

The purpose of a gross invoice is to provide a clear breakdown of the total amount due, including taxes and fees.

What information must be reported on so invoice - gross?

The information reported on a gross invoice must include the net amount, taxes, fees, date of transaction, and payment details.

Fill out your so invoice - gross online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

So Invoice - Gross is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.