Get the free Payment to Individual Report - University of Wisconsin - uwosh

Show details

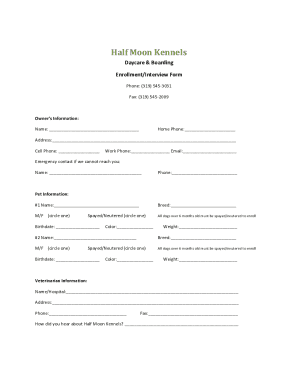

Payment to Individual Report USA Business Unit: Amount Account Org. Pro. $1440.00 Fund 084047 2 Total Subclass Budget Year Project SS#, Taxpayer ID#, ITIN Name(Last) (First) (Initial) 2014 ESTRELLA

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payment to individual report

Edit your payment to individual report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payment to individual report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit payment to individual report online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit payment to individual report. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payment to individual report

How to fill out payment to individual report:

01

Gather all necessary information: Before filling out the payment to individual report, make sure you have all the required information. This includes the name of the individual receiving the payment, their address, the payment amount, the purpose of the payment, and any additional details or references related to the transaction.

02

Access the payment to individual report form: Depending on the organization or platform you are using to process the payment, locate the payment to individual report form. This form may be available online, or you may need to request it from the appropriate department or authority.

03

Fill in the recipient's details: Start by entering the recipient's name, ensuring it matches the name on their identification documents. Then, provide their complete address and contact information. Double-check the accuracy of these details to avoid any potential issues or delays in delivering the payment.

04

Specify the payment amount and currency: Indicate the exact amount being paid to the individual. This could be a salary, a reimbursement, a bonus, or any other type of payment. Additionally, specify the currency in which the payment is being made, especially if it differs from the recipient's local currency.

05

Include the purpose of the payment: Describe the purpose or reason for the payment in a clear and concise manner. This could be for services rendered, goods purchased, or any other relevant purpose. Providing a brief explanation ensures transparency and helps both parties understand the purpose of the transaction.

06

Attach supporting documents if required: Depending on the organization's policies, you may need to attach supporting documents to the payment to individual report. This could include invoices, receipts, contracts, or any other documents that validate the transaction or provide additional context.

07

Review and double-check: Before submitting the payment to individual report, take a moment to review all the entered information. Make sure there are no spelling mistakes, missing details, or discrepancies that could cause any issues or complications.

08

Submit the report: Once you are confident that all the information is accurate and complete, submit the payment to individual report as per the instructions provided by the organization or platform. Follow any additional steps or procedures required for the payment to be processed and recorded successfully.

Who needs payment to individual report?

01

Businesses: Businesses need payment to individual reports when they need to make payments to individuals for various reasons such as salaries, reimbursements, commissions, or any other type of payment.

02

Employers: Employers use payment to individual reports to document and track payments made to their employees. This helps in maintaining accurate financial records and ensures compliance with payroll regulations.

03

Accounting departments: Accounting departments within organizations need payment to individual reports to record and reconcile payments made to individuals. These reports play a crucial role during audits and financial analysis.

04

Contractors and freelancers: Contractors and freelancers often receive payments for their services through payment to individual reports. These reports serve as a record of their earnings and can be used for tax purposes or to track their income.

05

Financial institutions: Financial institutions require payment to individual reports when individuals receive payments, such as wire transfers or international remittances. These reports help in verifying the legitimacy and purpose of the transactions.

Remember, the exact requirements and procedures for filling out payment to individual reports may vary depending on the organization or platform you are using. It is always recommended to follow their guidelines and seek clarification if needed.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is payment to individual report?

Payment to individual report is a document that reports payments made to individuals for services rendered.

Who is required to file payment to individual report?

Businesses and entities that make payments to individuals for services rendered are required to file a payment to individual report.

How to fill out payment to individual report?

The payment to individual report should be filled out with details of the individual receiving the payment, the amount paid, and the purpose of the payment.

What is the purpose of payment to individual report?

The purpose of the payment to individual report is to report payments made to individuals for services rendered to the appropriate tax authorities.

What information must be reported on payment to individual report?

The information that must be reported on a payment to individual report includes the name and address of the individual receiving the payment, the amount paid, and the purpose of the payment.

How can I send payment to individual report to be eSigned by others?

payment to individual report is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out payment to individual report using my mobile device?

Use the pdfFiller mobile app to complete and sign payment to individual report on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out payment to individual report on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your payment to individual report. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your payment to individual report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payment To Individual Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.