Get the free SUNY 403b Tax Deferred Annuity TDA Plan SALARY - fitnyc

Show details

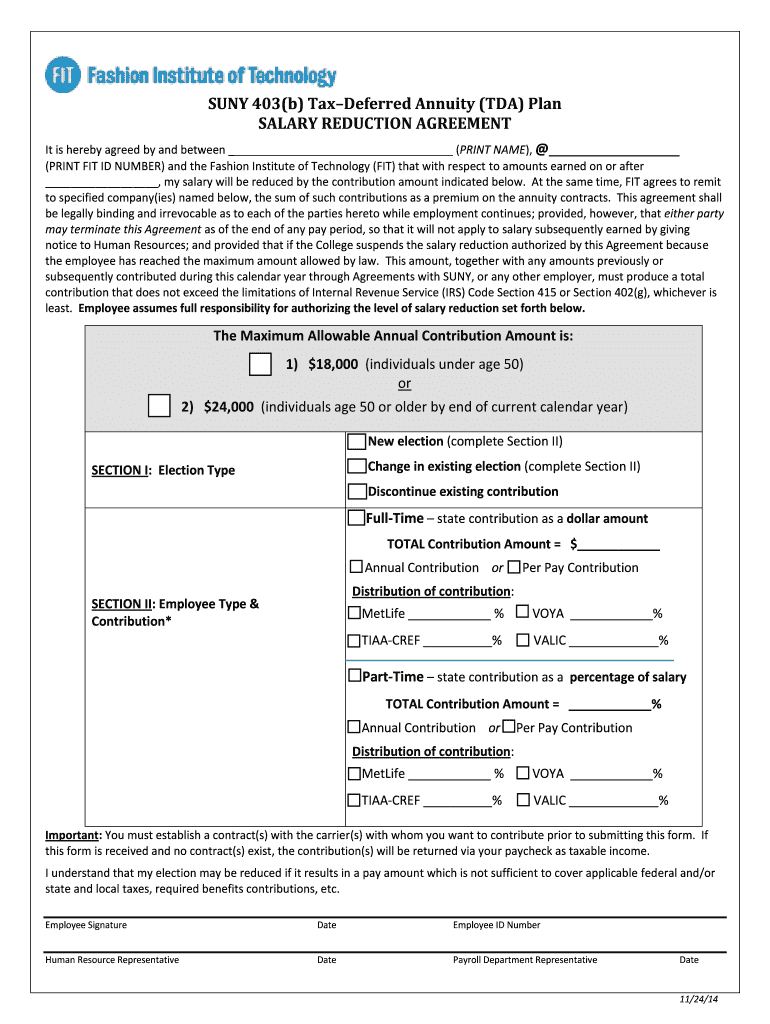

SUN 403(b) Deferred Annuity (TDA) Plan SALARY REDUCTION AGREEMENT It is hereby agreed by and between (PRINT NAME), (PRINT FIT ID NUMBER) and the Fashion Institute of Technology (FIT) that with respect

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign suny 403b tax deferred

Edit your suny 403b tax deferred form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your suny 403b tax deferred form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing suny 403b tax deferred online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit suny 403b tax deferred. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out suny 403b tax deferred

How to Fill Out SUNY 403b Tax Deferred:

01

Obtain necessary forms: Begin the process of filling out your SUNY 403b tax deferred by obtaining the required forms from your employer or the specific institution managing your retirement plan. These forms may be found online or be provided by your HR department.

02

Provide personal information: Start by entering your personal information accurately in the designated fields. This typically includes your full name, social security number, address, and date of birth. Double-check the accuracy of this information before proceeding to the next step.

03

Indicate contribution amount: Determine the contribution amount you wish to make for your SUNY 403b tax deferred plan. This is the maximum amount of pre-tax dollars you can contribute per year, as determined by the IRS. Consult the plan guidelines or your financial advisor to understand the contribution limits and choose an appropriate amount.

04

Select investment options: Within the SUNY 403b tax deferred plan, you are often given various investment options. Review the provided choices and select the investments that align with your goals and risk tolerance. Consider seeking professional advice if you are unsure which investments to choose.

05

Designate beneficiary information: In this section, identify the person(s) who will receive the funds in your SUNY 403b account in case of your death. Provide the required details, such as their full name, relationship to you, and contact information. It is essential to keep this information up to date as life circumstances change.

06

Sign and date the form: Once you have completed all the necessary sections and reviewed your information for accuracy, affix your signature and date the form at the bottom. Be sure to read any accompanying instructions regarding additional documentation or witness signatures, if applicable.

Who Needs SUNY 403b Tax Deferred:

01

SUNY employees: SUNY 403b tax deferred plan is specifically designed for employees of the State University of New York (SUNY). If you work for SUNY, whether as faculty, staff, or administrator, you are likely eligible to participate in this retirement savings plan.

02

Individuals seeking tax advantages: The SUNY 403b tax deferred plan offers tax advantages to participants. By contributing pre-tax dollars, you can potentially lower your taxable income, resulting in reduced tax liability. If you are looking for ways to save for retirement while minimizing your tax obligations, this plan may be beneficial for you.

03

Those planning for retirement: The SUNY 403b tax deferred plan is an excellent option for individuals who are actively planning for their retirement. By contributing regularly to your account, you can build savings that will support you during your retirement years. This plan allows for the benefit of compounded growth over time.

Remember, it's always essential to consult with a financial advisor or tax professional to ensure you understand the specific details of the SUNY 403b tax deferred plan and its implications for your personal financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is suny 403b tax deferred?

suny 403b tax deferred is a retirement savings plan offered to employees of State University of New York (SUNY) that allows contributions to be made on a pre-tax basis, reducing taxable income and deferring taxes on earnings until withdrawal.

Who is required to file suny 403b tax deferred?

Employees of SUNY who wish to participate in the 403b retirement savings plan are required to file suny 403b tax deferred.

How to fill out suny 403b tax deferred?

To fill out suny 403b tax deferred, employees need to provide information about their contributions, investment selections, and beneficiary designations.

What is the purpose of suny 403b tax deferred?

The purpose of suny 403b tax deferred is to help employees save for retirement by allowing for tax-deferred contributions and investment growth.

What information must be reported on suny 403b tax deferred?

Suny 403b tax deferred requires reporting of employee contributions, investment gains or losses, and any distributions made during the tax year.

How do I execute suny 403b tax deferred online?

pdfFiller has made it easy to fill out and sign suny 403b tax deferred. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the suny 403b tax deferred form on my smartphone?

Use the pdfFiller mobile app to fill out and sign suny 403b tax deferred on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit suny 403b tax deferred on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share suny 403b tax deferred on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your suny 403b tax deferred online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Suny 403b Tax Deferred is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.