Get the free Conventional (FHA, VA)

Show details

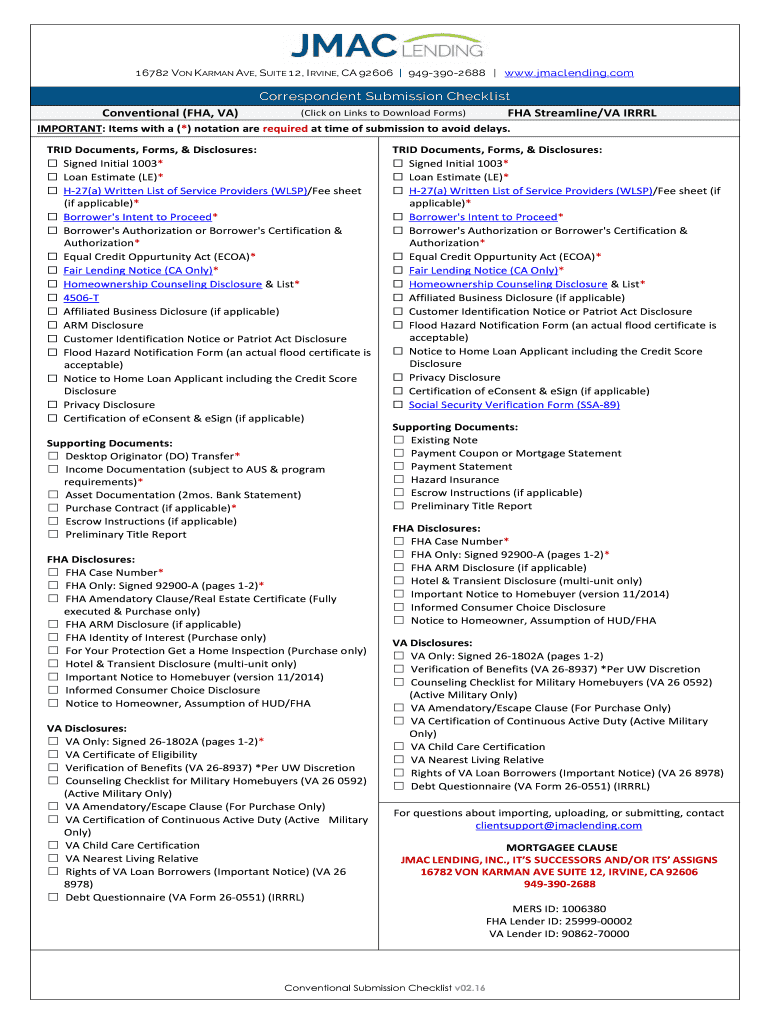

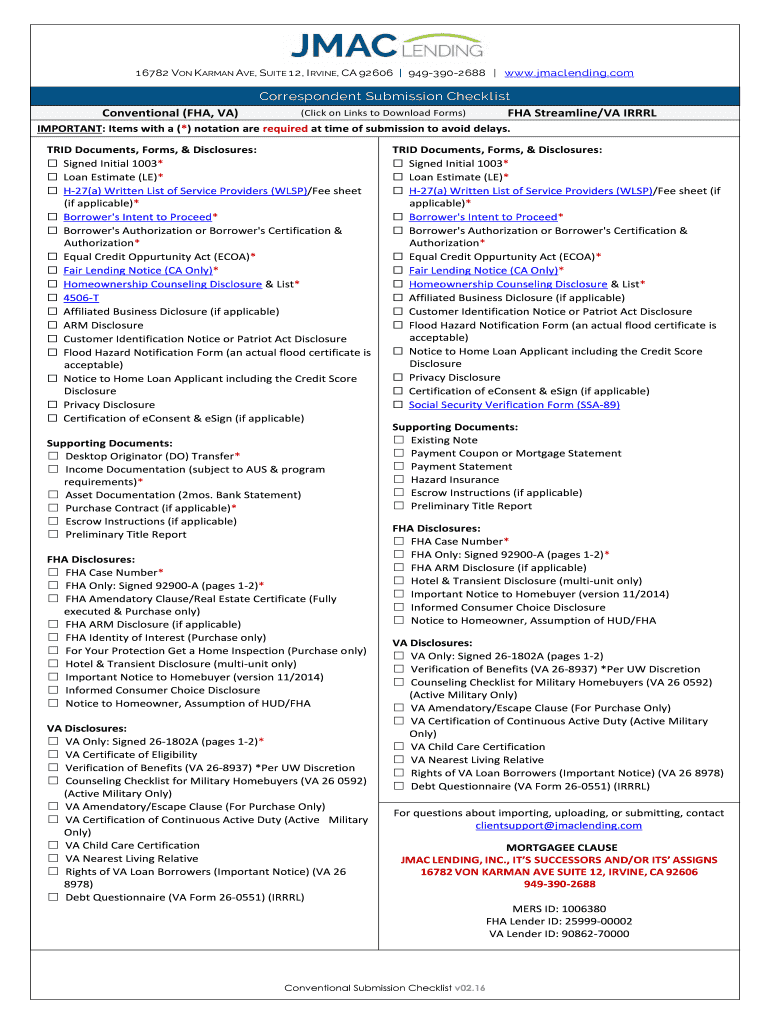

1 6782 ON K ARYAN AVE, SUITE 1 2, I RHINE, CA 92606 9493902688 www.jmaclending.comConventional (FHA, VA)Correspondent Submission Check list (Click on Links to Download Forms) FHA Streamline/VA IRRRLIMPORTANT:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign conventional fha va

Edit your conventional fha va form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your conventional fha va form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit conventional fha va online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit conventional fha va. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out conventional fha va

How to Fill Out Conventional FHA VA:

01

Gather necessary documents - Before starting the application process for conventional FHA VA, it's important to gather all the required documents. This may include proof of income, tax returns, bank statements, employment history, and documentation of any assets or liabilities.

02

Research eligibility requirements - Familiarize yourself with the eligibility requirements for conventional FHA VA loans. Each loan program may have specific criteria that the borrower needs to meet, such as credit score, income requirements, and down payment amount. Understanding these requirements will help you determine if you qualify for the loan.

03

Choose a lender - Research different lenders who offer conventional FHA VA loans. Compare their interest rates, terms, and fees. It's important to find a reputable lender with whom you feel comfortable working.

04

Complete the loan application - Once you have selected a lender, you will need to complete the loan application. This typically involves providing personal and financial information, such as your name, address, employment history, and income details. Be thorough and accurate when filling out the application.

05

Provide supporting documents - Along with the loan application, you will need to submit supporting documents that verify the information provided on the application. This may include pay stubs, W-2 forms, bank statements, and any other requested documentation.

06

Wait for loan approval - After submitting the application and supporting documents, the lender will review your information and determine if you meet the eligibility requirements. This process may take some time, so be prepared to wait for a decision.

07

Follow up with the lender - During the loan approval process, it's important to stay in communication with your lender. Respond to any requests for additional information promptly and provide any necessary documentation in a timely manner.

Who Needs Conventional FHA VA:

01

First-time homebuyers - Conventional FHA VA loans are often an attractive option for first-time homebuyers. These loans offer competitive interest rates and more flexible qualification criteria compared to traditional mortgage loans.

02

Veterans and active-duty military personnel - VA loans are exclusively available to veterans and active-duty military personnel. These loans offer benefits such as no down payment requirements and no private mortgage insurance (PMI).

03

Individuals with lower credit scores - FHA loans can be a good option for individuals with lower credit scores. These loans have more lenient credit requirements compared to conventional loans, making them accessible to a broader range of borrowers.

In conclusion, filling out a conventional FHA VA loan application involves gathering necessary documents, researching eligibility requirements, choosing a lender, completing the application, providing supporting documents, waiting for loan approval, and following up with the lender. These loans are useful for first-time homebuyers, veterans, active-duty military personnel, and individuals with lower credit scores.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is conventional fha va?

Conventional, FHA, and VA are different types of mortgage loans. Conventional loans are not insured or guaranteed by the government, while FHA loans are insured by the Federal Housing Administration and VA loans are guaranteed by the Department of Veterans Affairs.

Who is required to file conventional fha va?

Individuals or families applying for a mortgage loan may be required to file for either conventional, FHA, or VA loans depending on their eligibility and financial situation.

How to fill out conventional fha va?

To fill out a conventional, FHA, or VA loan application, you will need to provide information about your income, assets, debts, and credit history. It is recommended to work with a mortgage lender or financial advisor for guidance on completing the application.

What is the purpose of conventional fha va?

The purpose of conventional, FHA, and VA loans is to provide financing options for individuals looking to purchase or refinance a home. These loans typically have different requirements and benefits for borrowers.

What information must be reported on conventional fha va?

Applicants for conventional, FHA, or VA loans must report details such as income, employment history, credit score, assets, debts, and any other financial information that may impact their eligibility for the loan.

How do I modify my conventional fha va in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your conventional fha va and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit conventional fha va online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your conventional fha va to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I make edits in conventional fha va without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your conventional fha va, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Fill out your conventional fha va online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conventional Fha Va is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.