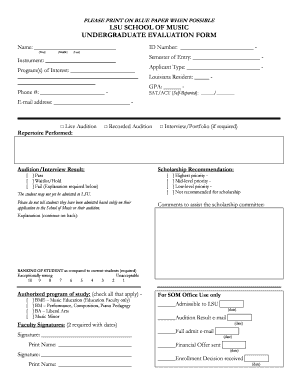

Get the free Is Your Bank’s Loan Portfolio Ready for Your Next Safety & Soundness Examination

Show details

This seminar addresses important factors for preparing a bank's loan portfolio for safety and soundness examination, discussing credit quality issues highlighted by regulators.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign is your banks loan

Edit your is your banks loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your is your banks loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit is your banks loan online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit is your banks loan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out is your banks loan

How to fill out Is Your Bank’s Loan Portfolio Ready for Your Next Safety & Soundness Examination

01

Review the bank’s loan portfolio documentation.

02

Assess the current performance metrics of the loans.

03

Identify any high-risk loans and categorize them.

04

Ensure compliance with regulatory standards and guidelines.

05

Prepare detailed reports for each loan type.

06

Conduct internal audits to verify data accuracy.

07

Compile records of any previously identified issues and resolutions.

08

Create an action plan for any identified deficiencies.

09

Schedule training sessions for staff on portfolio management.

Who needs Is Your Bank’s Loan Portfolio Ready for Your Next Safety & Soundness Examination?

01

Bank compliance officers

02

Internal audit teams

03

Risk management departments

04

Loan officers

05

Senior bank management

06

Members of the board of directors

07

Regulatory agencies conducting examinations

Fill

form

: Try Risk Free

People Also Ask about

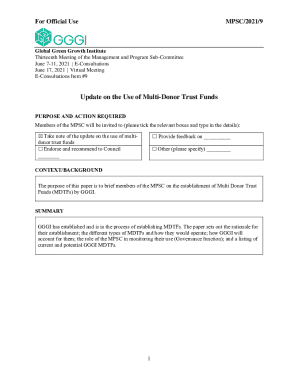

What is soundness in banking?

Bank soundness is a concept commonly used to denote, for example, an ability to withstand adverse events. Nevertheless, its usage is typically imprecise and gives rise to questions regarding its definition, measurement, and prediction.

What are the risks in a loan portfolio?

The loan portfolio at risk is defined as the value of the outstanding balance of all loans in arrears (principal). The Loan Portfolio at Risk is generally expressed as a percentage rate of the total loan portfolio currently outstanding.

What is safety and soundness in banking?

Safety and soundness used to mean things you did to avoid bank failure. Now, with agency risk management guidelines mandating you to be scored on how well you control risk, special examination teams have been trained to focus on nothing but an institution's compliance with safety and soundness regulations.

What is a loan portfolio in banking terms?

A loan portfolio is the totality of all loans issued by a bank or other financial institution to its customers. The portfolio can consist of both safe and risky loans. A diversified loan portfolio should contain a mix of different borrowers and industries to minimise the risk of losses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Is Your Bank’s Loan Portfolio Ready for Your Next Safety & Soundness Examination?

It is a comprehensive assessment tool designed to evaluate the quality, performance, and risk associated with a bank's loan portfolio in preparation for regulatory examinations.

Who is required to file Is Your Bank’s Loan Portfolio Ready for Your Next Safety & Soundness Examination?

All banks, including community banks and larger financial institutions, are typically required to file this assessment as part of their regulatory compliance and due diligence.

How to fill out Is Your Bank’s Loan Portfolio Ready for Your Next Safety & Soundness Examination?

To fill out the assessment, banks need to gather detailed information on their loan types, performance metrics, risk assessments, and compliance with lending regulations, and then complete the forms or documentation as prescribed by their regulatory authority.

What is the purpose of Is Your Bank’s Loan Portfolio Ready for Your Next Safety & Soundness Examination?

The purpose is to ensure that banks maintain high standards of loan underwriting and management, thereby safeguarding the soundness of the financial institution and protecting depositors and the economy.

What information must be reported on Is Your Bank’s Loan Portfolio Ready for Your Next Safety & Soundness Examination?

Banks must report detailed information including loan types, delinquency rates, loan concentrations, risk ratings, collateral values, and compliance with applicable laws and regulations.

Fill out your is your banks loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Is Your Banks Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.