Get the free 2009 BSA/AML Compliance Management

Show details

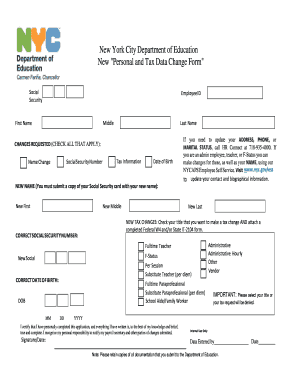

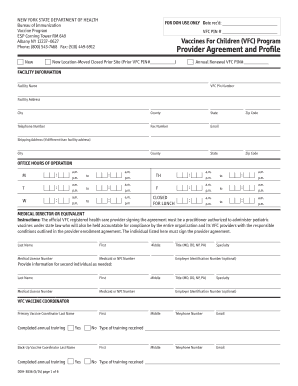

This document outlines a seminar program focusing on BSA/AML compliance management, detailing the schedule, content, learning objectives, registration information, and instructor background for the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2009 bsaaml compliance management

Edit your 2009 bsaaml compliance management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009 bsaaml compliance management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2009 bsaaml compliance management online

Follow the steps down below to use a professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2009 bsaaml compliance management. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2009 bsaaml compliance management

How to fill out 2009 BSA/AML Compliance Management

01

Gather necessary documents: Ensure you have all relevant documents related to your business operations.

02

Review the BSA/AML regulations: Familiarize yourself with the BSA and AML compliance requirements as they were defined in 2009.

03

Conduct a risk assessment: Identify and assess the risks associated with your business type and clientele.

04

Develop policies and procedures: Create comprehensive policies and procedures that align with BSA/AML regulations.

05

Implement training programs: Train staff on BSA/AML compliance obligations and reporting requirements.

06

Establish a compliance officer role: Designate a compliance officer responsible for overseeing the BSA/AML program.

07

Set up monitoring systems: Implement systems to monitor transactions for suspicious activities.

08

Document the compliance program: Keep detailed records of your compliance efforts and any updates made.

09

Conduct annual reviews: Regularly review and update your compliance program to ensure adherence to regulations.

Who needs 2009 BSA/AML Compliance Management?

01

Financial institutions: Banks, credit unions, and other entities offering financial services.

02

Money service businesses: Entities that provide services like currency exchange, money transfers, or check cashing.

03

Insurance companies: Firms offering insurance products that may be involved in financial transactions.

04

Securities firms: Broker-dealers and investment advisors that manage securities transactions.

05

Any business involved in financial transactions: Companies that handle cash-intensive operations or have clients with potential higher risk for money laundering.

Fill

form

: Try Risk Free

People Also Ask about

What is the role of a BSA compliance manager?

Responsible for developing, implementing and administering all aspects of the Bank Secrecy Act and Anti-Money Laundering Compliance Program. Ensures all affected areas of the Credit Union are kept informed of changing laws and procedures for implementation to be completed at the appropriate time.

What does an AML compliance officer do?

An AML (Anti-Money Laundering) compliance officer is responsible for ensuring that a financial institution, such as a bank, adheres to laws and regulations designed to prevent money laundering and other financial crimes.

What are the three components of BSA AML compliance?

FInCEN works to ensure banks adhere to the three main AML requirements of the BSA: Report cash transactions over $10,000 using the Currency Transaction Report. Properly identify those conducting transactions. Keeping appropriate records of financial transactions to maintain an accurate paper trail.

What is BSA and AML?

BSA is the common name for a series of laws and regulations enacted in the United States to combat money laundering and the financing of terrorism.

What is the AML compliance?

Anti-money laundering (or AML) compliance entails a careful adherence to rules and regulations aimed at combating illicit financial activities. In the US, AML compliance is upheld by the US Treasury's Financial Crimes Enforcement Network (FinCen) and governed by the Bank Secrecy Act (or BSA).

What are the 5 pillars of BSA?

The Five Pillars of the Bank Secrecy Act Designate a compliance officer. Develop internal controls. Establish an AML compliance training program. Have independent audits of the program done. Perform customer due diligence.

What is the BSA and AML compliance?

BSA/AML statutes require individuals, banks, and other financial institutions to file currency reports with the U.S. Department of the Treasury, properly identify persons conducting transactions, and maintain a paper trail by keeping appropriate records of financial transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2009 BSA/AML Compliance Management?

2009 BSA/AML Compliance Management refers to the regulations and frameworks established for financial institutions to prevent and detect money laundering and terrorist financing activities, as mandated by the Bank Secrecy Act (BSA) and the Anti-Money Laundering (AML) regulations.

Who is required to file 2009 BSA/AML Compliance Management?

All financial institutions, including banks, credit unions, broker-dealers, and money services businesses, are required to implement and maintain BSA/AML compliance programs and file relevant reports as necessary.

How to fill out 2009 BSA/AML Compliance Management?

To fill out the 2009 BSA/AML Compliance Management, institutions must systematically document their compliance policies, internal controls, risk assessments, and the effectiveness of their AML programs, ensuring they are aligned with regulatory requirements.

What is the purpose of 2009 BSA/AML Compliance Management?

The purpose of 2009 BSA/AML Compliance Management is to establish a robust system that helps financial institutions identify, examine, and report suspicious activities, thereby safeguarding the financial system from misuse by criminals and terrorists.

What information must be reported on 2009 BSA/AML Compliance Management?

Financial institutions must report information related to suspicious activity, including transactions that appear to involve money laundering or other criminal activities, as well as generally adhere to recordkeeping and reporting requirements outlined in the BSA.

Fill out your 2009 bsaaml compliance management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009 Bsaaml Compliance Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.