Get the free SBA 504 LOAN AppLicAtiON checkLiSt - RMI Inc - rmiinc

Show details

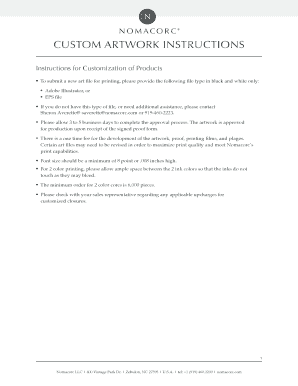

SBA 504 LOAN Application Checklist The following items must be submitted to complete the application. Use attached forms where indicated. Sign and date all information. If documents are not applicable,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba 504 loan application

Edit your sba 504 loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba 504 loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sba 504 loan application online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sba 504 loan application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba 504 loan application

How to Fill out SBA 504 Loan Application:

01

Start by downloading the SBA 504 loan application form from the Small Business Administration (SBA) website or obtain a physical copy from your local SBA office.

02

Carefully read through the instructions provided with the application form to understand the requirements and documentation needed to complete the application accurately.

03

Begin filling out the application by providing your personal information, such as your name, contact details, social security number, and date of birth.

04

Next, provide detailed information about your business, including its legal structure, industry type, number of employees, and the date it was established.

05

Fill in your business's financial information, including the income statements, balance sheets, and cash flow statements for the past three years. Additionally, include projections for the future.

06

Provide the details of the project you intend to use the SBA 504 loan for. This can include information about the property, its location, the estimated costs, and any plans for renovations or improvements.

07

Include information about your personal financial situation, such as your assets, liabilities, and any other existing debts or loans.

08

Gather all the necessary supporting documents, such as tax returns, bank statements, business licenses, business plans, and any other relevant paperwork.

09

Review the completed application thoroughly to ensure accuracy and completeness.

10

Once you are satisfied with the application, sign and date it. Make sure to also have any required signatures from other parties involved, such as business partners or co-owners.

11

Keep a copy of the completed application and all supporting documents for your records.

Who needs SBA 504 loan application?

Small business owners and entrepreneurs who require financing to invest in fixed assets such as land, buildings, equipment, or machinery for their businesses may need to fill out the SBA 504 loan application. This loan program specifically targets businesses that aim to contribute to job creation and economic development and meet the eligibility criteria set by the SBA. Whether you are looking to purchase a commercial property for expansion, upgrade essential equipment, or acquire machinery to enhance your operations, the SBA 504 loan application can provide access to affordable and long-term financing options. It is important to note that you should consult with SBA-approved lenders or local SBA offices to determine if the SBA 504 loan program suits your business needs before proceeding with the application process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute sba 504 loan application online?

pdfFiller has made it simple to fill out and eSign sba 504 loan application. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out sba 504 loan application using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign sba 504 loan application and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I complete sba 504 loan application on an Android device?

On Android, use the pdfFiller mobile app to finish your sba 504 loan application. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is sba 504 loan application?

The SBA 504 loan application is a form used to apply for a specific type of small business loan that is guaranteed by the Small Business Administration.

Who is required to file sba 504 loan application?

Any small business looking to finance the purchase of fixed assets, such as real estate or equipment, is required to file an SBA 504 loan application.

How to fill out sba 504 loan application?

To fill out an SBA 504 loan application, applicants need to provide detailed information about their business, financial history, and the purpose of the loan.

What is the purpose of sba 504 loan application?

The purpose of the SBA 504 loan application is to help small businesses secure long-term, fixed-rate financing for the acquisition of assets that will contribute to the growth and success of the business.

What information must be reported on sba 504 loan application?

Information such as business financial statements, personal financial statements of the business owners, business tax returns, and a detailed business plan must be reported on the SBA 504 loan application.

Fill out your sba 504 loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba 504 Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.